On Thursday USDJPY retreated from the three-month high of 153.177 reached in the previous trading session. The recent rally was driven by the strength of the US economy and expectations of a divergence in the pace of interest rate cuts by the world’s leading central banks.

The US currency strengthened for the 16th session out of the last 18. This was due to a series of positive economic data that reduced expectations of a significant interest rate cut by the Federal Reserve (Fed). The 10-year US Treasury bond yield rose to 4.24%, strengthening the dollar’s position.

At the same time, the yen weakened on the back of the Bank of Japan’s continued loose monetary policy. The difference in policy between the US and Japan central banks continues to support USDJPY.

The yen is also being pressured by political instability in Japan as the country prepares for a general election on 27 October. Polls suggest that the ruling Liberal Democratic Party may lose its majority. This increases the likelihood of political uncertainty and makes it more difficult for the Bank of Japan to reduce its reliance on monetary stimulus.

Au Jibun Bank’s preliminary Manufacturing PMI fell to 49.0 in October from 49.7 the previous month. This is the fourth consecutive monthly decline, driven by weakening demand both at home and abroad, as well as lower new orders index. These statistics set the stage for further weakening of the yen.

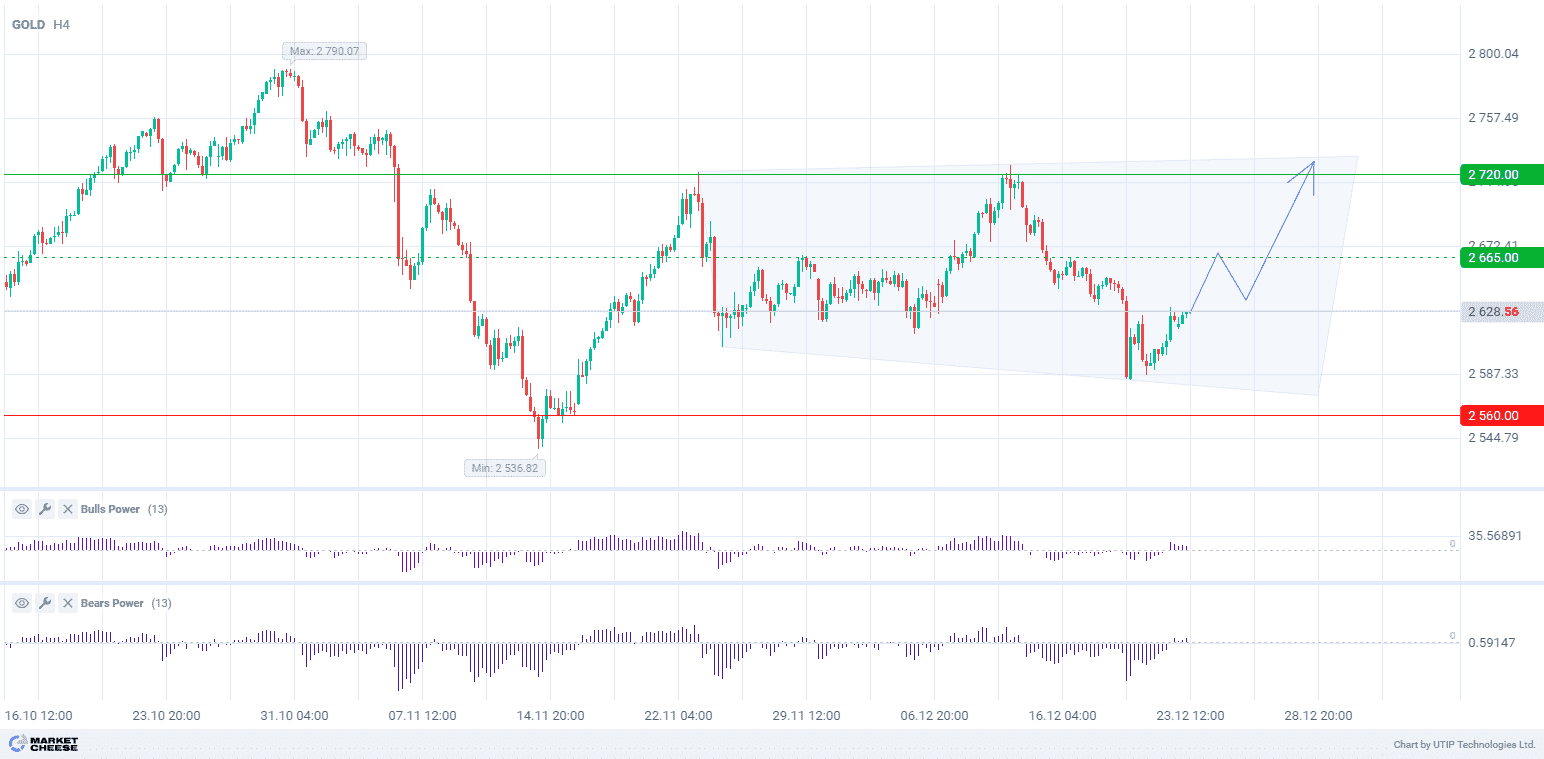

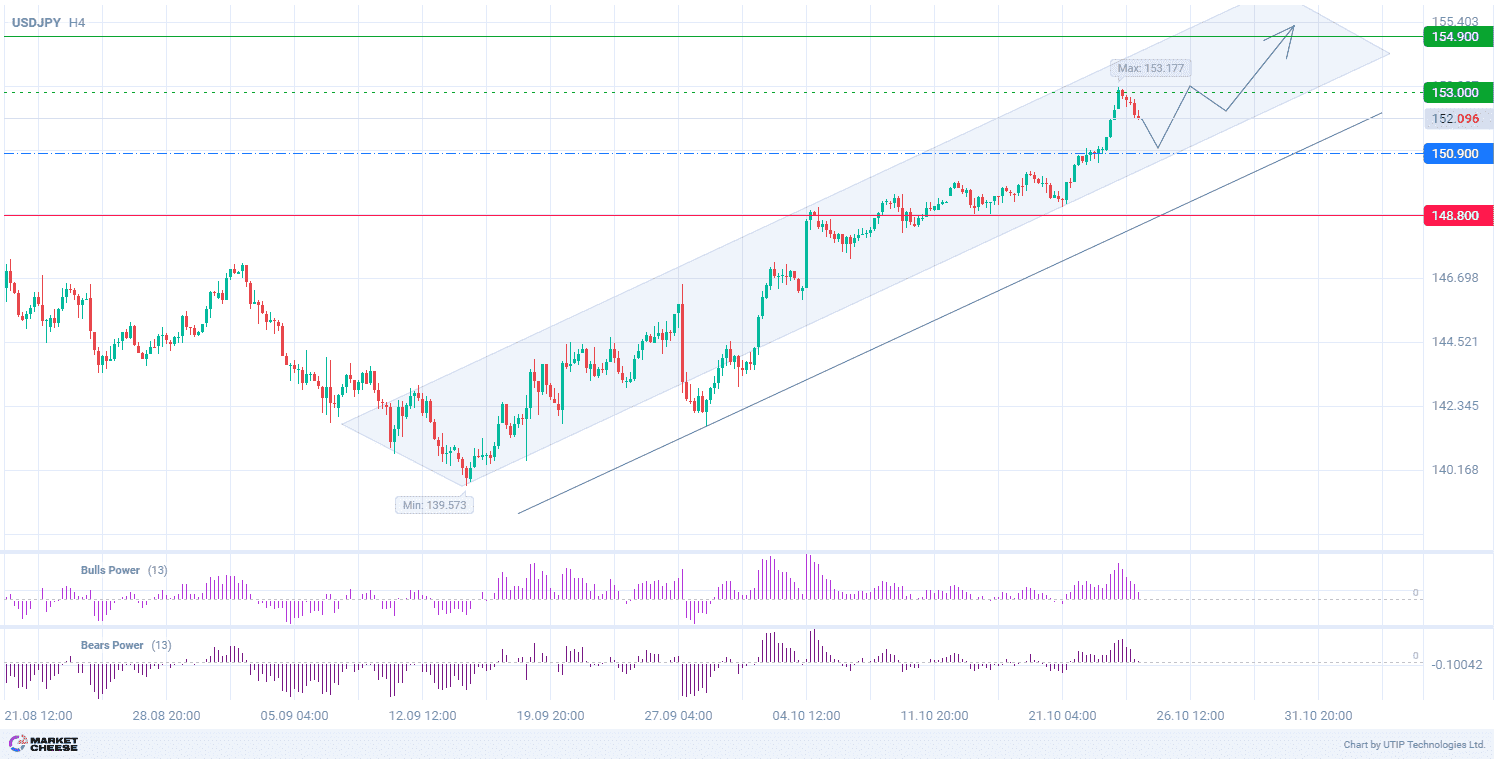

From a technical point of view, the USDJPY rate remains in the uptrend on the H4 timeframe. The Bulls and Bears Power indicators (default values) are approaching zero, confirming the current correction in the pair. The price may resume growth from the local channel support near the 150.90 level.

Signal:

Short-term prospects for USDJPY suggest buying around the 150.90 level.

The target is at the level of 154.00.

Part of the profit should be taken near the level of 153.00.

A stop-loss could be placed at the level of 148.80.

The bullish trend is short-term, so trade volume should not exceed 2% of your balance.

Source: