On Friday, the AUDCAD pair is rising and continuing to form a bullish trend. This is due to the strengthening of the Australian dollar after the People’s Bank of China left its interest rates unchanged. This is important given the close trade ties between Australia and China.

At the same time, the continental country has seen stability in the labor market with the unemployment rate at 4.2% in August. Employment Change came in at 47.5K, which was well above the consensus forecast of 25K. At the same time, the Reserve Bank of Australia sees no reason to cut rates due to persistently high inflation.

In Canada, meanwhile, inflation fell to its lowest level since early 2021, coming in at 2% annualized at the start of the week. This increases the possibility of a significant interest rate cut by the Bank of Canada in the coming months, putting pressure on the Canadian dollar.

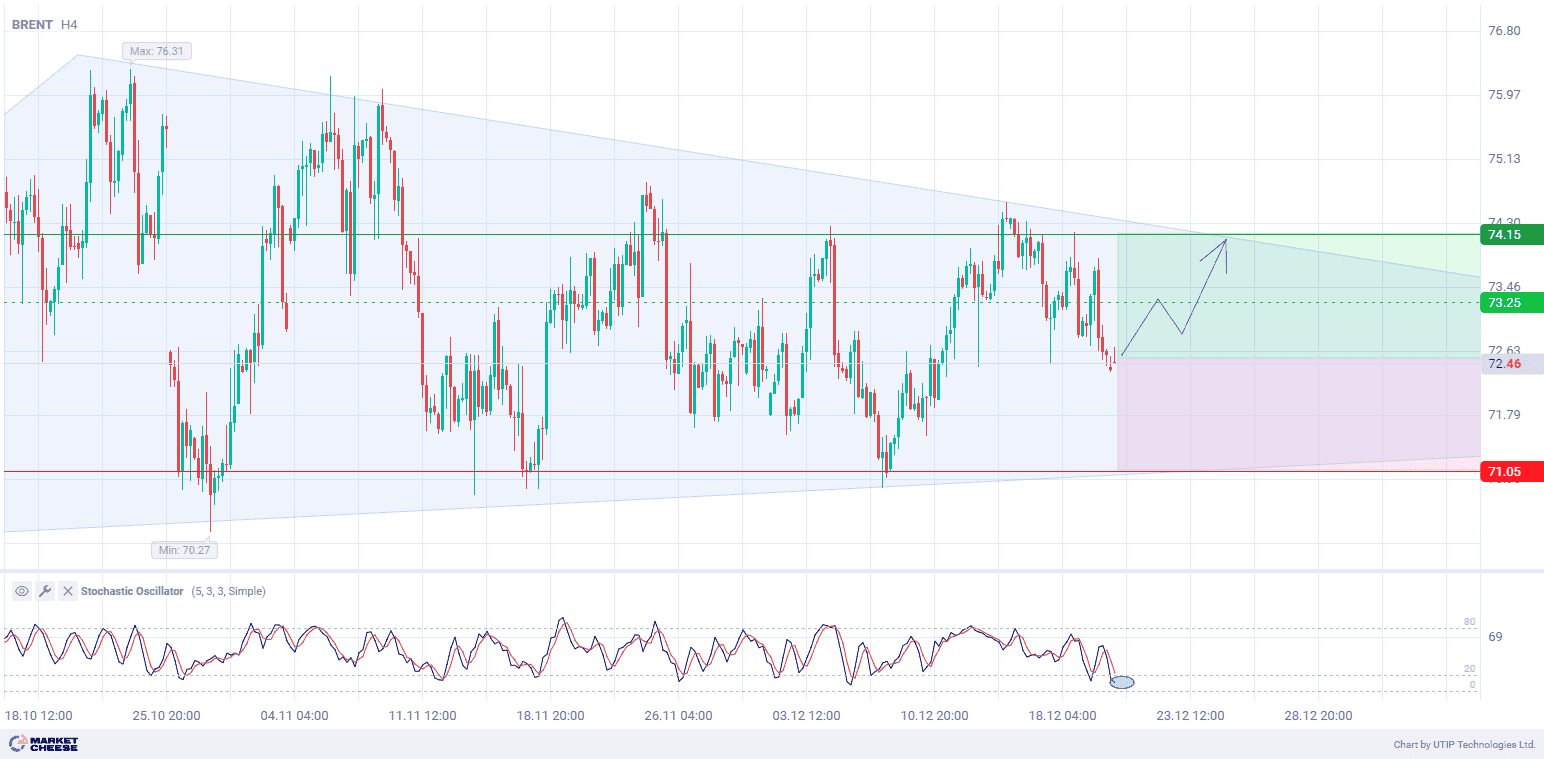

The Canadian currency may also be affected by upcoming speeches by the country’s central bank governor and the dynamics of oil prices. These factors will continue to influence the dynamics of the currency pair.

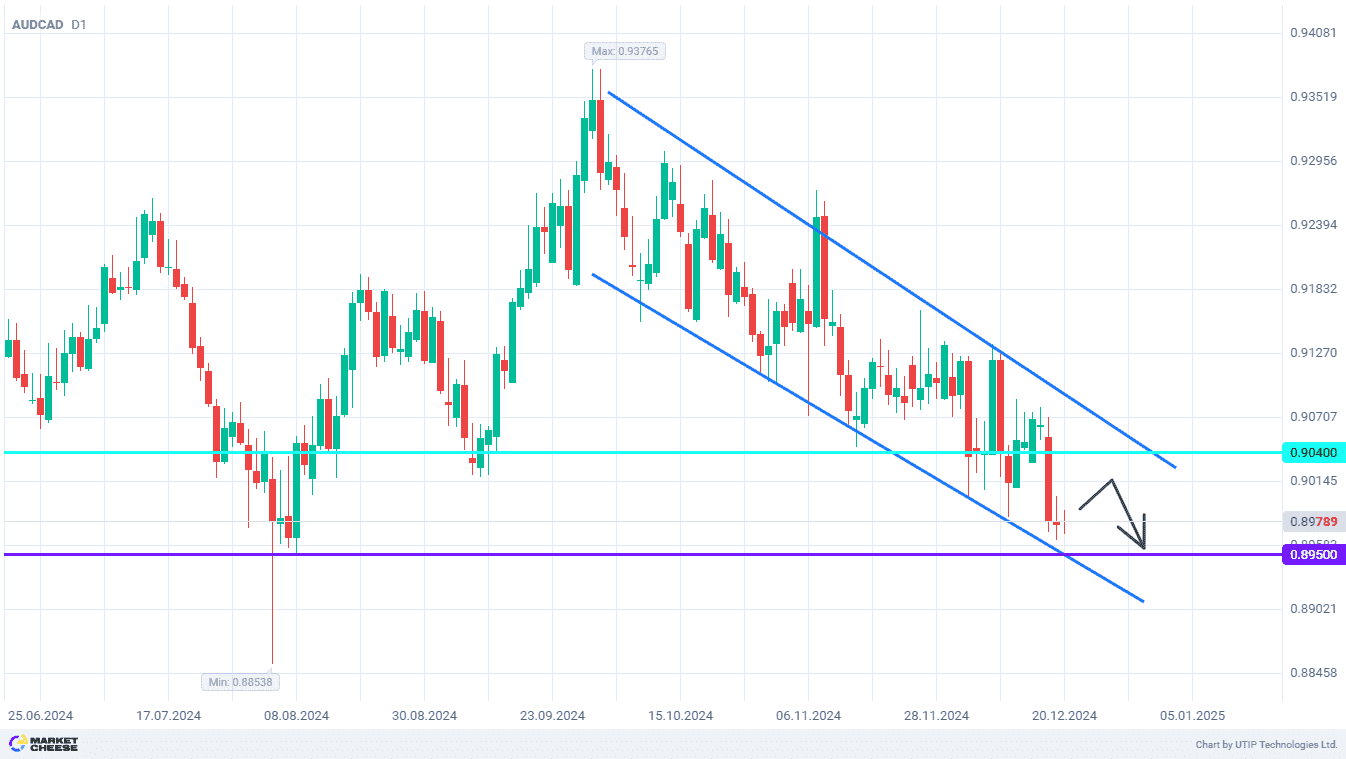

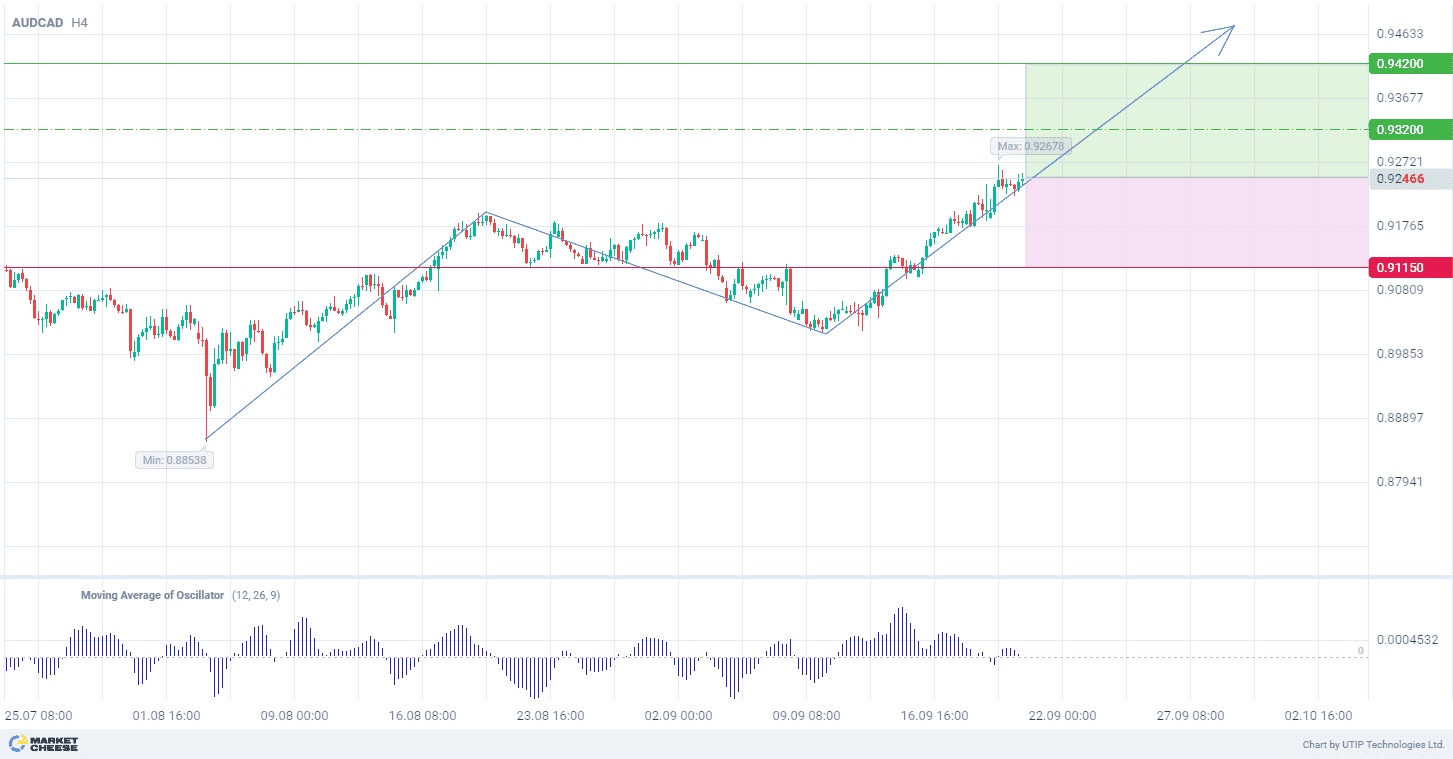

From the technical point of view, the pair is forming an uptrend on the H4 timeframe. According to the wave analysis, AUDCAD is forming the third ascending wave. The breakthrough of the top of the first wave at 0.9195 has already occurred, which indicates a possible strengthening of the upward momentum. The volumes of the Moving Average of the Oscillator (with parameters 12, 26, 9) remain in the positive zone. This strengthens the signal for the growth of the pair.

The short-term outlook for the AUDCAD currency pair is to buy with the target at 0.9420. Part of the profit should be fixed near 0.9320. The Stop loss can be placed at 0.9115.

The bearish trend is of a short-term nature, so it is suggested to limit the trading volume to no more than 2% of your capital to reduce risks.