The GBPUSD currency pair quotes are consolidating near a seven-month low on Tuesday, having started the holiday week with a 0.3% decline. Trading activity in the markets remains low due to the approaching Christmas holidays in Western countries. Global markets will be closed on Wednesday, which will restrict liquidity.

Economic data from the UK failed to support the pound. GDP for the third quarter showed 0.0%, below the forecast of 0.1%. Annual GDP amounted to 0.9% against the expected 1.0%. This data increased concerns about slowing economic growth in the UK.

In the US, Durable Goods Orders for November also disappointed the markets. The indicator decreased by -1.1% compared to the forecasted -0.4%. This was significantly worse than the revised October reading of 0.8%. The main part of the decline is attributable to the automotive sector. Meanwhile, the core indicator (excluding autos) came in at -0.1%. This is better than the overall result, but below the expected 0.3%.

The market reaction to the economic reports was limited. Traders preferred to take a wait-and-see stance ahead of the holiday weekend. Important data on both sides of the Atlantic, including initial jobless claims in the US, published on Thursday, may cause a slight movement.

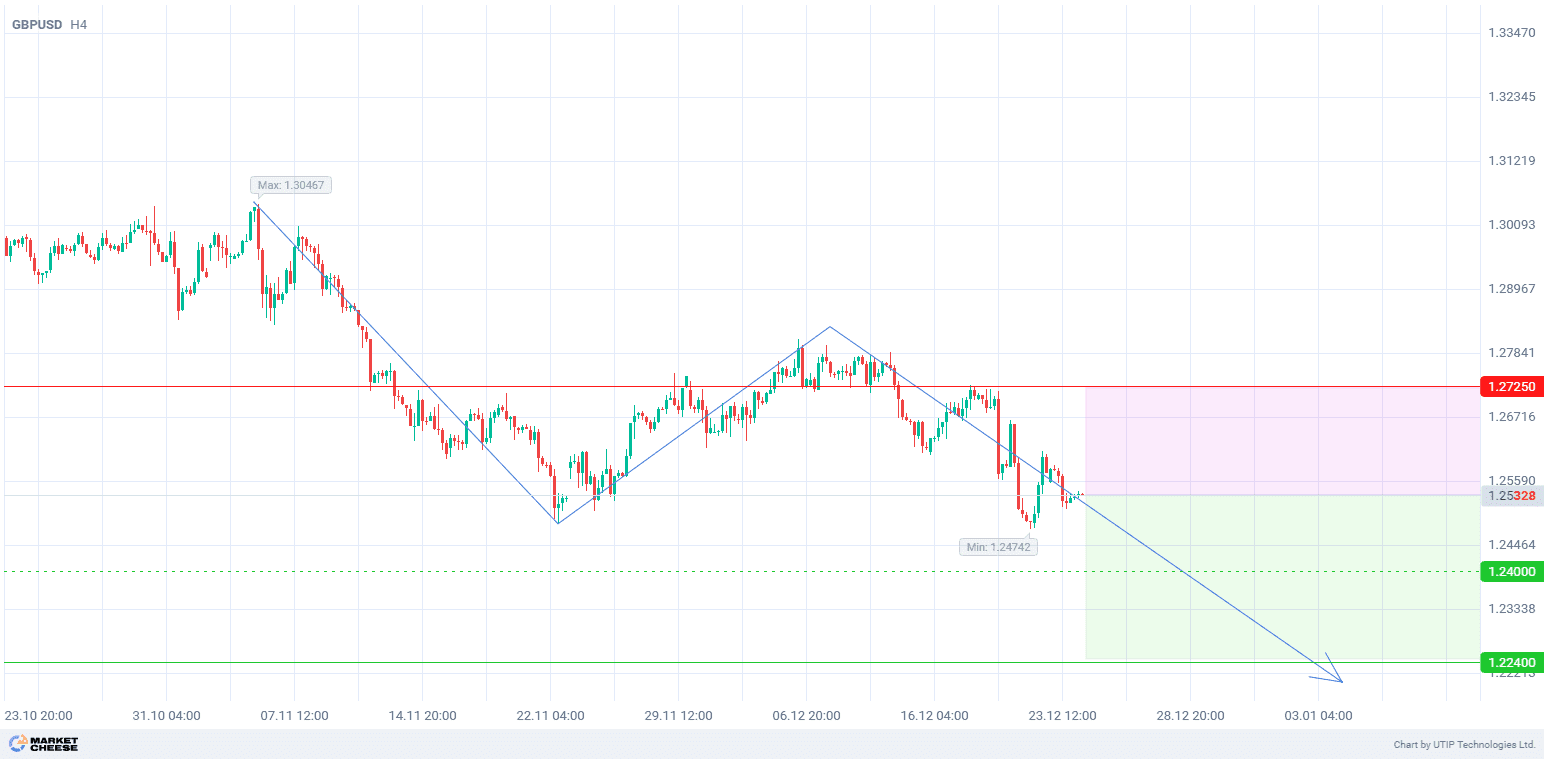

Technical data on GBPUSD indicates the formation of a downtrend on the H4 timeframe. In terms of wave analysis, the pair is in the process of forming the third downward wave. Breaking through the top of the first wave at 1.2485 will strengthen the price movement towards sales.

Short-term prospects for the GBPUSD currency pair suggest selling with the target of 1.2240. Part of the profit should be taken near the level of 1.2400. A Stop loss could be set at 1.2725.

Since the bearish trend is short-term, the trading volume should not exceed 2% of your total balance to reduce risks.