On Friday, Brent crude oil recorded its first weekly decline in 2025, losing around 3% of its value. The main reason was the statements of new US President Donald Trump, who raised questions about possible trade confrontations and called on Saudi Arabia and OPEC to lower oil prices.

Trump’s first week in the White House began with threats to impose tariffs on imports from Canada, Mexico and China. On Thursday, however, he said he would prefer to avoid tariffs on China. This statement weakened the dollar and partially offset the decline in oil prices. However, prices remain on track for their biggest weekly drop since November, despite a general rise in the cost of the hydrocarbon since the beginning of the year, driven by a cold winter in the northern hemisphere and restrictive measures against Russia.

Restrictions imposed by the previous U.S. administration reduced Russian oil exports, pushing up the cost of Middle Eastern crude. As a result, some Asian refiners have begun to cut back on processing or are considering doing so.

One of Trump’s first executive orders was to declare an energy emergency aimed at boosting domestic production.

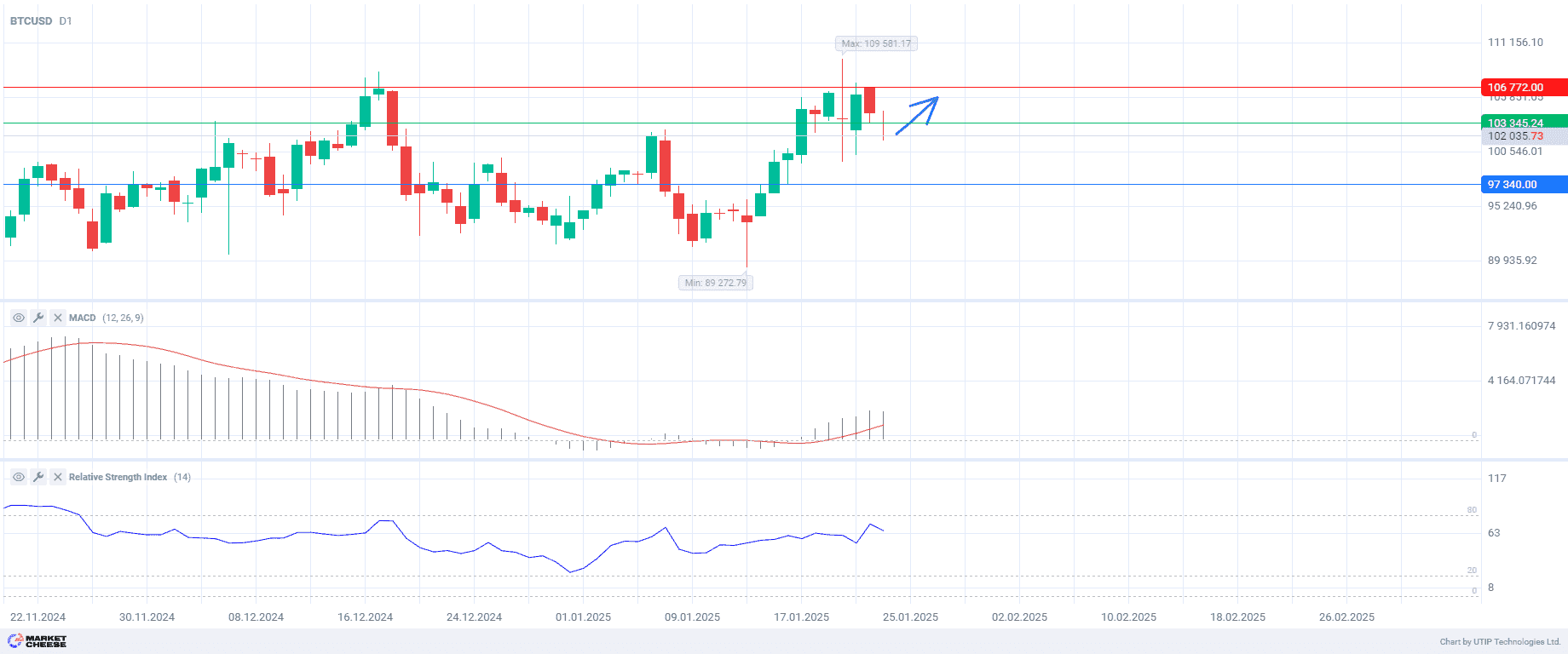

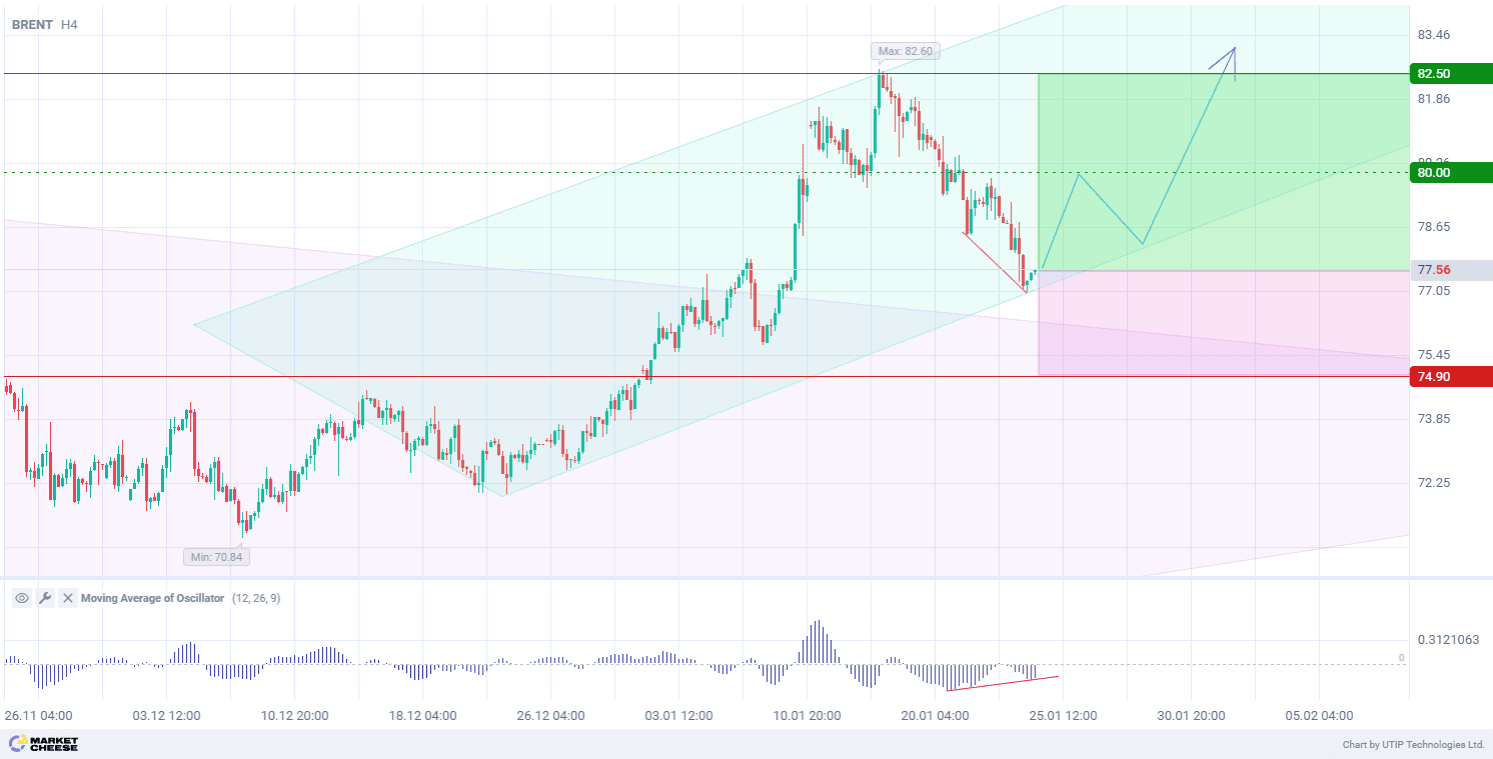

From a technical perspective, the price of Brent crude oil is forming a new bullish trend on the H4 timeframe, despite the bearish direction in recent days. The nine-month downtrend ended in early January. The price is showing signs of a pullback as it approaches the channel support. The volume of the Moving Average of Oscillator (parameters 12, 26, 9) is showing a divergence, indicating a possible trend reversal to the upside.

The short-term outlook for the price of Brent oil suggests buying with the target level at 82.50. Partial profit taking is recommended at 80.00. A stop loss could be set at 74.90.

As the bullish trend is short term, the trading volume should not exceed 2% of the total balance to reduce risks.

Source: