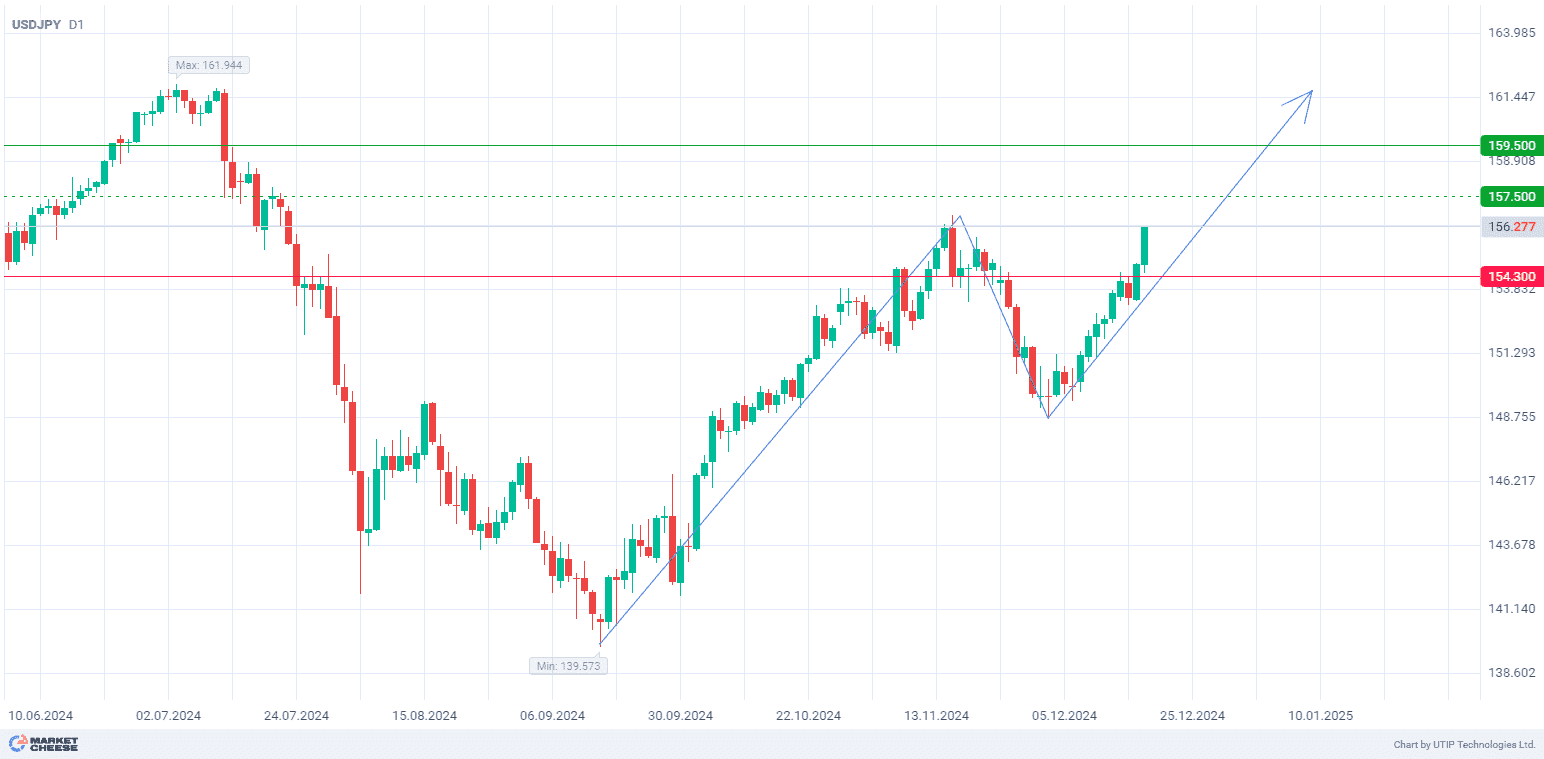

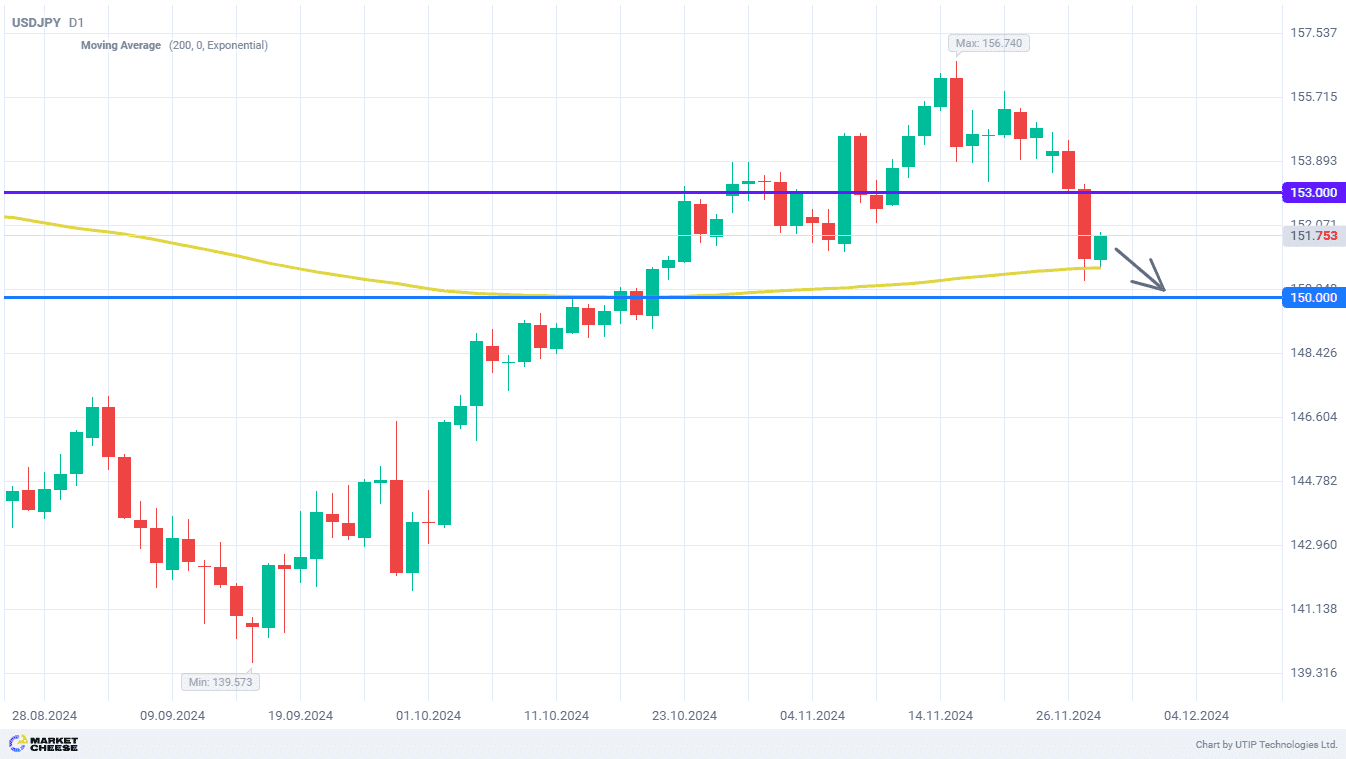

The USDJPY currency pair fell by more than 2% over the last 2 days, leveling all the gains of November. Quotes were exactly at the level of the 200-day moving average, the breakdown of which may lead to the acceleration of the downward movement. The nearest target for buyers of the yen against the dollar is the round level of 150, where there is a high probability of fixing at least part of the profit on short positions. This scenario may materialize in the nearest future.

A trigger for the current wave of the Japanese currency strengthening was the statistics on inflation in the service sector companies. The October figure excluding wages amounted to 2.9%, and including them reached the highest level of 3.3% since 1992. Officials of the Bank of Japan, commenting on the published data, noted the massive transfer of growing costs by companies to their customers through higher prices. In this regard, the bank should continue the cycle of tightening monetary policy.

According to a Bloomberg poll, more and more market participants expect the next key rate hike by the Bank of Japan in December rather than January. The probability of such a scenario is now estimated at about 60%, although at the beginning of the week the value was near 30%. Carol Kong, currency strategist at Commonwealth Bank of Australia, predicts an increase in Japan’s borrowing costs along with a new Fed rate cut next month. This outcome may increase the pressure on USDJPY quotes.

Takeshi Ishida of Kansai Mirai Bank considers the yen the most attractive G10 currency in the medium term. He estimates that the dollar/yen ratio will fall below the 150 mark by the end of 2024. Mark Cranfield, strategist at MLive, makes an even bolder prediction about USDJPY moving towards 143.5. According to him, traders will not get rid of long positions on the yen yet, as its strengthening potential is far from being exhausted.

Bears on USDJPY will be active as long as quotes are kept below the level of 153. The downside target at 150 remains valid.

Consider the following trading strategy:

Sell USDJPY at the current price. Take profit – 150. Stop loss – 153.