USDJPY is falling on Thursday following a speech by Bank of Japan board member Toyoaki Nakamura. He expressed doubts about the sustainability of wage growth and sees inflation likely to fall below 2% starting from fiscal 2025.

On the other hand, Federal Reserve (Fed) Chairman Jerome Powell said on Wednesday that the US economy is stronger than it was expected to be when the Fed started cutting interest rates in September. He also hinted at a possible slowdown in the pace of further cuts. San Francisco Fed President Mary Daly added that there is no urgent need for monetary easing. The comments helped push US bond yields moderately higher, limiting demand for the lower-yielding Japanese yen.

According to data released on Wednesday, US private sector employment increased at a moderate pace in November, while activity in the service sector slowed after strong gains in recent months.

Nevertheless, the acceleration in Japan’s core inflation leaves the likelihood of a BOJ rate hike in December intact. In addition, geopolitical tensions and concerns over President-elect Donald Trump’s tariff plans are supporting the Japanese yen’s safe-haven status.

Traders are now focusing on the release of the weekly US jobless claims data. Friday’s Nonfarm Payrolls report will be in the spotlight this week.

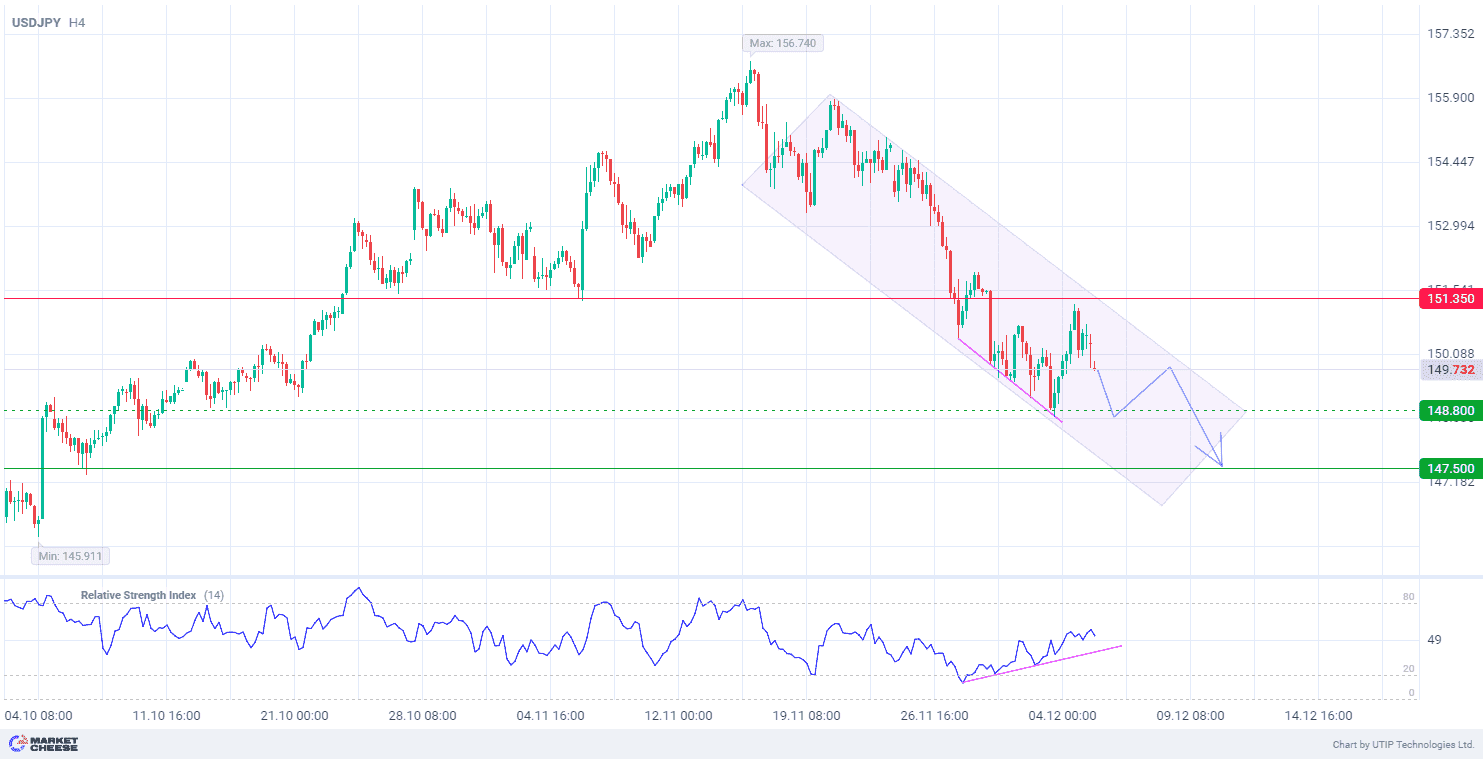

From a technical point of view, USDJPY is forming a new bearish trend on the H4 timeframe. The divergence of the Relative Strength Index (RSI) (default settings) confirms the downward movement of the currency pair.

Signal:

Short-term prospects for USDJPY suggest selling.

The target is at the level of 147.50.

Part of the profit should be taken near the level of 148.80.

A stop-loss could be placed at the level of 151.35.

The bearish trend is short-term, so trade volume should not exceed 2% of your balance.