On Monday, gold prices rose 0.2% on the back of covering short positions after a week of declines triggered by the Federal Reserve’s (Fed) cautious stance on the pace of interest rate cuts in 2025.

Last week, the Fed confirmed its intention to slow the pace of interest rate cuts in 2025. This strengthens the dollar’s positions, making gold less appealing to investors. At the same time, gold is supported by geopolitical tensions in the Middle East and Eastern Europe.

The latest US economic data shows a slowdown in inflation. The personal consumption expenditures (PCE) price index rose just 0.1% in November, compared to 0.2% in October. The annual rate rose to 2.4% from 2.3% in October.

Today, the market’s attention will be focused on the Conference Board consumer sentiment index in the US. On Tuesday, real GDP growth estimates from the Federal Reserve Bank of Atlanta are expected to be published.

Gold continues to balance between support from geopolitical risks and pressure from a stronger dollar and high interest rates in the US. Further dynamics will depend on new economic data.

In addition, the growth in demand for gold in China may contribute to higher prices for the metal, as the country is the largest consumer of this asset in the world. Less than six weeks before the Chinese New Year, the largest gold-buying festival in the world, demand in China is overtaking the Diwali festival in India.

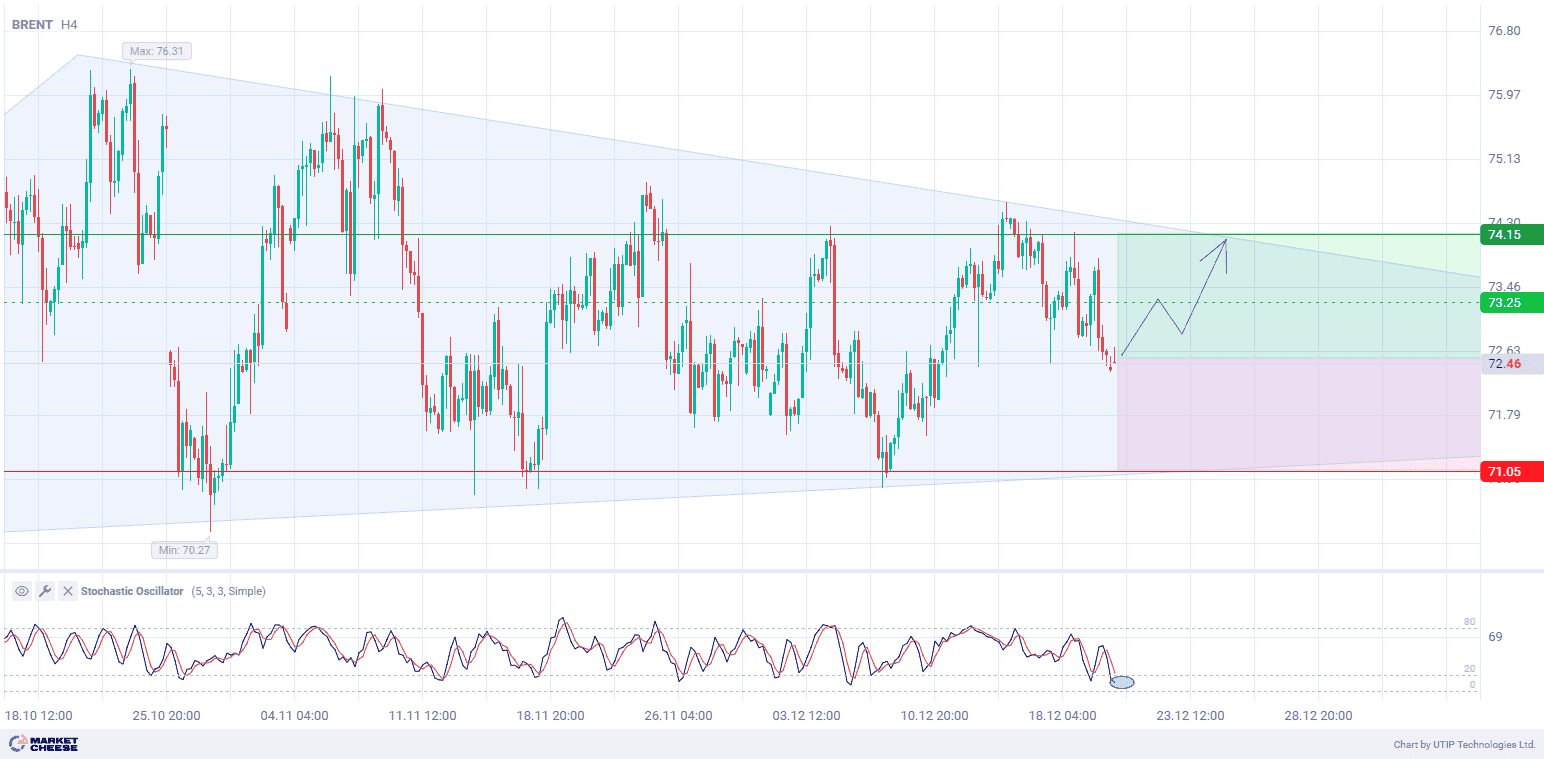

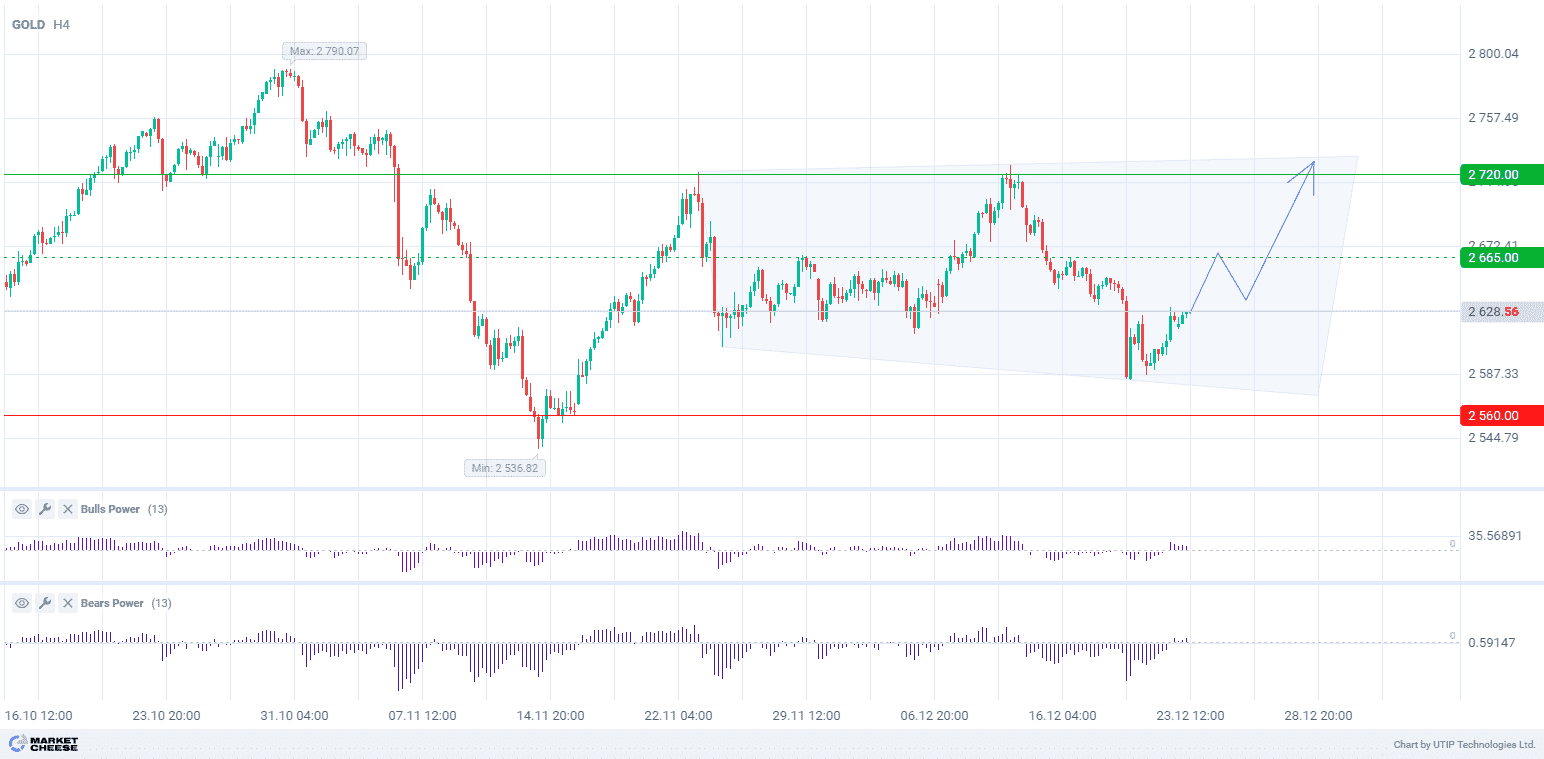

From a technical point of view, gold quotes are forming a widening correction corridor on the H4 timeframe. Bulls Power and Bears Power indicators (standard settings) have moved into the positive zone, confirming the dominance of bullish sentiment.

Signal:

The short-term outlook for GOLD suggests buying.

The target is at the level of 2720.00.

Part of the profit should be taken near the level of 2665.00.

A stop-loss could be placed at the level of 2560.00.

The bullish trend is short-term, so a trading volume should not exceed 2% of your balance.

Source: