A two-day Fed’s policy committee meeting, expected by many investors and traders, starts today. It’s projected to result in a rate cut. Investors are certain that the Fed will begin to cut rates, the question is, will the Fed opt for a quarter-of-a-percentage-point reduction or for a half-percentage-point rate cut. The rate reduction has turned into a coin flip between 50 and 25 bps over the last few days.

Futures on the fed funds rate, which measures the cost of unsecured overnight loans between banks, have priced in a nearly 60% chance of a 50 basis-point rate cut by the Federal Reserve on Wednesday.

That was up from 45% last Friday following the release of an in-line U.S. consumer price index report.

For 2024, rate futures have factored nearly 120 bps in easing, and about 250 bps in cuts by September of 2025.

Reports by the Wall Street Journal and Financial Times late Thursday saying a 50-bp rate reduction is still an option, and comments from former New York Fed President Bill Dudley arguing for an outsized cut, triggered a pivot in market expectations.

On Monday, Dudley reiterated his stance on the need for the Fed to do a big cut. In an article on Bloomberg News, the former Fed official noted that the Fed’s dual mandate of price stability and maximum sustainable employment has become more balanced, which suggests monetary policy should be neutral, neither restrictive nor boosting economic activity.

Nevertheless, the situation is such that a 25 basis point cut has already been factored in by the market and is embedded in the current price, including the EURUSD currency pair.

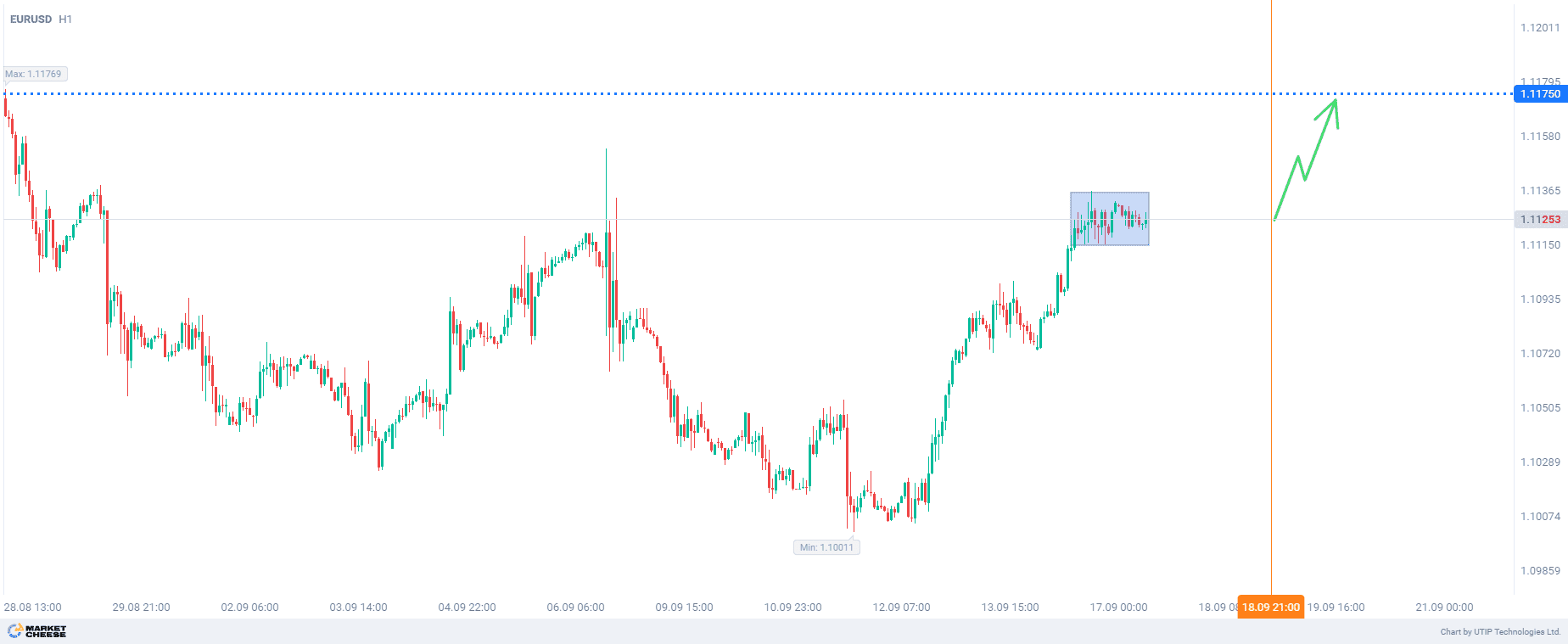

A rate cut by 50 basis points is likely to push the EURUSD currency pair to the level of 1.1175. From the technical point of view, the quotes are forming a flag pattern on the hourly timeframe, which, conventionally speaking, signals the accumulated potential and market readiness to take on new opportunities.

The final recommendation is to buy EURUSD if the Fed reduces the interest rate by 50 basis points at once.

The profit could be fixed at the level of 1.1175. The Stop loss could be placed at the level of 1.1100.

The volume of the opened position should be set so that the value of a possible loss, defined with a protective stop order, does not exceed 2% of your deposit.

Source: