The BTCUSD exchange rate on Tuesday stabilized near the all-time high of 107,793 set during yesterday’s trading session. This rise was due to US President-elect Donald Trump’s support for digital assets and optimism about the inclusion of MicroStrategy Inc. in the main stock index — the Nasdaq 100.

MicroStrategy, the largest corporate holder of Bitcoins, announced a $1.5 billion purchase of the digital asset over the past week. The decision to include the company in the Nasdaq 100 Index provided new prospects for raising money through index funds.

The optimism about cryptocurrencies is also backed by Donald Trump’s plans to undo the previous administration’s restrictions and create a favorable environment for digital assets. Among the proposals is even the idea of a national Bitcoin reserve, but its feasibility is questionable. The newly elected US president’s support boosts confidence in Bitcoin as a strategic asset. This is reflected in a significant influx of funds into cryptocurrency ETFs. Since Trump won the election in 2020, US funds investing in the major digital currency have raised $12.2 billion.

However, Bitcoin’s slowing growth rate may indicate the likelihood of a pullback after a 7-week period of strong rally. Nevertheless, the outlook for Bitcoin remains positive due to institutional interest and global recognition of cryptocurrencies as important investment assets.

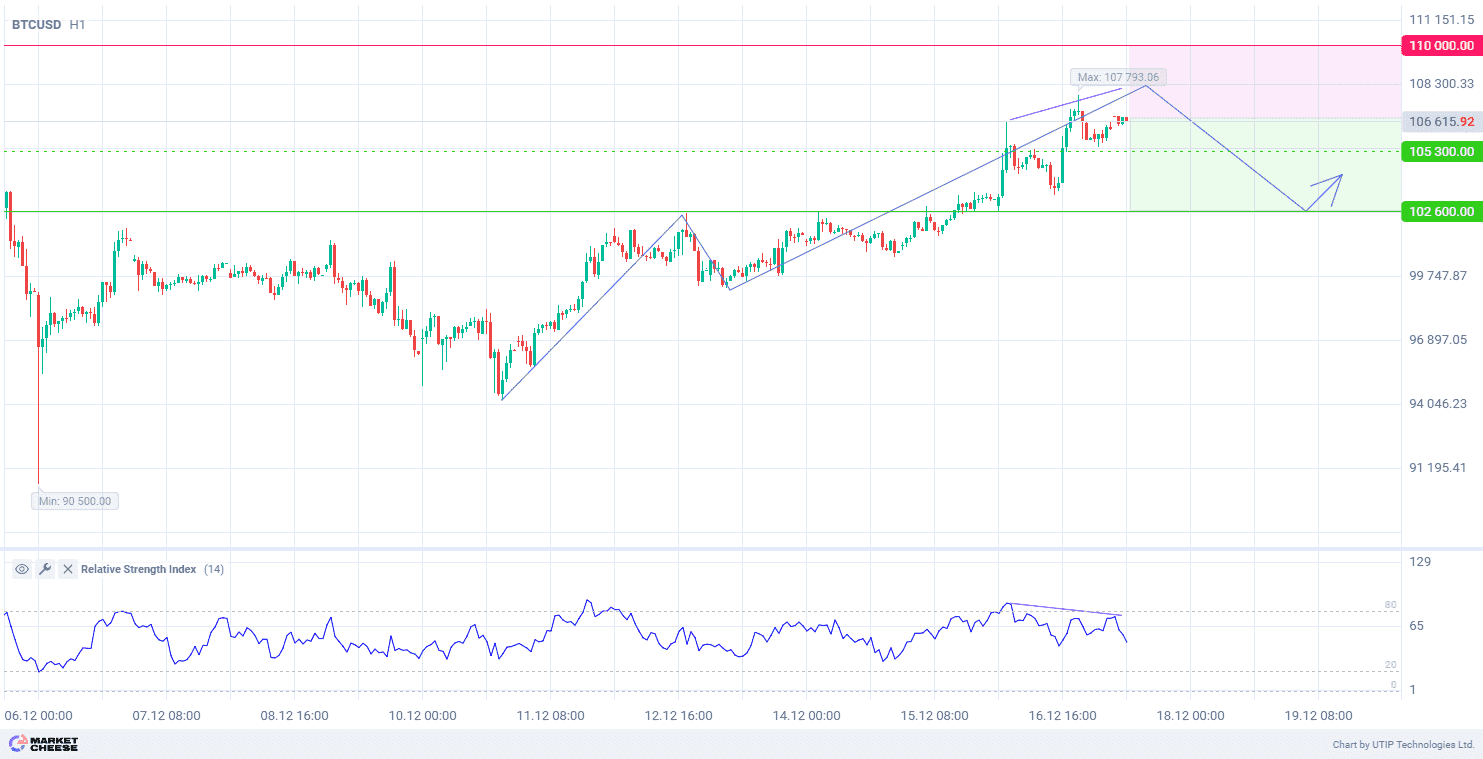

Technical analysis of BTCUSD on the daily timeframe (D1) indicates a continuation of the uptrend. In terms of wave analysis, the pair is now forming the third ascending wave on the H1 timeframe. Relative Strength Index (period 14) suggests a possible change in the direction of the trend and the start of the fourth corrective downward wave, which is confirmed by the divergence.

Short-term prospects for BTCUSD suggest a price decline with the target level of 102,600.00. Part of the profit should be taken near the level of 105,300.00. A Stop loss could be set at 110,000.00.

Since the bearish trend is short-term, the trading volume should not exceed 2% of your total balance to reduce risks.

Source: