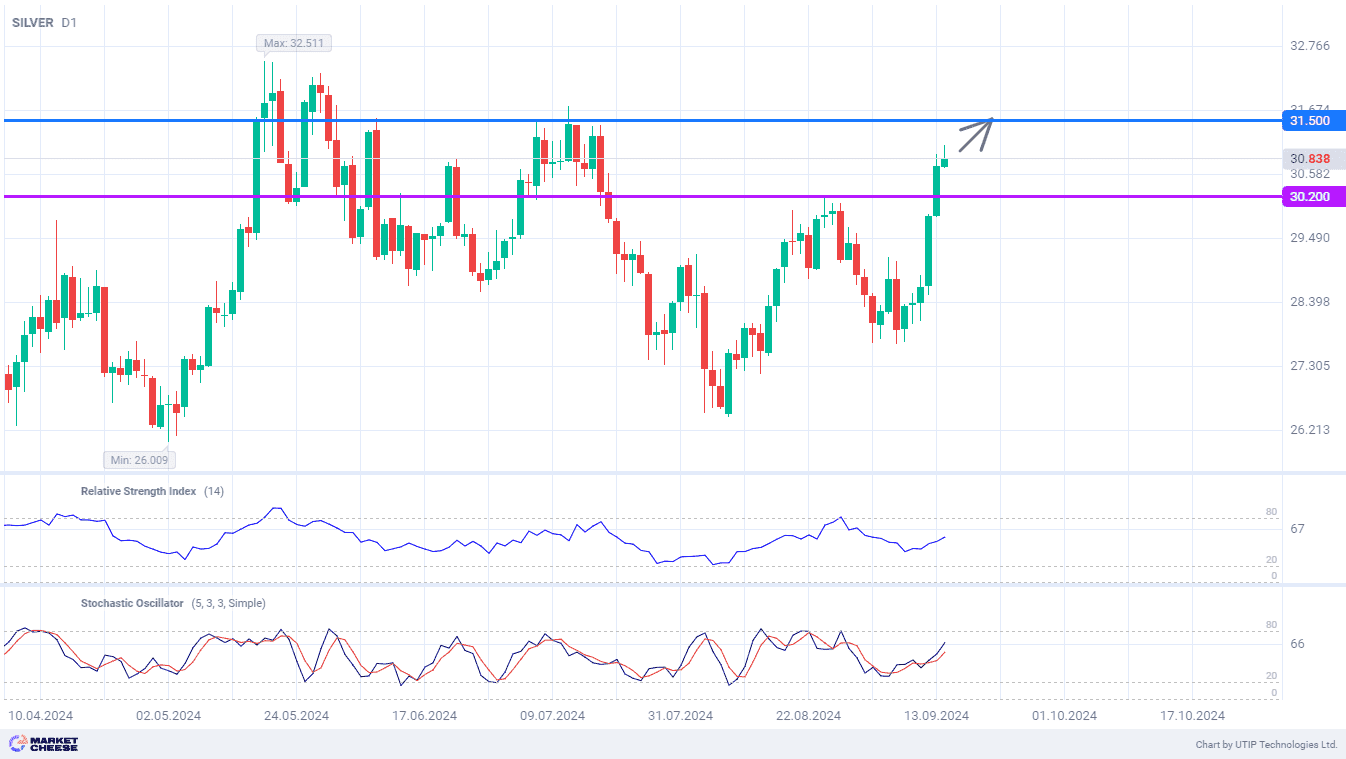

Silver prices showed a steady rise last week. A strong upward momentum of 10% brought the price back above the important level of 30, but it’s not the highest level the price can reach. The July highs near 31.5 may become the next target for the bulls. And the May top of 32.5 is not unattainable, given the new surge of investors’ interest in precious metals. The technical picture also doesn’t prevent further silver price growth.

Participants of financial markets are waiting for the first Fed rate cut in 4 years. The U.S. regulator will announce its decision on Wednesday, but it’s already noticeable that demand for gold, silver and other precious metals is rising. Many traders expect the rate to be cut by 0.5% at once, which will provide great support to commodity assets amid weakening dollar. However, silver has other growth drivers.

Peter Krauth in an article for Money Metals analyzed the future of the white metal market. China dominates in terms of demand, and the slowdown in the economy of the Celestial Empire has increased the risks for silver demand. Nevertheless, the consumption of this metal will continue to grow due to stable demand from India. This country can fully compensate for the negative effect of the weak Chinese industry.

Previously, almost all silver imported by India was used for jewelry. Now the picture has changed dramatically, in July this item of purchases barely exceeded 30%. All the rest of the purchased metal is intended for production purposes: the manufacture of solar panels, electronics and medical equipment. By the end of 2024, silver imports to India may almost double and reach 6,500–7,000 tons. Krauth also draws attention to the reduced duties that allow Indian consumers to increase purchases of white metal on more favorable terms.

Indicators RSI and Stochastic on the daily chart of silver have reversed. Now they support the upward movement of the silver price. The overbought zone is still far away, so the price has no serious obstacles to reach the level of 31.5.

The following trading strategy can be suggested:

Buy silver at the current price. Take profit — 31.5. Stop loss — 30.2.

Source: