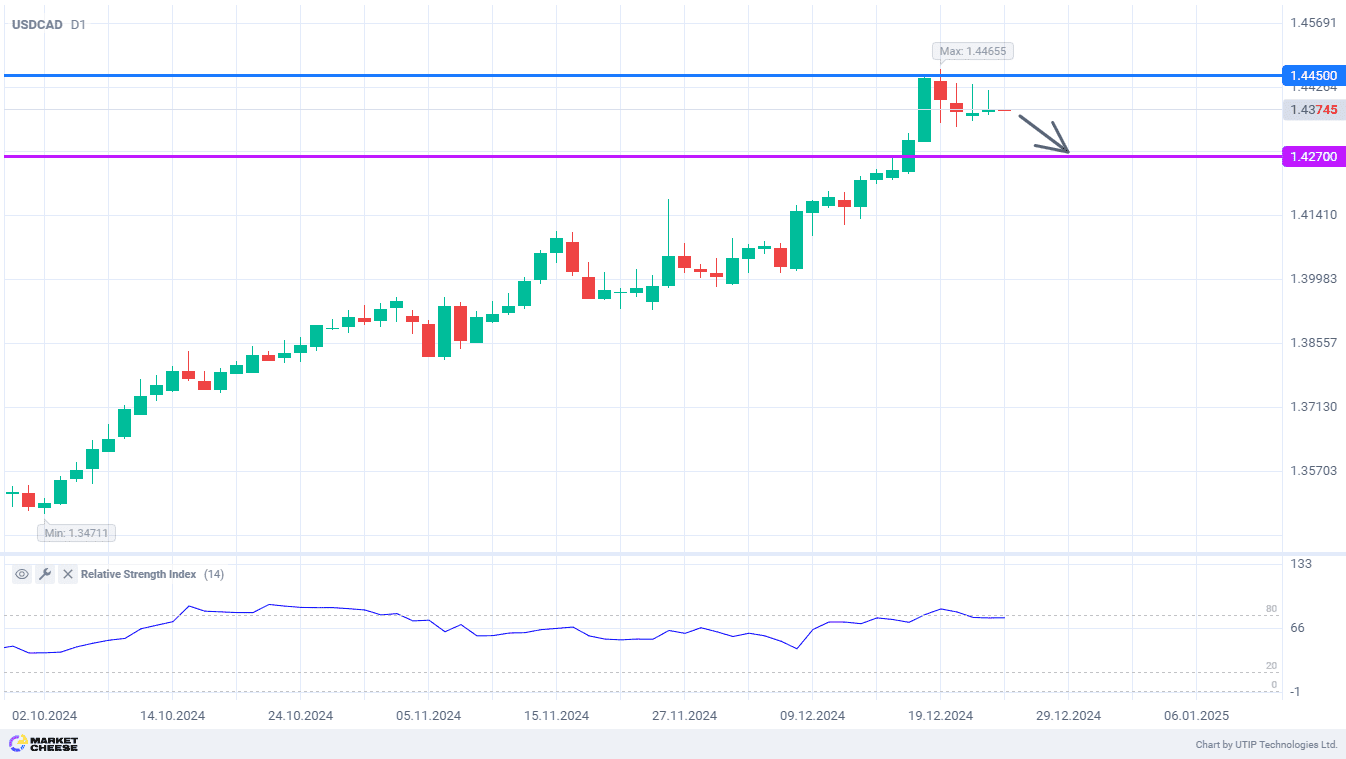

The USDCAD currency pair, after setting a new high from March 2020 last week, moved to correction. Quotes have not had significant pullbacks down for more than 3 months, so the number of those willing to take profits on long positions is probably very high. The downward movement may bring the price to the level of 1.427, where buying the US dollar vs. the Canadian counterpart will once again look attractive.

Some strengthening of the Canadian currency was supported by the release of the minutes of the central bank meeting held on December 11. Contrary to expectations, a decision to reduce the key rate again by 0.5% was made by a narrow margin of votes. A number of the Bank of Canada officials called for a return to a more gradual easing of monetary policy, with steps of 0.25%. They drew attention to the borrowing costs reaching a neutral range of 2.25–3.25%, i.e. further rate cuts may not be appropriate.

The data on Canadian GDP for October additionally strengthened this point of view. In the first month of the fourth quarter, the economy grew by 0.3%, beating analysts’ forecasts of 0.2%. Estimates for September were also revised upward, from 0.1% to 0.2%. Positive statistics may prevent further monetary policy easing at the Bank of Canada meeting on January 29. According to Reuters estimates, now the chances of a rate cut and keeping it at the current level are almost equal.

Macquarie analysts see one more factor in favor of strengthening of the Canadian dollar. It is connected with the growing probability of the collapse of the current government of the country and early elections. According to Macquarie forecasts, conservatives will come to power, whose economic policy is largely similar to Donald Trump’s position. In this regard, the lowest point of decline of the Canadian currency may already be passed, and in the future it will move to growth.

The RSI indicator on the daily chart of USDCAD went down from the overbought zone, confirming the sell signal. The next correction target is 1.427.

Consider the following trading strategy:

Sell USDCAD at the current price. Take profit – 1.427. Stop loss – 1.445.