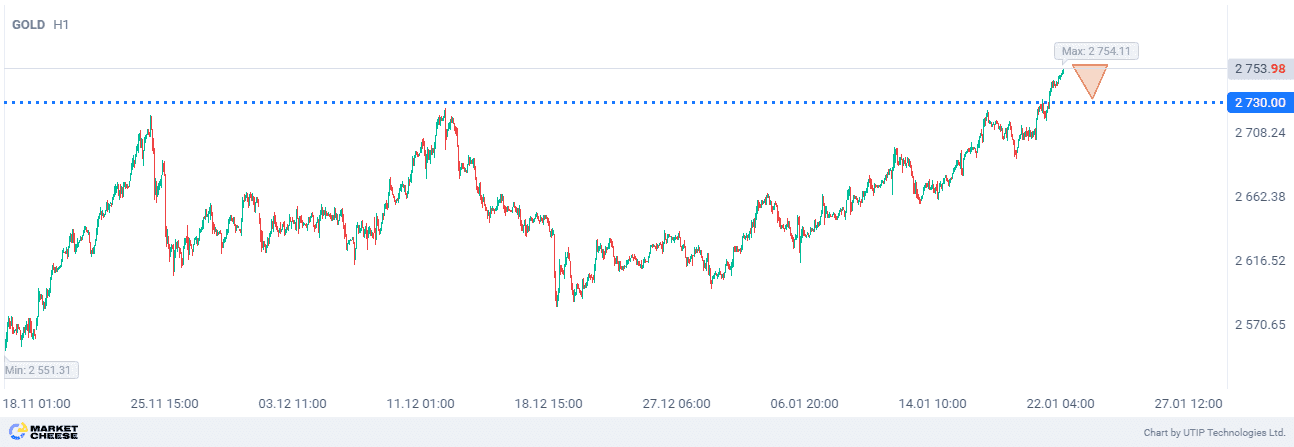

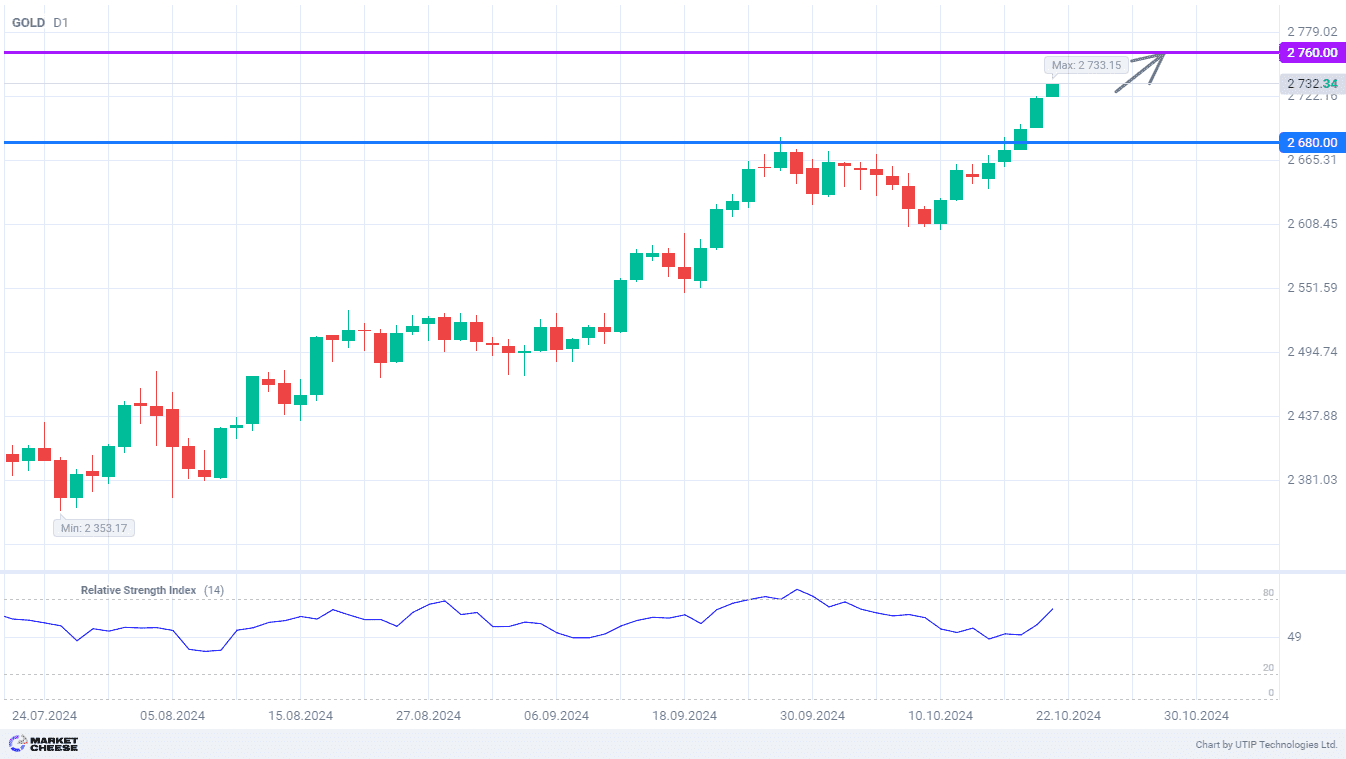

As was expected at the beginning of October, gold prices experienced a pullback to the 2600 level, after which they resumed their upward movement. On Friday, the yellow metal broke above 2700 for the first time and immediately consolidated at the new highs. From the technical point of view, there are no signs of a further correction, so the rise in gold prices may well continue. Buyers will now target the 2760 level.

Geopolitical tensions and the cycle of interest rate cuts by the world’s leading central banks remain the main drivers of the yellow metal’s rally. Investors’ nervousness on the eve of the US presidential election on 5 November is also becoming increasingly apparent. Even after a 30% rise in the price of gold since the beginning of the year, the fundamentals remain extremely favorable for investment. The situation in the physical market is also in favor of rising prices, despite a certain loss of excitement.

The World Gold Council (WGC) presented a review of the Chinese market for September. According to the organization, demand for the main precious metal in China increased moderately in the first month of autumn. Deliveries from the warehouses of the Shanghai Stock Exchange increased, as did traders’ investments in gold ETFs. Consumption of the metal in the country’s jewelry industry did not show any pick-up, but this could be a temporary phenomenon. The WGC predicts that demand for physical gold in China will increase significantly in Q4.

Incrementum’s Ronny Stoferle believes that India will make up for some sluggish consumption of the yellow metal in China. In the first half of the year, the Reserve Bank of India bought about 35 tons of gold, increasing its reserves by almost 5%. Other regulators may be doing the same, but information about these transactions is not disclosed. According to Incrementum, over-the-counter gold transactions are up about 60% this year.

The RSI indicator on the daily chart of gold is steadily rising, but has not yet reached the overbought zone. The bulls still have a good chance of reaching 2760.

Consider the following trading strategy:

Buy gold at the current price. Take profit – 2760. Stop loss – 2680.