Brent crude oil prices are rising on Friday, posting the biggest weekly gain since early October on escalating geopolitical tensions in Eastern Europe. Uncertainty regarding the expansion of the conflict in the region increases concerns on the oil market.

Oil prices have been fluctuating since mid-October, influenced by various factors, including a strong dollar and ample supply. According to the US Department of Energy, crude oil inventories in the country increased by 545,000 barrels to 430.3 million barrels in the week ending November 15. This put downward pressure on energy prices.

On Thursday, the Chinese government announced the introduction of measures aimed at supporting energy imports, amid worries over US President-elect Donald Trump’s intentions to impose tariffs.

Goldman Sachs predicts the Brent crude to average around $80 a barrel this year, despite an expected deficit in 2024 and ongoing geopolitical uncertainty. A surplus of 0.4 million bpd is anticipated next year, according to the bank’s report on Thursday. This could limit the rise in energy prices.

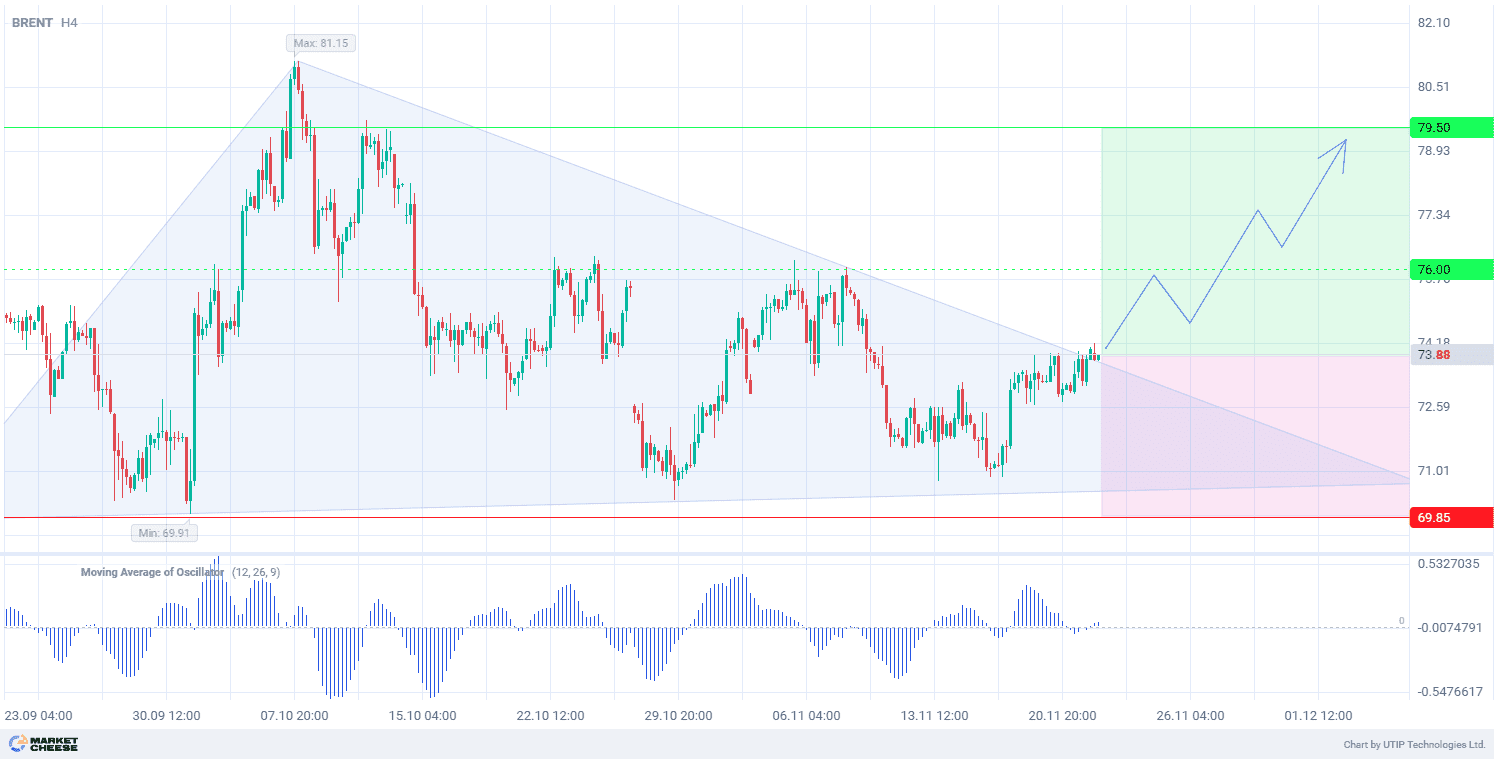

From the technical point of view, Brent crude oil price exited the triangle bilateral pattern on the H4 timeframe. Having broken through the resistance level of the pattern, the price showed an uptrend. The Moving Average of Oscillator indicator (parameters 12, 26, 9) has moved into the positive zone, which confirms the strength of the bullish sentiment.

Short-term prospects for Brent oil prices suggest buying, with the target at 79.50. Part of the profit should be taken near the level of 76.00. A Stop loss could be set at 69.85.

Since the bullish trend is short-term, the trading volume should not exceed 2% of your total balance to reduce risks.

Source: