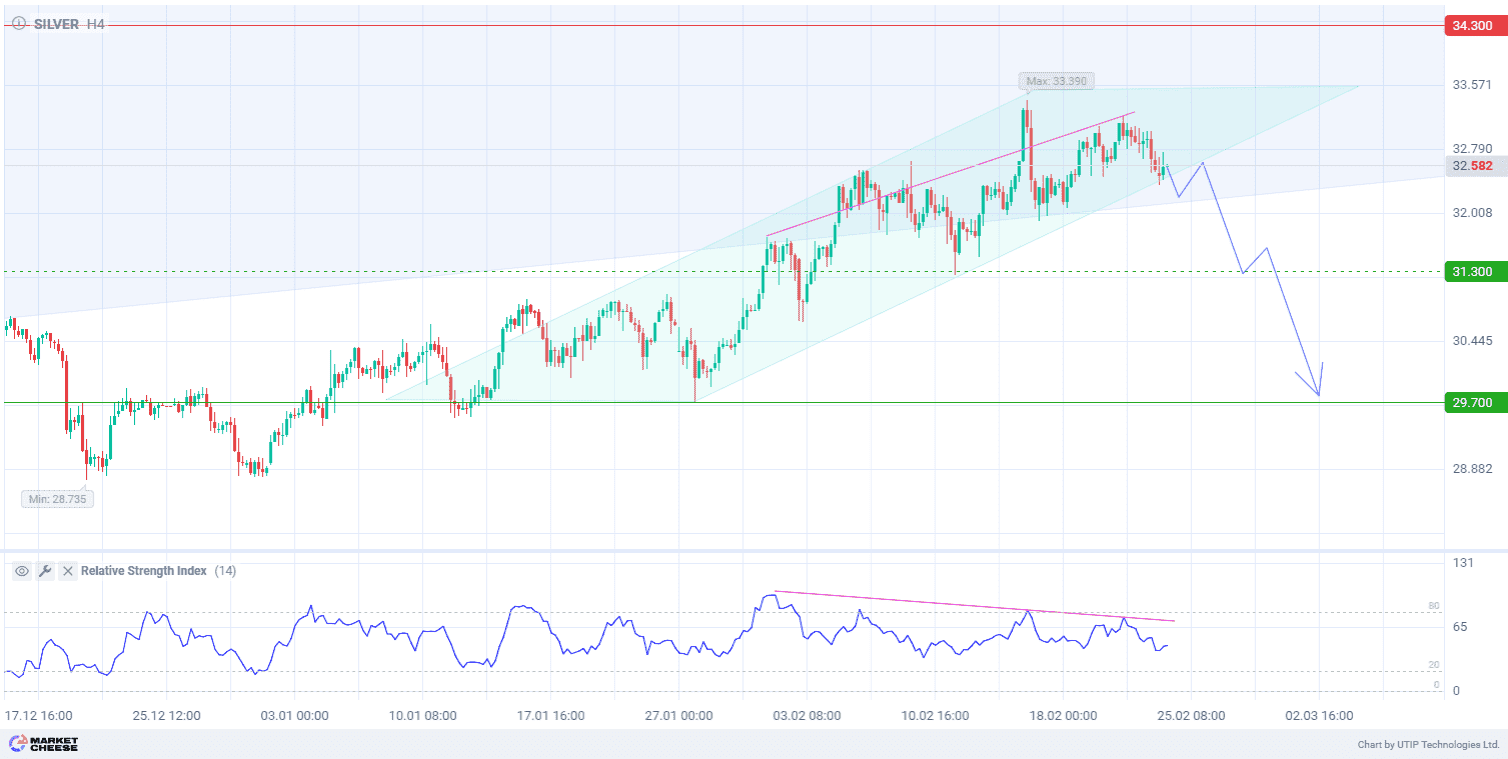

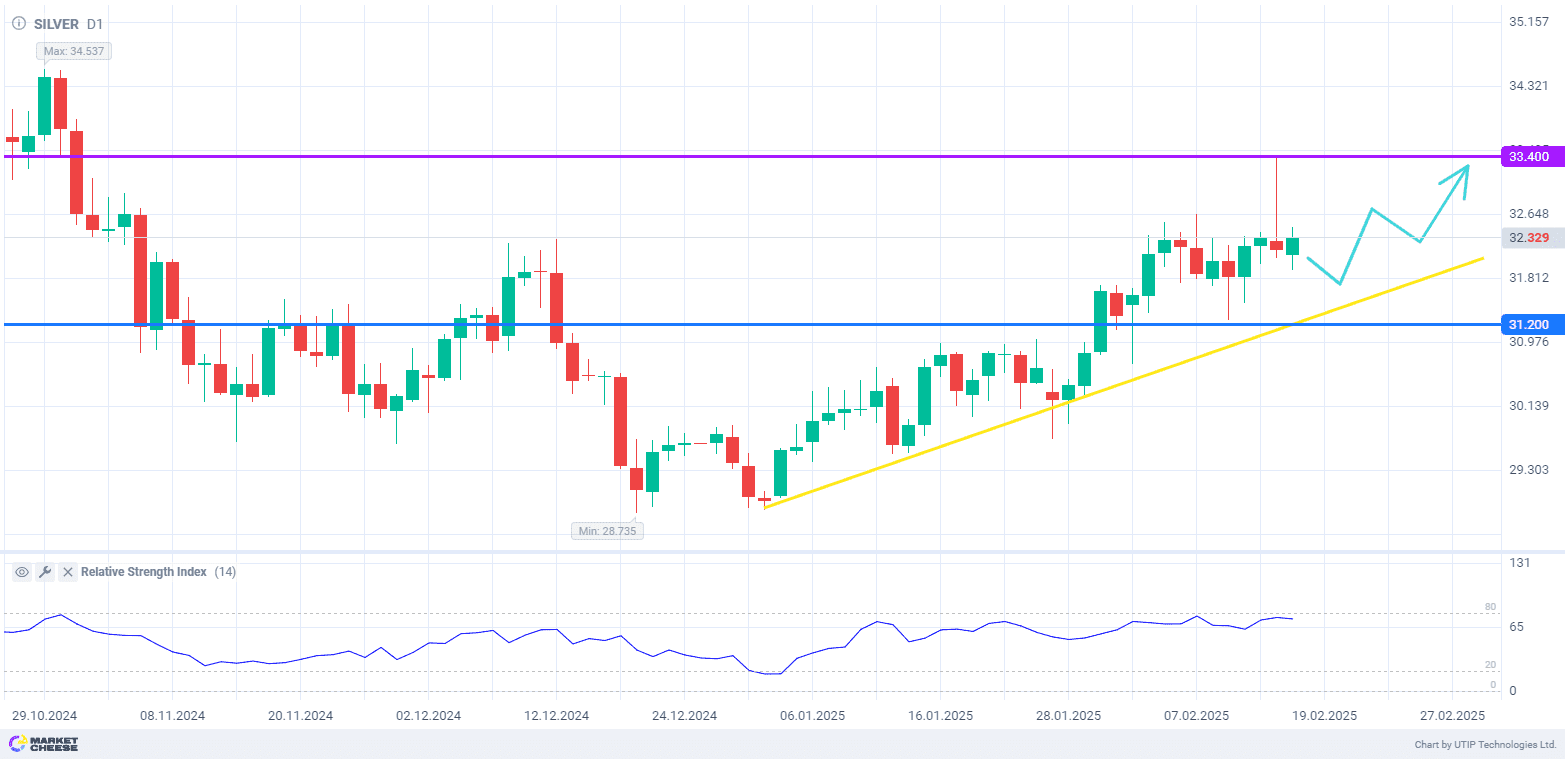

On Friday, silver prices made a powerful surge by almost 3.5%, exceeding the level of 33 for the first time since November 1. The prices did not manage to remain at the level, but there is no abrupt closure of long positions in today’s trading session either. In this regard, buyers of silver may make another attempt to bring prices out of the two-week-long upward consolidation. A rise to the level of 33.4 will be a signal for the bulls to seize the initiative.

According to Reuters, silver prices reached the local high mostly due to higher gold price. The analysts surveyed by the agency suggest that if the current momentum continues, silver will surpass the 10-year peak near $35 an ounce reached in 2024. Moreover, in case of the gold price correction traders may switch to silver, since the ratio of these metals is again close to the important mark of 90.

Meanwhile, the Chicago Mercantile Exchange (CME) silver stocks have increased 22% to 375.8 million ounces over the past 4 months due to the expected imposition of import tariffs by US President Donald Trump. At the same time, the volume of this metal in London Exchange (LME) storages fell by 8.6% in January alone. According to Reuters, it was the largest monthly decrease since 2016.

Fidelity International’s Tom Stevenson forecasts a stronger momentum for the price of silver compared to gold. Over the past year, the yellow metal updated its historical maximum several dozen times, while silver has to rise in price by more than 50% to reach its 2011 peak. These assets’ correlation has recently broken down, and its restoration will favorably affect silver prices.

The latest growth momentum has not brought the RSI to the overbought area yet. Therefore, silver buyers can still expect the price to reach 33.4 before correcting.

Consider the following trading strategy:

Buy silver at the current price. Take profit – 33.4. Stop loss – 31.2.