On Friday, the price of Brent oil showed multidirectional momentum following the OPEC+ decision to postpone the resumption of suspended production for another three months. This came against a backdrop of weak demand and increased production from outside the group. However, this decision did not significantly improve sentiment in the market, which may face an oversupply of commodities next year.

OPEC+ decided to start with a moderate increase in production in April 2025 and to phase out the cuts over 18 months. This approach is more cautious than previously expected. The actions of the organization’s members indicate a willingness to restore balance in the oil market.

According to Standard Chartered Plc, the delay in easing restrictions, the extension of the deadline for lifting them and the UAE’s agreement to delay the increase in the baseline target will lead to a significant reduction in the amount of oil that OPEC+ will add to the market in 2025. The projected increase will be only 191.3 million barrels instead of the previously planned 496.3 million barrels, which is a 61% reduction.

Optimistic sentiments about geopolitical events in the Middle East and Eastern Europe are offset by fears of oversupply in 2025. Market participants have not yet fully considered the impact of production cuts on supply balance. This could lead to an increased volatility.

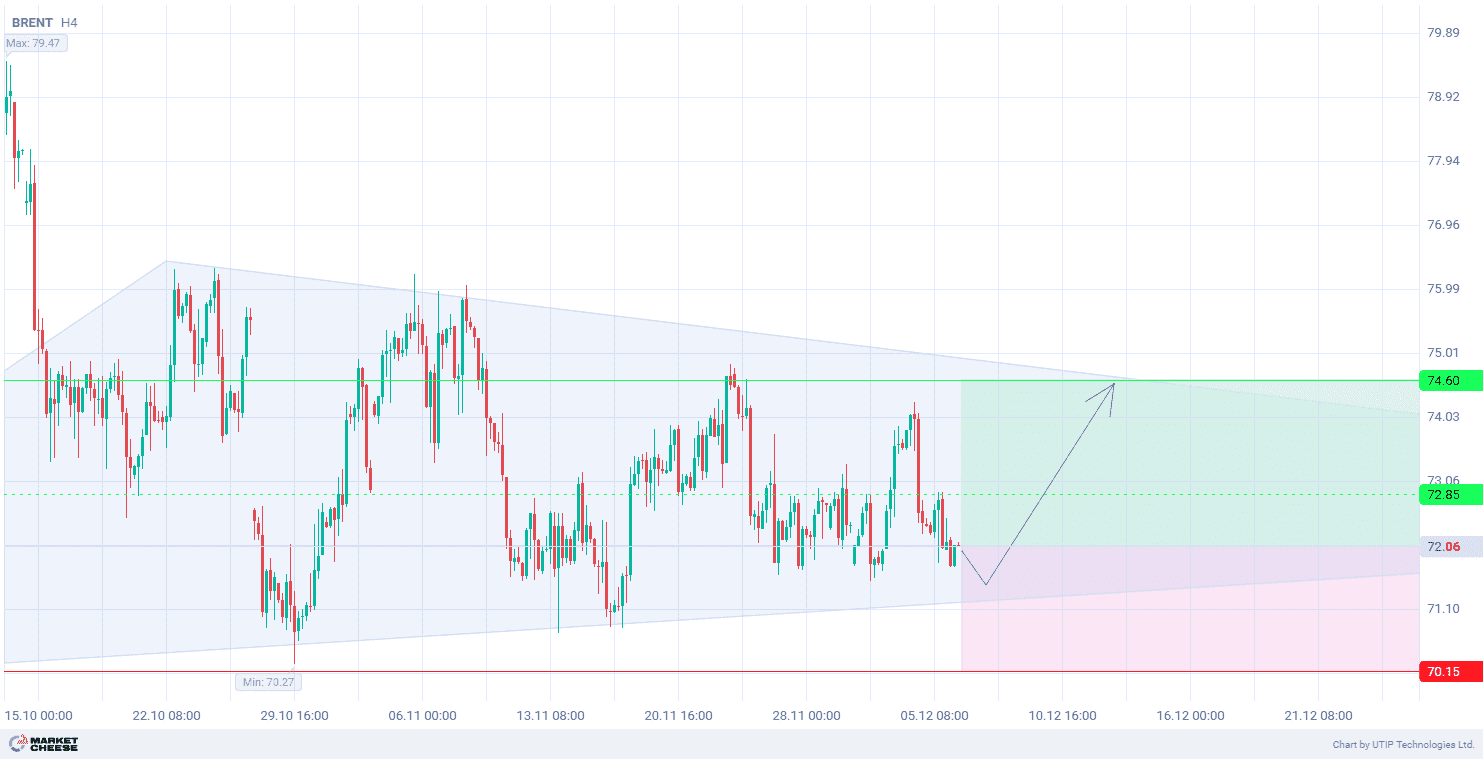

From a technical point of view, the price of Brent is in the “triangle” of uncertainty on the H4 timeframe. The price is approaching the lower border of the trend support. A potential pullback from this level may be a signal to buy within the “triangle” formation.

The short-term outlook for Brent oil suggests buying with a target at 74.60. Partial profit taking is recommended at 72.85. A stop loss could be set at 70.15.

As the bullish trend is short term, the trading volume should not exceed 2% of the total balance to reduce risks.

Source: