On Tuesday, the GBPUSD currency pair quotes are trading in a narrow range, consolidating the growth of the previous week. Investors are anticipating the upcoming data on the US economy to get more information on possible interest rate cuts this year.

Yesterday, Federal Reserve Chairman Jerome Powell said the regulator is considering two interest rate cuts of up to a total of 50 basis points in 2024 if the economic growth meets expectations. However, the Fed may adjust the pace of rate cuts depending on the economic situation.

The comments of the Fed Chairman were immediately reflected in traders’ forecasts. For the most part, they retained their confidence in the Fed’s November rate cut. However, now only about 35% of respondents expect a reduction of 0.5%, while a day earlier this figure was 53.3%, according to the FedWatch tool from the CME Group.

Now, investors are looking forward to the publication of purchasing managers’ index (PMI) data for the US manufacturing sector for September and speeches by Fed officials Rafael Bostic and Lisa Cook scheduled for Tuesday.

Market attention will also be focused on Friday’s US labor market data. These indicators may have an impact on the further dynamics of rate cuts.

Meanwhile, Bank of England representative Megan Green said that the consumption-driven recovery of the UK economy could trigger a new round of inflation. Despite her words, monetary easing is likely to be continued as inflation is moving in the right direction. At the same time, traders lowered their expectations of a possible rate cut by the Bank of England in November.

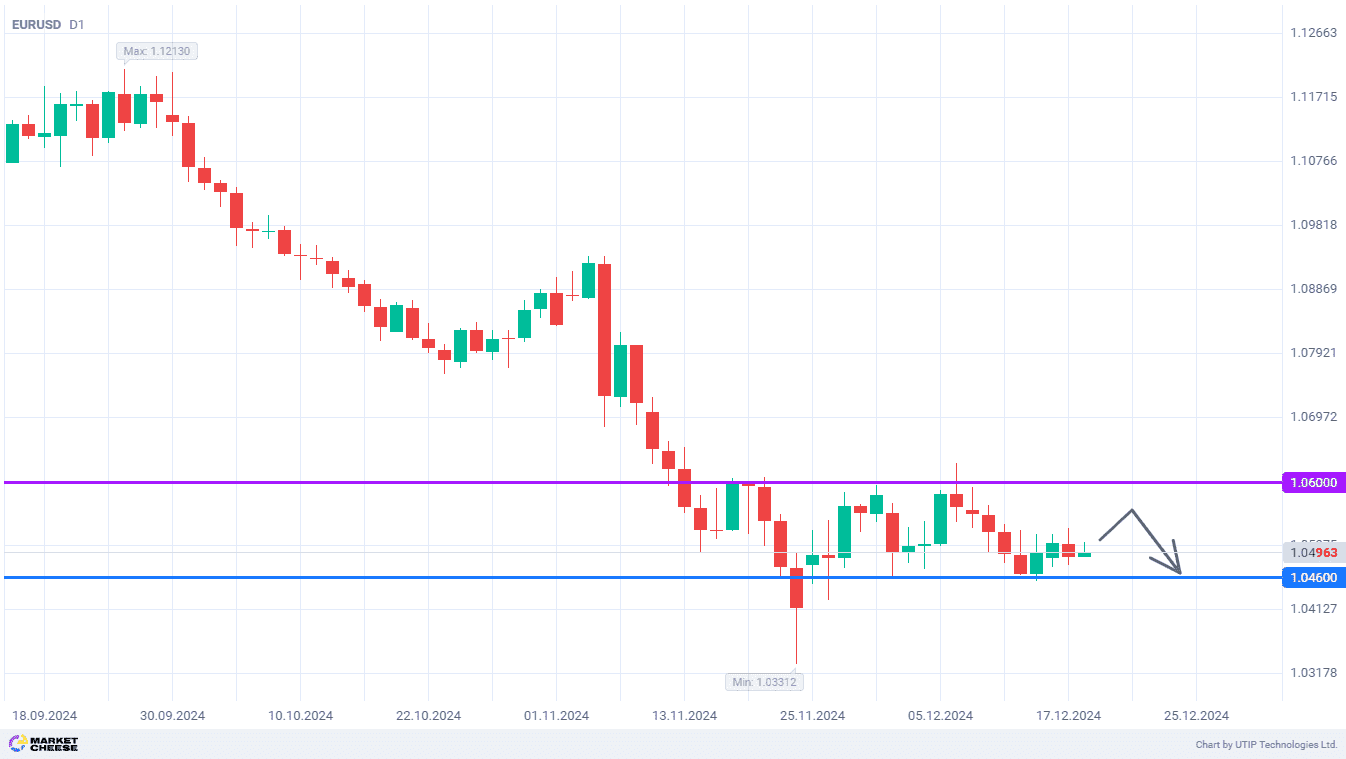

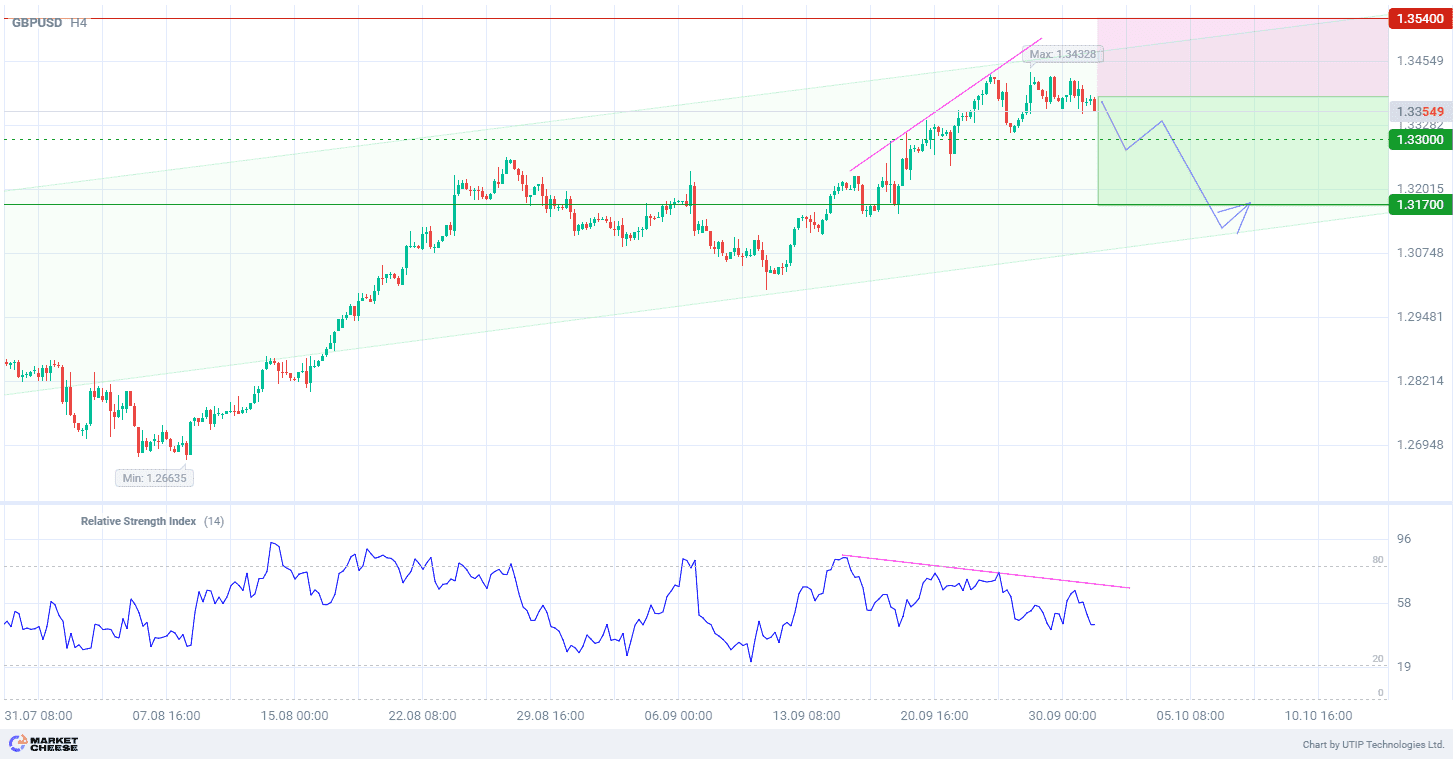

The technical data on the GBPUSD price chart shows the formation of an uptrend on the D1 timeframe. The price reaching the upper boundary of the channel indicates possible correction on the H4 timeframe. Divergence of the Relative Strength Index (RSI) indicator (with standard settings) shows the possibility of a reversal towards the trend support of the channel.

Short-term prospects of the GBPUSD currency pair suggest selling, with the target at the level of 1.3170. Partial profit taking is recommended near 1.3300. The loss limitation level is set at 1.3540.

Since the bearish trend is of a short-term nature, the trading volume should not exceed 2% of the total balance to reduce risks.

Source: