Gold prices are starting the week with another attempt to consolidate above the key level of $2,000 per ounce. The bulls’ attacks are becoming more and more decisive, and the sellers of the yellow metal should think about closing short positions to limit losses. This morning the gold price has already reached a 6-month high, and this is not the limit.

Daniel Ghali, Senior Commodity Strategist at TD Securities, links the new wave of rising gold prices to active purchases in Asian countries. Thus, the People’s Bank of China (PBC) actively sold dollars last week, buying yuan and gold. Chinese traders replenished their stocks by about 17.5 tons of the yellow metal. At the same time, Western investors’ demand for gold remains weak.

Ghali considers demand from developing countries in Asia and other continents as the main reason for higher prices in the gold market. Without their involvement, the price of the yellow metal would be much lower, given high-yield dollar bonds. But gradually, more and more market participants will pay attention to the high investment potential of gold and other safe-haven assets.

TD Securities analysts expect a recession in the U.S. in the first half of 2024. In their opinion, investors underestimate this risk, as the recent economic data mislead them. But in the end, the Fed will have to ease monetary policy much sooner than market participants are expecting. Then gold will receive an even stronger influx of demand. According to Ghali’s forecast, the price of the yellow metal will rise to the level of $2,100 per ounce.

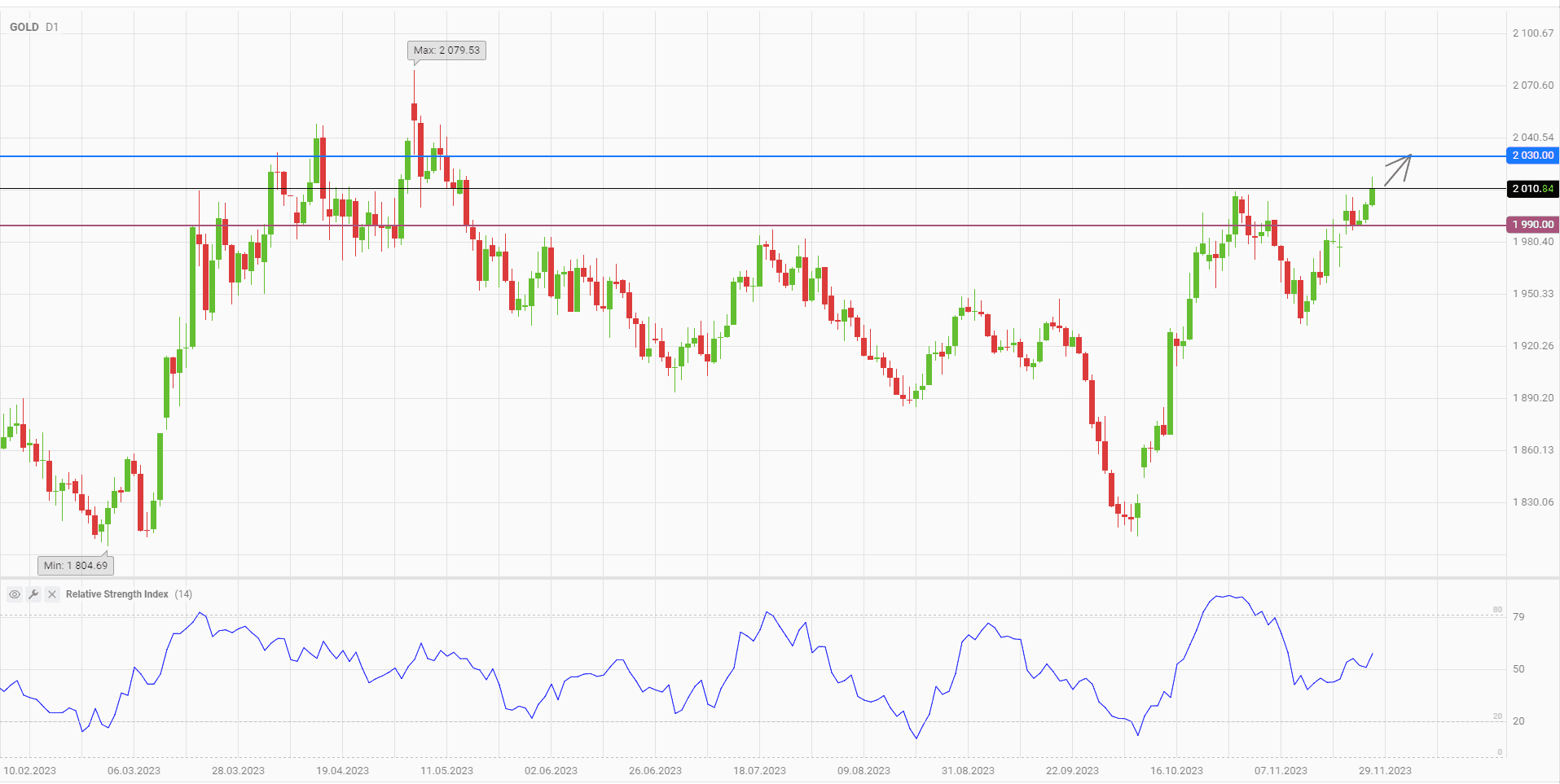

From a technical point of view, gold still has potential within the current growth wave. The RSI indicator, due to the corrective pullback in the first half of November, is now far from the overbought zone and does not prevent the price from rising. Reuters analyst Wang Tao expects an increase in gold prices to the range of 2,026–2,032, where profit should be taken.

Consider the following trading strategy:

Buy gold at the current price. Take profit – 2,030. Stop loss – 1,990.

Traders may also use a Trailing stop instead of a fixed Stop loss at their discretion