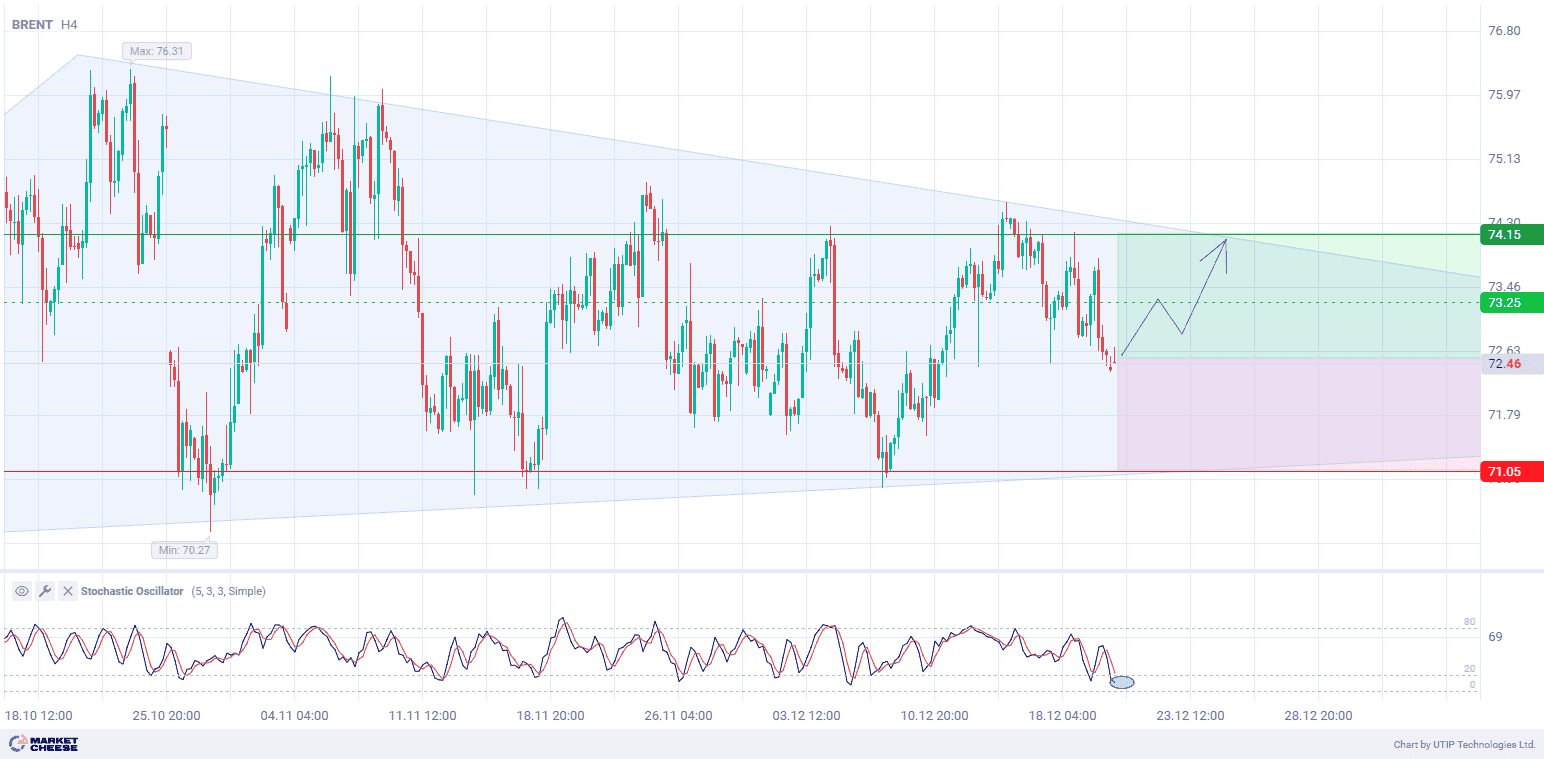

Brent oil prices failed to rebound from last week’s lows. Although drawdowns below the level of $80 per barrel are usually quickly bought back, it is still impossible to develop stable upward dynamics. In such a situation there is a significant risk for the prices to break down the 80 mark and to consolidate below it. The news background confirms a high risk of such a scenario.

The OPEC+ meeting, initially scheduled for Sunday, was postponed to 30 November. Disagreements between some countries over oil production quotas are likely to be the reason. According to Reuters, Nigeria and Angola want to increase oil production in spite of current restrictions.

Olufemi Soney, director of corporate communications for Nigeria’s state oil company NNPC, confirmed the intention to increase oil production. He estimates that the country’s oil production will increase from 1.7 to 1.8 million barrels per day by the end of this year. At the same time, Gabriel Tanimu Aduda, Nigeria’s representative in OPEC, denies the existence of disagreements between members of the organization.

According to Reuters sources, back in June the leading OPEC+ countries expressed doubts regarding the validity of data on the level of oil production in African countries. As a result, consulting companies (IHS, Rystad Energy and Wood Mackenzie) were instructed to conduct an independent assessment and present their findings at OPEC’s November meeting. The current postponement of the meeting date may be related precisely to the outcome of the audit.

Considering recent news, it is unlikely that OPEC+ will be able to agree on additional limits for oil production. Perhaps Saudi Arabia will voluntarily reduce oil production due to forecasts of weak demand in early 2024. But it will be extremely difficult to find support from other exporting countries.

As a result, the overall picture for Brent is very negative. If the information about disagreements in OPEC+ is confirmed, oil prices will not avoid another test of the 80 level.

Consider the following trading strategy:

Selling Brent oil at the current price. Take profit – 80. Stop loss – 82.5.

Traders may also use a Trailing stop instead of a fixed Stop loss at their discretion.

Source: