The situation in the financial markets is constantly changing and it provides the necessary volatility. Even in the middle of last week the market was overshadowed by the Fed’s conservative assessments of the prospects for further easing, but by the opening of the new week investors had pondered these expectations and partially discarded the pessimistic sentiment.

Even after the S&P 500’s strong decline this week, investors are still hoping that the end of 2024 will bring some holiday spirit. On the downside, the number of S&P 500 components that fell exceeded those that rose for 13 consecutive sessions, the longest losing streak since 2012.

In another worrying sign, the percentage of S&P 500 stocks trading above their 200-day moving averages fell to 56%, the lowest in a year. Overall sentiment remains cautious as investors prepare for the prospect of sweeping global duties imposed by U.S. President-elect Donald Trump.

Contrary to negative estimates, historical fifty-year sample data suggests that the last five trading days of the year combined with the first two days of the following year yield an average gain of 1.3% for the S&P 500 Index. This period, also known as the Santa Claus rally, very often fulfills the best New Year’s Eve expectations.

In addition, lower than expected U.S. core PCE inflation data for November suggests that the Fed may have been too negative on inflation and the bull market has not lost its potential.

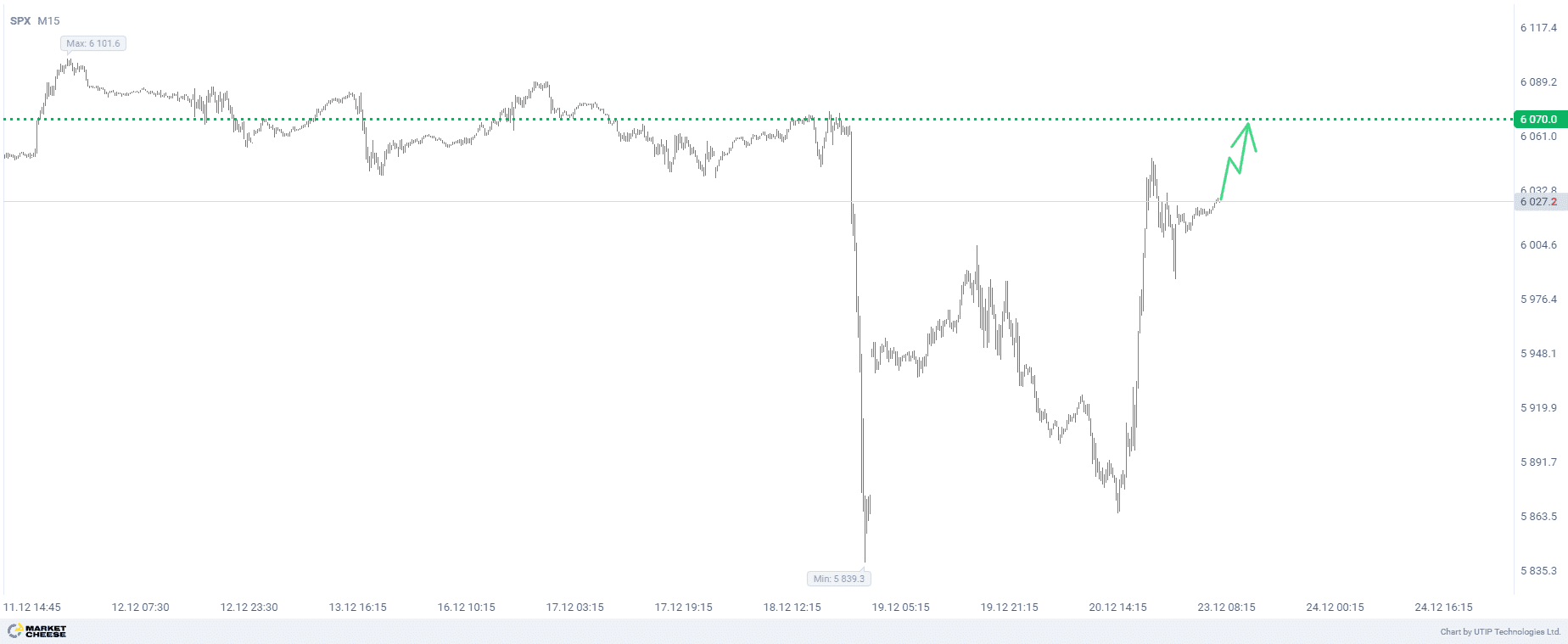

From a technical point of view, the resistance level at 6070 could be a target for strengthening the S&P 500.

The overall recommendation is to buy S&P 500.

Profits should be taken at the level of 6070. A Stop loss could be set at the level of 5950.

The volume of the opened position should be set in such a way that the value of a possible loss, fixed with the help of a protective Stop loss order, is no more than 1% of your deposit funds.