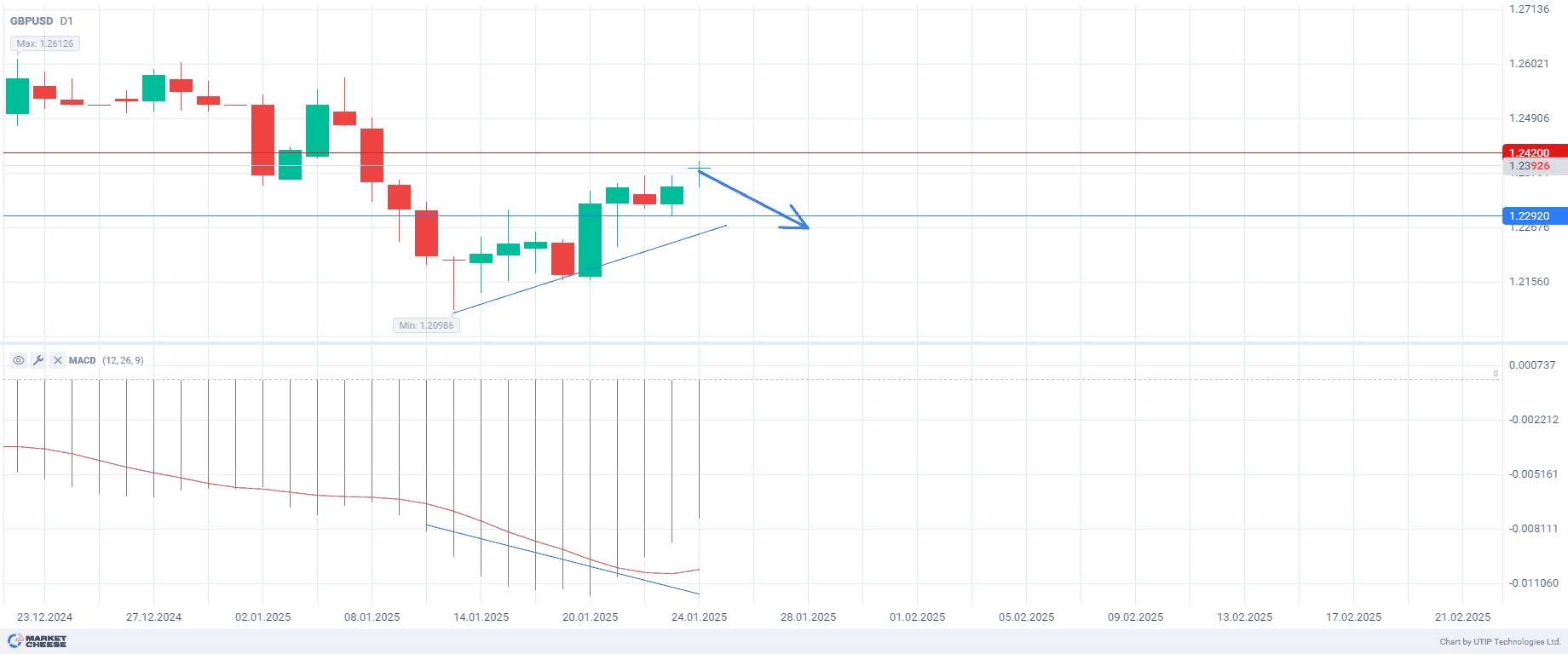

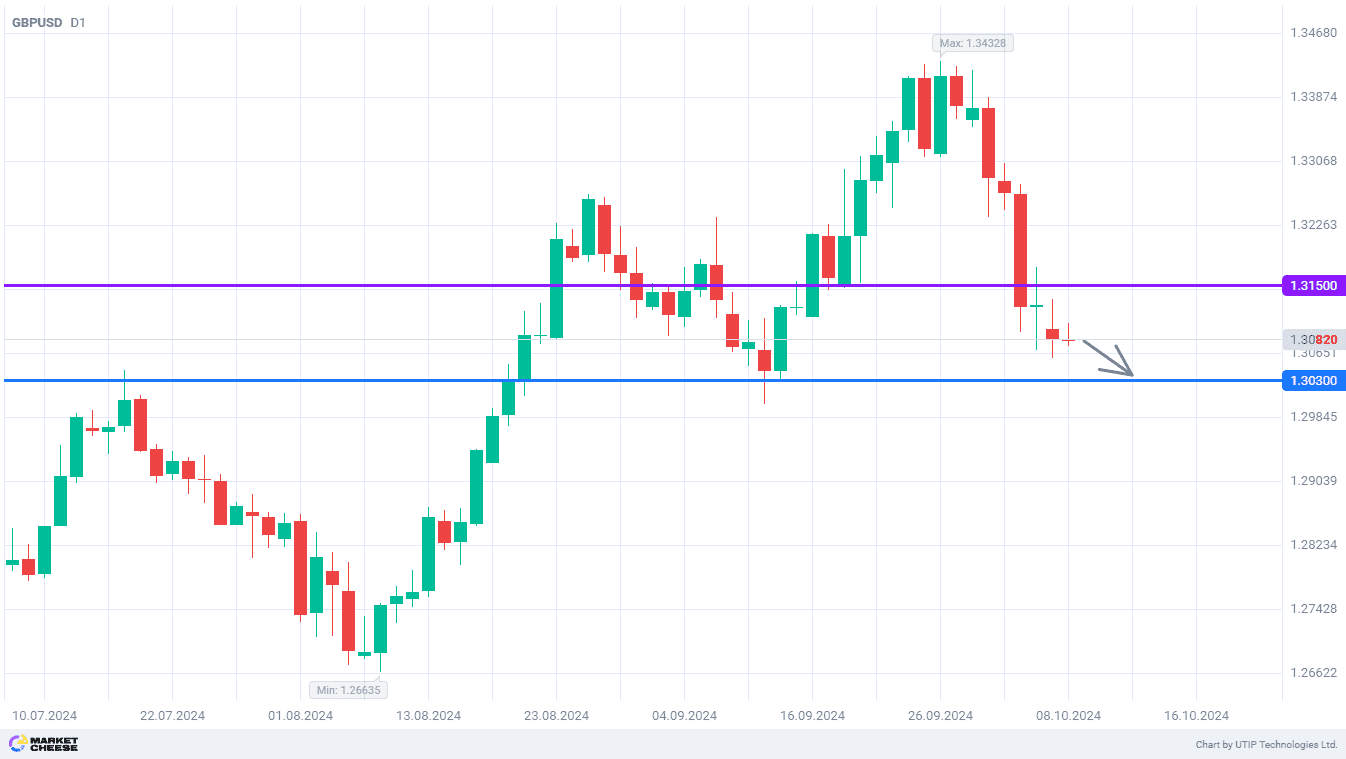

Last week, the GBPUSD currency pair went into a sharp pullback from the two-year highs. By the current moment, prices have already lost almost all the gains of the second half of September, but the “bears” still have one more target near the 1.303 level. Here, profit taking on short positions can stop the downward price movement, but the fundamental view on the prospects of the pound-dollar ratio is unlikely to return to the recent level of optimism.

The seemingly strong position of the pound was undermined at the end of last week by the Governor of the Bank of England Andrew Bailey. During his speech, he directly stated the possibility of a more aggressive monetary policy easing program than had been previously expected. Market participants believed that the British regulator would cut rates more slowly than the Fed and ECB, but this view has been called into serious question. Andrew Goodwin of Oxford Economics now expects a key rate cut in both November and December.

Analysts polled by Bloomberg see even greater risks to the pound over the coming weeks. The 2025 UK budget is scheduled to be presented on October 30, and it is highly likely to feature tax hikes and severe austerity measures. Pierre Lequeux from Millennium Global Investments believes that such measures will severely limit the country’s economic growth potential and reduce the attractiveness of investments in British assets. According to his estimates, GBPUSD may fall to the level of 1.2 in the medium term.

Nick Andrews, senior currency strategist at HSBC, also points out the excessive optimism of traders regarding the pound. According to his data, at the end of September, long positions on the British currency reached the maximum in 6 years. Now they have to be closed to avoid even bigger losses, putting additional pressure on the pound price. Andrews considers the forecast of GBPUSD falling to 1.2 too drastic, but he does admit a possible correction within 5%.

Reaching the September low near the level of 1.303 may trigger the activation of the GBPUSD bulls. At this level, it is advisable to exit short positions at least partially.

We can offer the following variant of the trading strategy:

Sell GBPUSD at the current price. Take profit – 1.303. Stop loss – 1.315.