Brent crude oil prices have formed a narrow range on medium timeframes as a more favorable supply outlook and sluggish growth in global demand outweighed concerns that escalating tensions in the Middle East could affect output in the key exporting region.

At the moment, there are many concerns regarding oil prices, with market participants expecting an upcoming increase in supply from OPEC+ by the end of this year, and a still weak demand outlook from China, reflected in the country’s latest PMI data.

According to a survey of the private sector released on Monday, China’s manufacturing activity contracted sharply in September due to a drop in new orders both domestically and overseas, which sent manufacturing sector confidence to a record low.

Analysts say a series of incentives introduced over the past week is likely to be enough to bring China’s economic growth back to around 5% in 2024.

However, lower-than-forecast data over the past few months has raised doubts about reaching that target.

Along with demand concerns, OPEC+, which brings together OPEC members and their allies, is set to increase production by 180,000 barrels per day in December.

Meanwhile, US stocks of crude oil and petroleum products are expected to fall by about 2.1 million barrels, acording to a preliminary Reuters poll released on Monday.

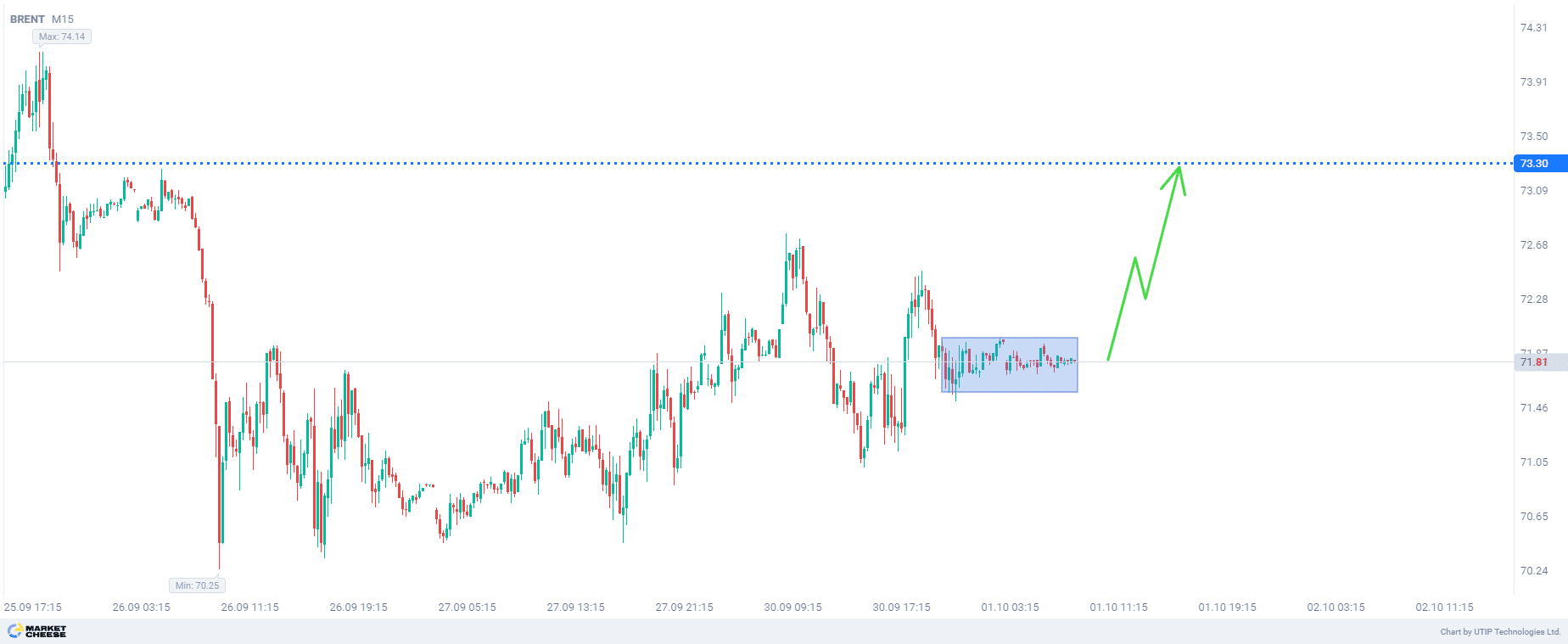

The final recommendation is to buy Brent, provided that the actual US crude oil inventories are lower than the estimated 2.1 million barrels.

The profit is taken at the level of 73.3. The loss is fixed at the level of 70.7.

The volume of the opened position is determined so that the amount of the possible loss, fixed with a protective stop order, does not exceed 2% of your deposit funds.