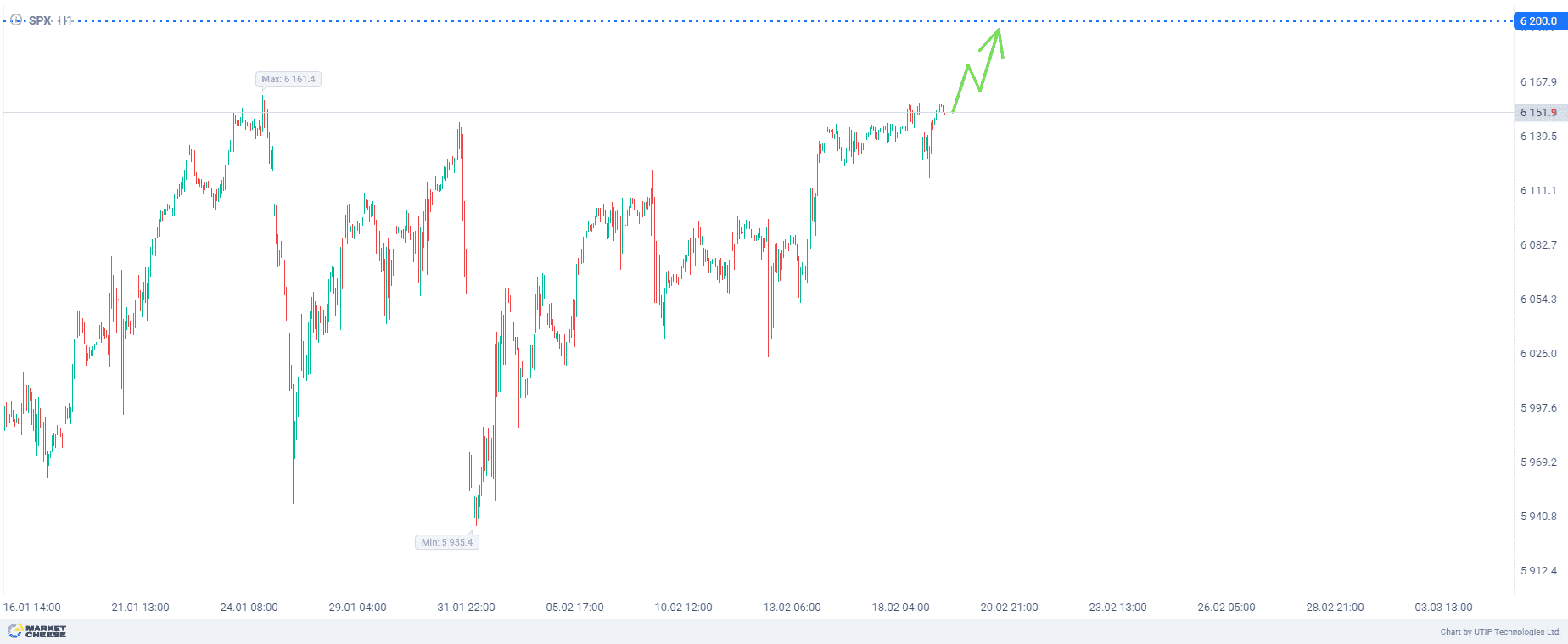

The S&P 500 index exceeded its previous historical maximum yesterday amid the earning season end, the release of the US Federal Reserve minutes, and geopolitical uncertainty.

The Federal Reserve is expected to publish the minutes of its January meeting today. During the meeting, Fed officials decided to leave interest rates unchanged amid the signs of inflation recovering, and the unknown effects of President Trump’s threats to impose tariffs.

The speeches of US Federal Reserve policymakers generally followed the same script. The president of the Philadelphia Fed, as well as Governors Michelle Bowman and Christopher Waller, said they believe the strong economy and high inflation justify keeping interest rates unchanged.

The president of the San Francisco Fed Mary Daly reiterated that pausing rate cuts is reasonable until more progress is made in bringing inflation down to the Fed’s 2% target.

The fourth-quarter earnings season came to a close, with 383 companies in the S&P 500 index reporting as of Friday. 74% of them provided results that exceeded expectations, according to LSEG.

Fourth-quarter earnings for S&P 500 companies are currently expected to have grown 15.3% year-over-year, compared with a 9.6% forecast on January 1.

On the NYSE, the number of rising stocks exceeded the falling ones by a ratio of 1.53 to 1. There were 298 new highs and 85 new lows on the NYSE. On the Nasdaq exchange, 2,289 stocks rose and 2,087 fell. The rising stocks outnumbered the falling ones by a ratio of 1.1 to 1.

The S&P 500 Index posted 29 new 52-week highs and 11 new lows, while the Nasdaq Composite recorded 126 new highs and 113 new lows.

The data inspires some optimism about further growth of the S&P 500 index.

The overall recommendation is to buy S&P 500.

Profits should be taken at the level of 6,200. A Stop loss could be set at the level of 6,080.

The volume of the opened position should be set in such a way that the value of a possible loss, fixed with the help of a protective Stop loss order, is no more than 1% of your deposit funds.