A US government report released yesterday showed that new equipment orders rebounded in November. Capital goods orders rose by 0.7%, showing the strongest monthly growth over the past year.

The value of core capital goods orders, a proxy for investment in equipment excluding aircraft and military equipment, increased last month after a revised 0.1% decline in October.

The rise in orders may be just the beginning, as companies are more comfortable now that the election is past and are making long-term investments. The report showed growth in orders for machinery, computers and primary metals.

Another sign of optimism came earlier this month, when a gauge of new orders moved into expansion territory for the first time in eight months, according to the Institute for Supply Management’s November manufacturing survey.

If one looks at the situation with new orders in the longer term, from several months to a year, the picture will not be optimistic. Decrease is noted in all groups of orders, somehow related to metals: automobiles and spare parts, transport equipment, construction vehicles, electrical equipment, industrial equipment, etc.

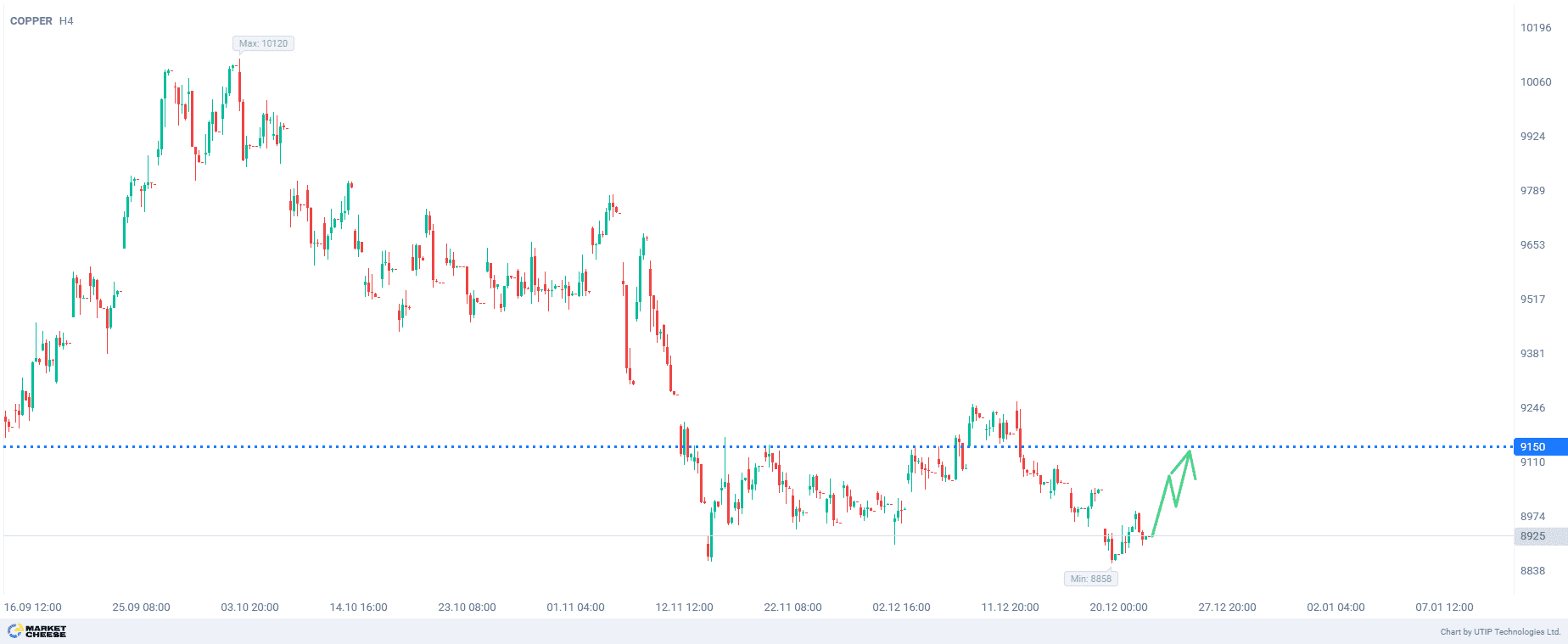

From a technical point of view, copper prices are now in a multi-month support zone in the range of 8800–8900. For those traders who accept the scenario of a possible upward reversal of copper prices, it gives an opportunity to open short positions, which will provide the best ratio of potential risk to profit.

The overall recommendation is to buy copper.

Profits should be taken at the level of 9150. A Stop loss could be set at the level of 8800.

The volume of the opened position should be set in such a way that the value of a possible loss, fixed with the help of a protective Stop loss order, is no more than 1% of your deposit funds.