EURUSD remains under pressure for the fourth consecutive day. The US dollar is still strong due to the rise of Treasury bond yields and cautious market sentiment before the publication of data on the consumer price index (CPI) in the United States.

Market participants expect an increase in annualized CPI to 2.7% in November versus 2.6% in October. Core inflation, which excludes volatile components, is forecast at 3.3%. A day later, market participants are also expecting the publication of the producer price index (PPI), another key inflation indicator.

Any deviations from forecasts could significantly affect expectations of a Fed rate cut. Although the chance of the US monetary easing by 25 basis points is estimated at 85.8% (according to the CME FedWatch Tool), a slowdown in inflation could dampen these expectations.

In the eurozone, traders await the ECB’s decision, which will be announced on Thursday. It’s forecasted that the refinancing rate will be cut from 3.4% to 3.15% and the deposit rate from 3.25% to 3.0%. The ECB decision may have a significant impact on EURUSD, especially taking into account the strong dollar.

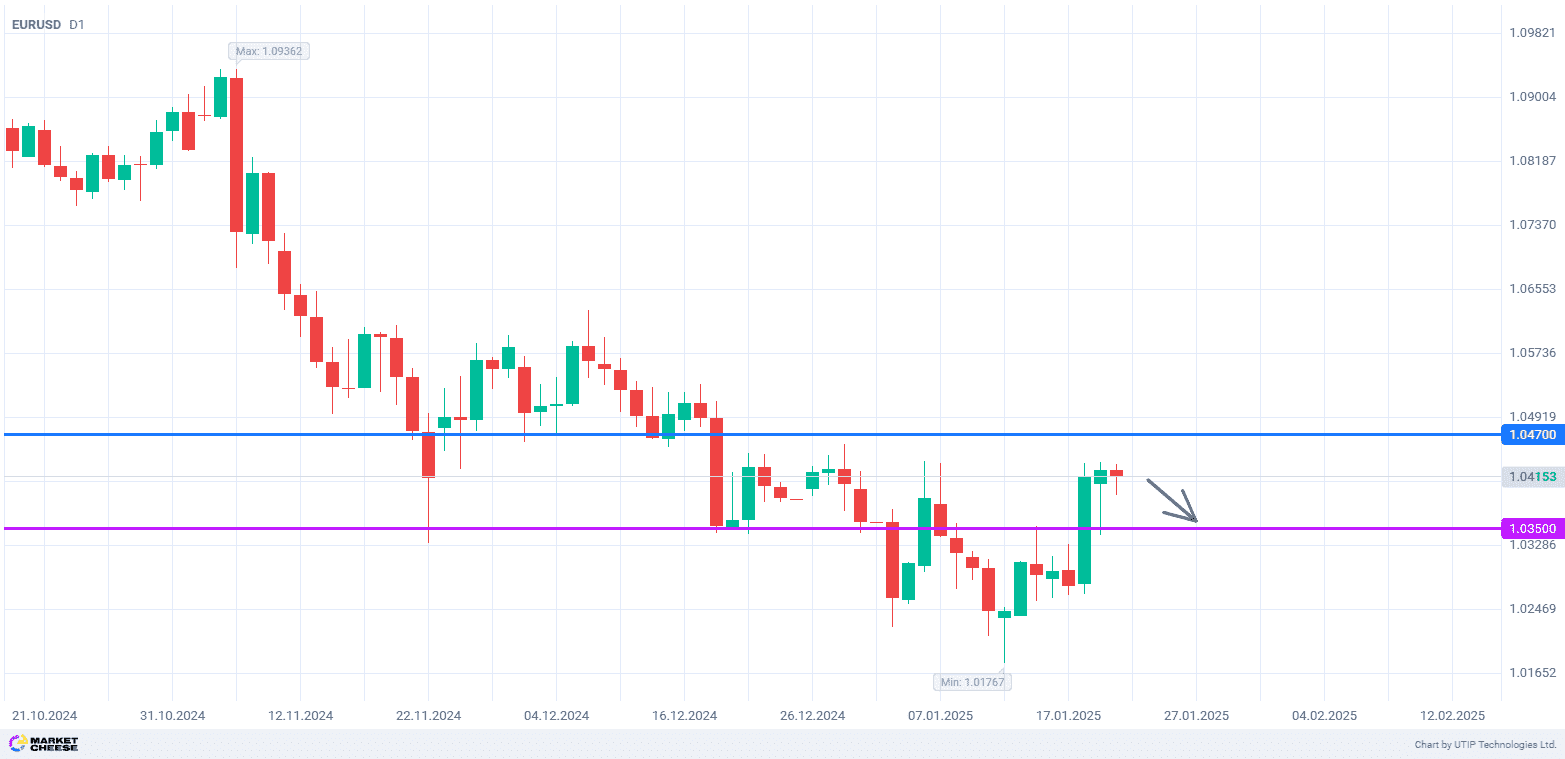

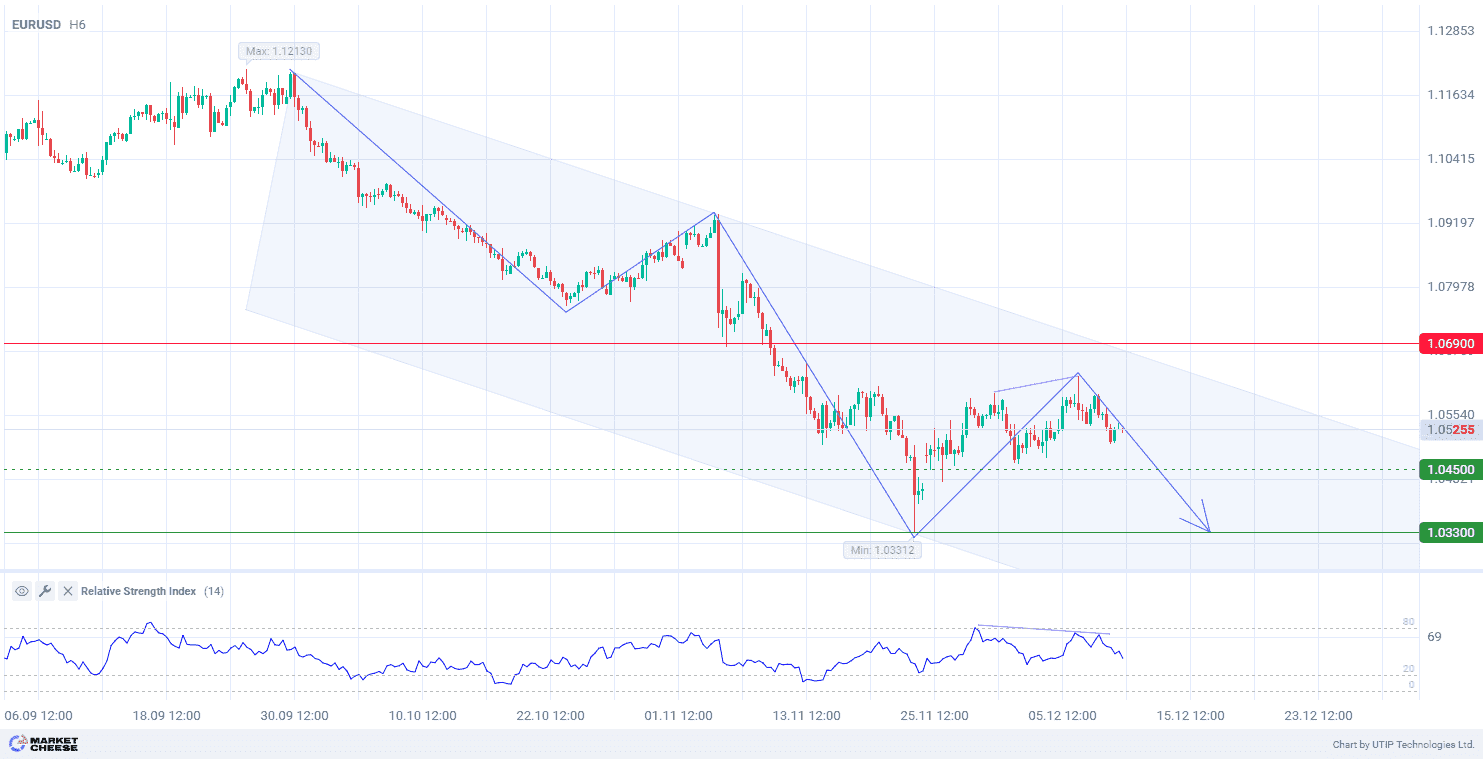

According to the technical analysis, EURUSD is correcting in a narrow channel on the daily timeframe (D1) after the impulsive movement in November, while the downtrend remains intact.

In terms of wave analysis, a quadruple downward wave is being formed on the H6 timeframe. However, its potential is largely exhausted, which is seen in the current price correction. Additionally, the RSI shows divergence, indicating the possibility of transition to the fifth downward wave.

Signal:

The short-term outlook for EURUSD is to sell.

The target is at the level of 1.0330.

Part of the profit should be fixed near the level of 1.0450.

The Stop loss could be placed near the level of 1.0690.

The bearish trend is of a short-term nature, so it is suggested to limit the trading volume to no more than 2% of your capital.