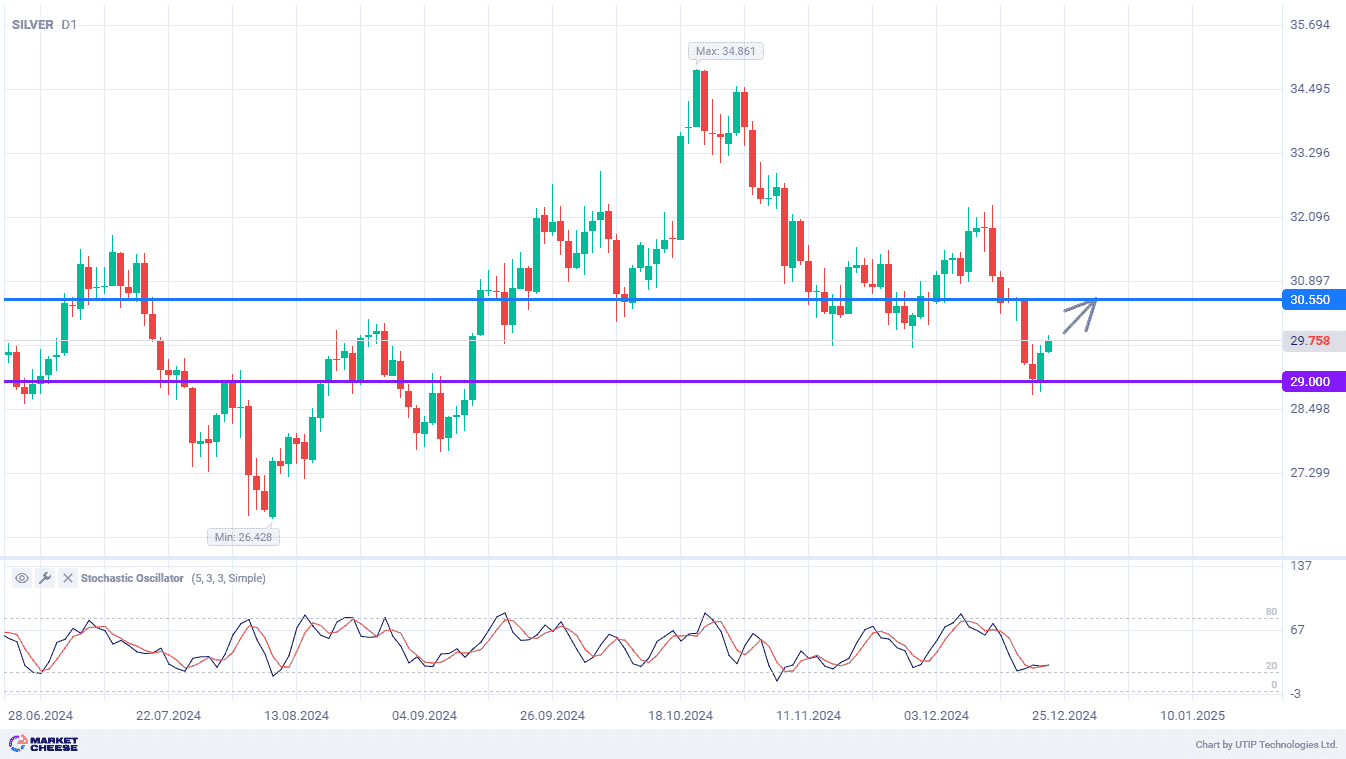

Last week, silver quotes hit a 3-month low, testing the level of 29 for the first time since mid-September. The bulls managed to reserve this level, and on Friday the price rebounded upwards by more than 1.5%. At Monday’s trading session, the upward movement continues with the aim of returning above the level of $30 per ounce. In case of success, silver has a good opportunity to end 2024 near the level of 30.55.

Assessing the investment outlook for next year, Ole Hansen, head of commodity strategies at Saxo Bank, sees silver as the best choice. Despite the significant price growth, traders’ long positions both in the futures market and through ETFs remain small. In this regard, the potential for rise in silver prices is far from exhausted. According to Hansen’s forecast, silver price growth in 2025 will be similar to the 2024 result of 25%, with quotations reaching the level of $40 per ounce.

FXEmpire experts are also optimistic about silver. The main factors contributing to silver price growth are the transition to clean energy and the development of artificial intelligence. As a result, consumption of the metal in solar panels, electric cars and high-performance semiconductors is increasing.

If global central banks interest rates fall further in 2025, silver’s uptrend will continue, FXEmpire believes. As historical data shows, precious metals become more popular when monetary policy eases. According to forecasts for the coming year, global regulators will take a dovish stance. Against this background, silver prices may reach $50 per ounce, the organization notes.

The Stochastic indicator on the daily chart of silver is ready to form a full-fledged buy signal. The main target of investors in the last days of the year will be the mark of 30.55.

Consider the following trading strategy:

Buy silver at the current price. Take profit – 30.55. Stop loss – 29.