The USDCAD currency pair is moderately rising on Wednesday. The Canadian dollar weakened to a five-year low, reaching the lowest level since April 2020. The main reasons for the national currency depreciation were political instability in Canada and an unexpected decline in inflation.

Investors await the results of the two-day meeting of the U.S. Federal Reserve, which will be announced on Wednesday. Market participants expect the Fed to reduce rates by 25 basis points. This will be the third cut in a row. According to the CME FedWatch Tool, the chances of such a move are almost 100%.

Market participants will pay special attention to the Fed’s press conference and the publication of the Summary of Economic Projections, which will shed light on the regulator’s monetary policy plans for the next year.

The Canadian dollar remains under pressure after the unexpected resignation of Canadian Deputy Prime Minister Chrystia Freeland on Monday. She has disagreed with Prime Minister Justin Trudeau over Donald Trump’s U.S. tariff threats. The move marked the first open discord within Trudeau’s cabinet, intensifying calls for him to step down as prime minister.

In addition, Canada’s annual inflation rate fell to 1.9% in November from 2% in October. Against this backdrop, investors continue to expect another interest rate cut by the central bank in January.

In the short term, the dynamics of the pair will depend on the outcome of the Fed meeting: a rate cut may correct the pair’s course.

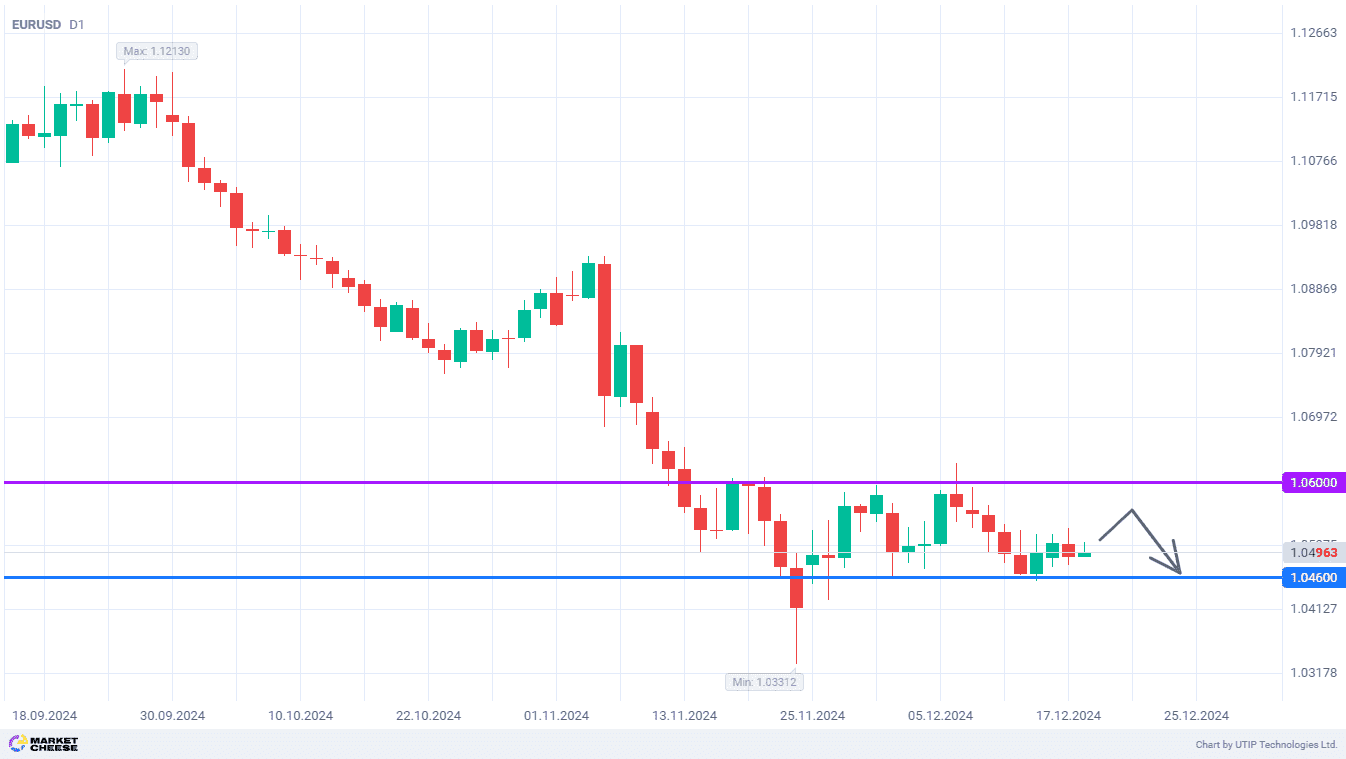

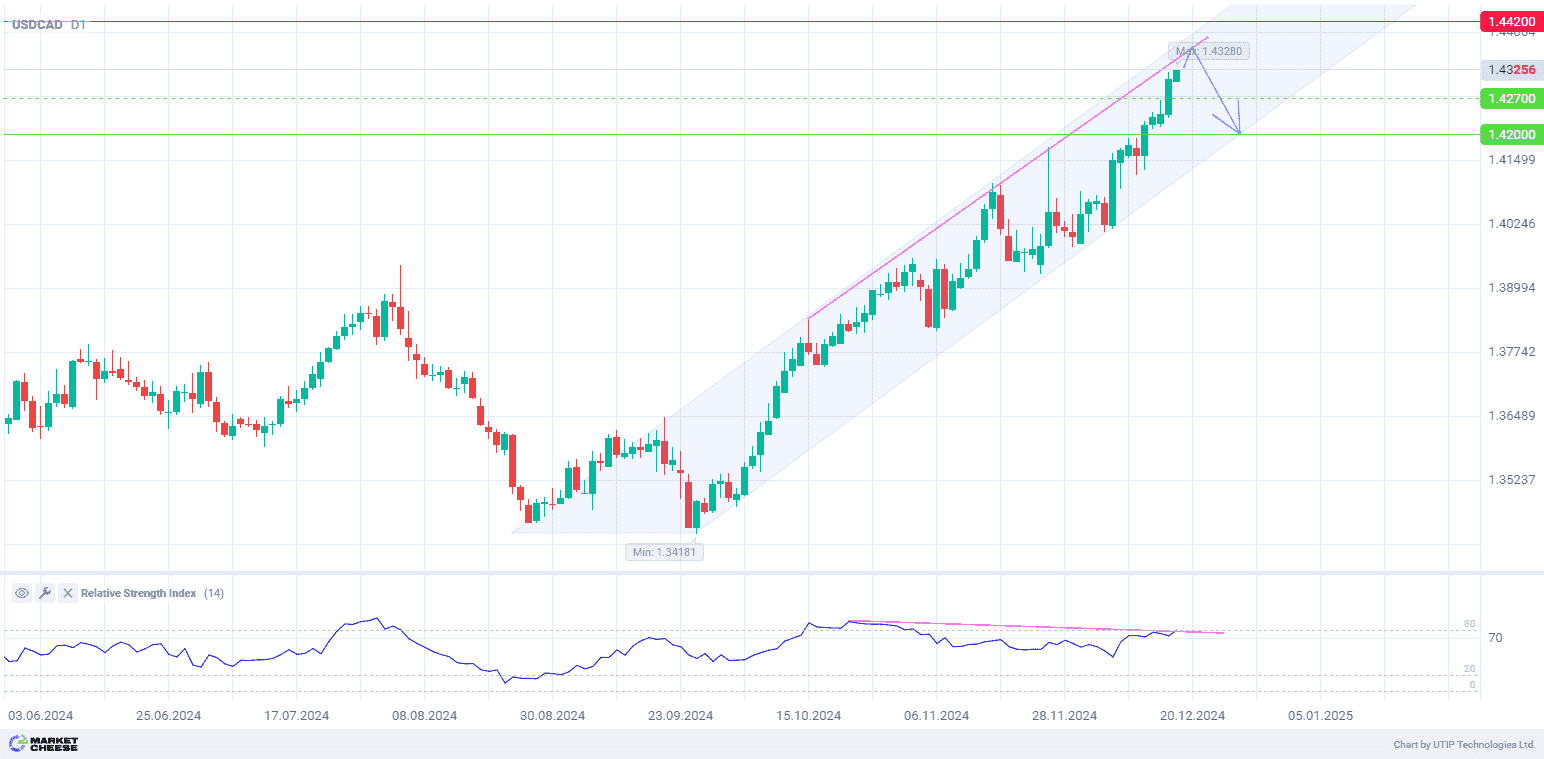

From the technical point of view, USDCAD is in an upward trend on the daily timeframe (D1). The quotes, approaching the trend resistance, may weaken the bullish dynamics. Additionally, the RSI divergence (standard values) indicates a possible change in price direction towards the trend support of the ascending channel.

Signal:

The short-term outlook for USDCAD is to sell.

The target is near the level of 1.4200.

Part of the profit could be fixed near the level of 1.4270.

The Stop loss could be placed near the level of 1.4420.

The bearish trend is of a short-term nature, so it is suggested to limit the trading volume to no more than 2% of your capital.