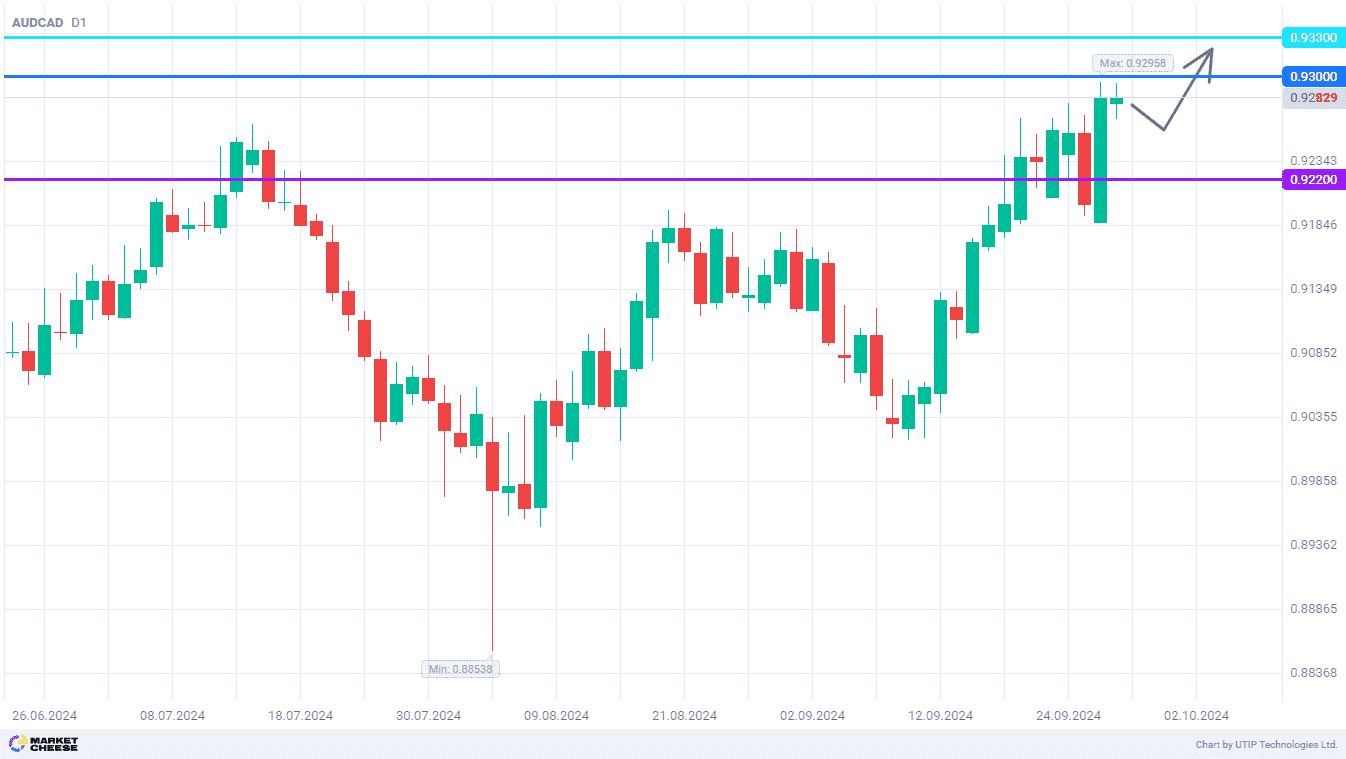

This week, the AUDCAD currency pair updated July highs and approached the level of 0.93 for the first time since February last year. Bears tried to intercept the initiative, but all of Wednesday drawdown was bought back the next day. Taking into account the strength of yesterday’s growth momentum, now the buyers of the Australian dollar can take a small pause. Still, the fundamental picture speaks in favor of further increase of the AUDCAD quotes to 0.933.

The hawkish stance of the country’s financial regulator is of great support for the strengthening of the Australian currency. On Tuesday, the Reserve Bank of Australia (RBA) once again left the key rate at 4.35%. Unlike the vast majority of central banks in other countries, the RBA is not even contemplating the issue of monetary policy easing. Head of the regulator Michelle Bullock again pointed out that core inflation in the country is too high. In her opinion, there will be no reduction in interest rates in the short term.

Against this background, UBS analysts recommend investors to increase long positions on the Australian dollar. According to their estimates, this monetary unit, along with the Japanese yen, has the highest growth potential among the G10 currencies. In addition to the hawkish rhetoric of the RBA officials, UBS also draws attention to the greatest supporting measures for the Chinese economy since 2008, announced this week by the country’s government. China is Australia’s largest trading partner, so the positive effect could spread to both economies.

Meanwhile in Canada, the monetary policy easing cycle is still evolving. Governor of the Bank of Canada Tiff Macklem announced the long-awaited achievement of the inflation target in the country. He also expressed fears that the GDP growth rate for Q3 will not meet expectations of 2.8%. As a result, the Canadian economy may need more support from the regulator. According to Maklem, the Bank of Canada is ready to consider lowering the key rate by 0.5% at the meeting on October 23. This step is going to put more pressure on the national currency.

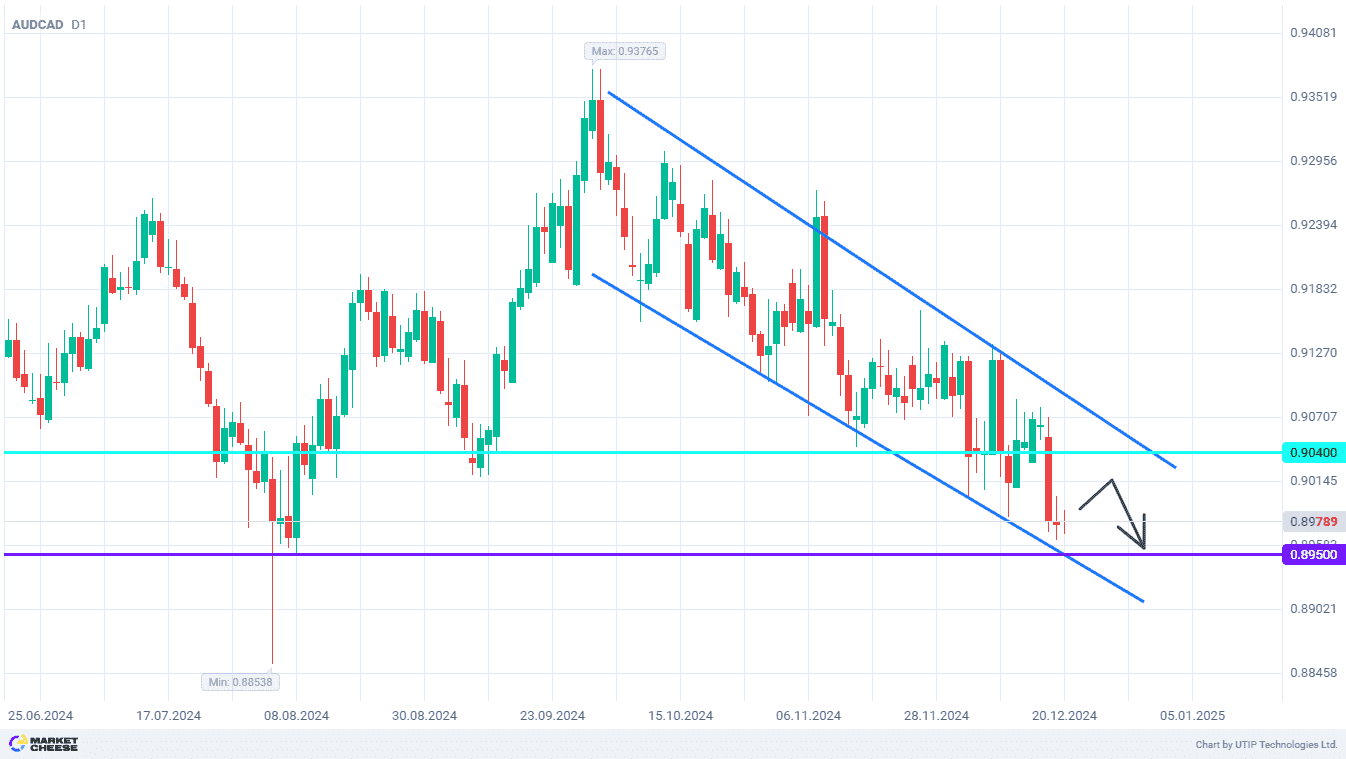

In the coming days, the bulls will surely start testing the level of 0.93. If they manage to consolidate at this level, the AUDCAD will get the way to the next target of 0.933.

The following trading strategy can be suggested:

Buy AUDCAD in the range of 0.925-0.928. Take profit 1 – 0.93. Take profit 2 – 0.933. Stop loss – 0.922.