The BTCUSD exchange rate is falling on Tuesday, after hitting this month’s high of $69,519 the day before.

Significant inflows into exchange-traded funds (ETFs), as well as increased optimism about cryptocurrency regulation in the United States have been the main drivers of the recent rise in the price. In the last six days through October 18, spot bitcoin ETFs in the US raised approximately $2.4 billion. This is due to expectations that cryptocurrency regulation will become more friendly after the Nov. 5 election. Republican candidate Donald Trump supports the digital currency, making bitcoin more attractive to investors. His rival, Vice President Kamala Harris, has also promised to support the regulatory framework for the sector.

According to experts, the current market sentiment is focused on two factors – the upcoming US elections and the overall macroeconomic situation. The inflow of money into cryptocurrency funds led to bitcoin’s growth of almost 10% during the week. This was the best performance for the past month.

Options markets are showing high volatility around the election date, making the events of November key to the further movement of the cryptocurrency market.

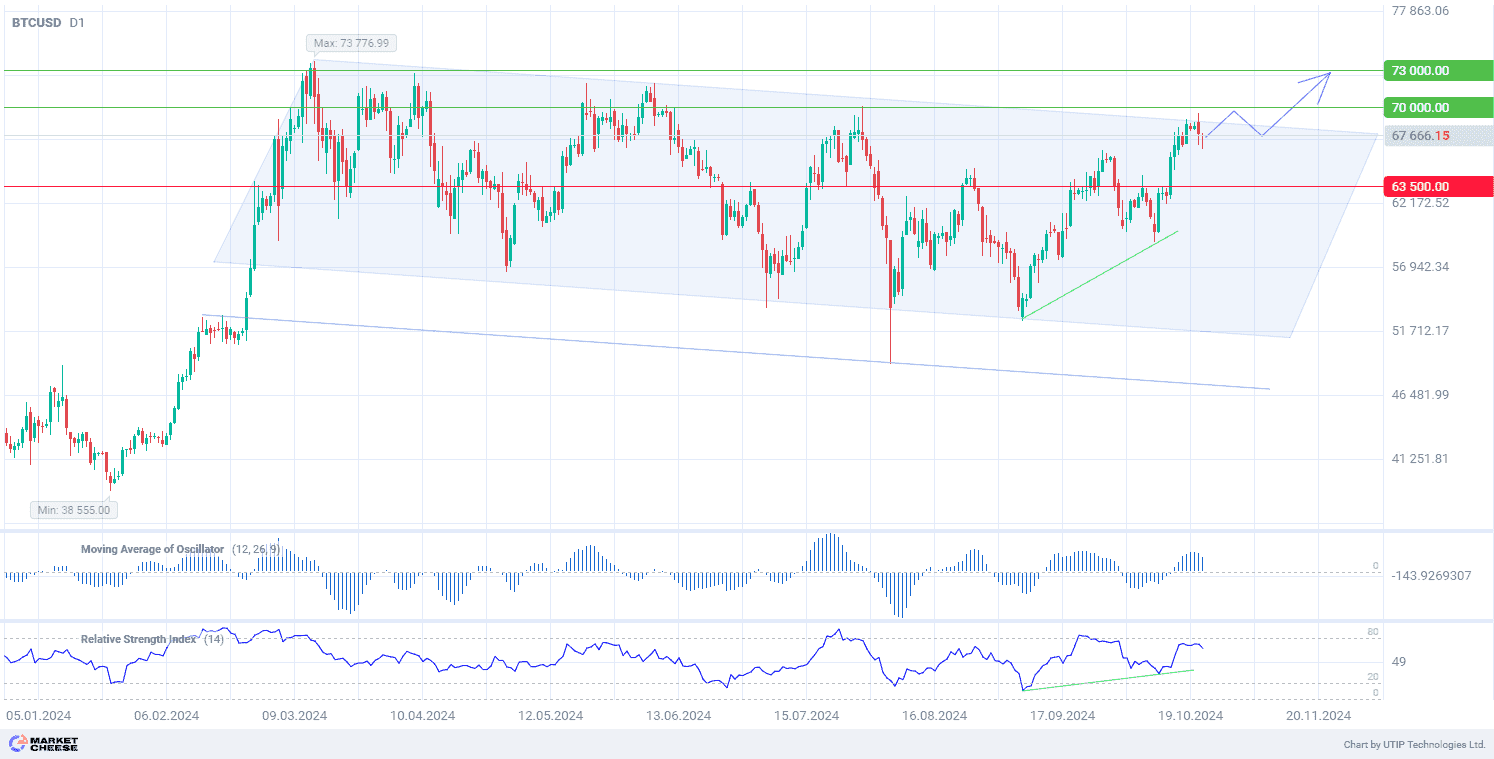

The technical picture of BTCUSD shows the formation of a long term downward correction on the daily timeframe (D1). The price retreated from trend channel resistance, confirming its strength. However, fundamental factors and technical indicators point to a possible future breakout from the resistance. In particular, the Moving Average of Oscillator (parameters 12, 26, 9) remains in the positive zone and the RSI shows convergence, which supports the current value of the cryptocurrency.

The short-term outlook for BTCUSD suggests buying with the target at 73,000.00. Partial profit taking is recommended at 70,000.00, while a stop loss could be set at 68,500.00.

As the bullish trend is short term, the trading volume should not exceed 2% of the total balance.