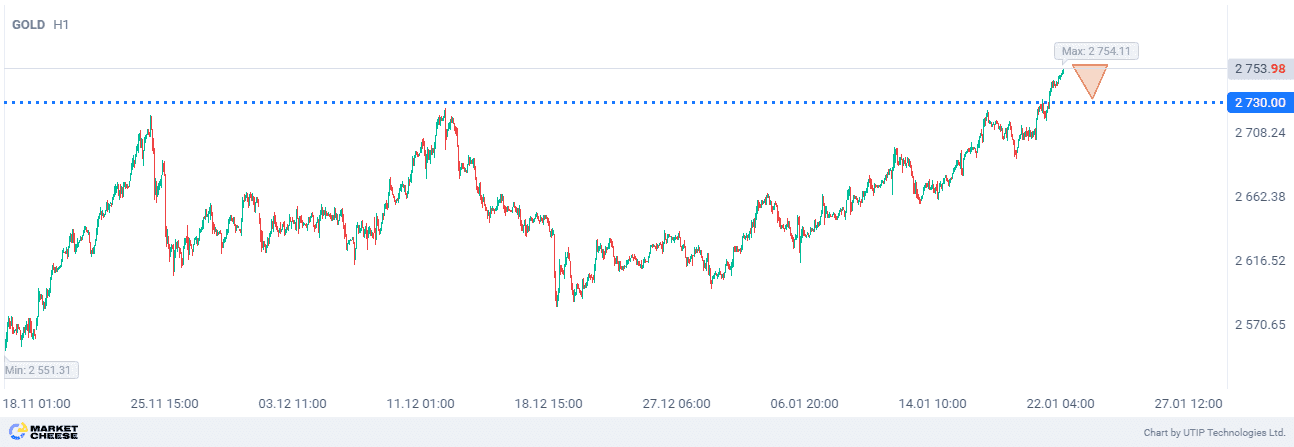

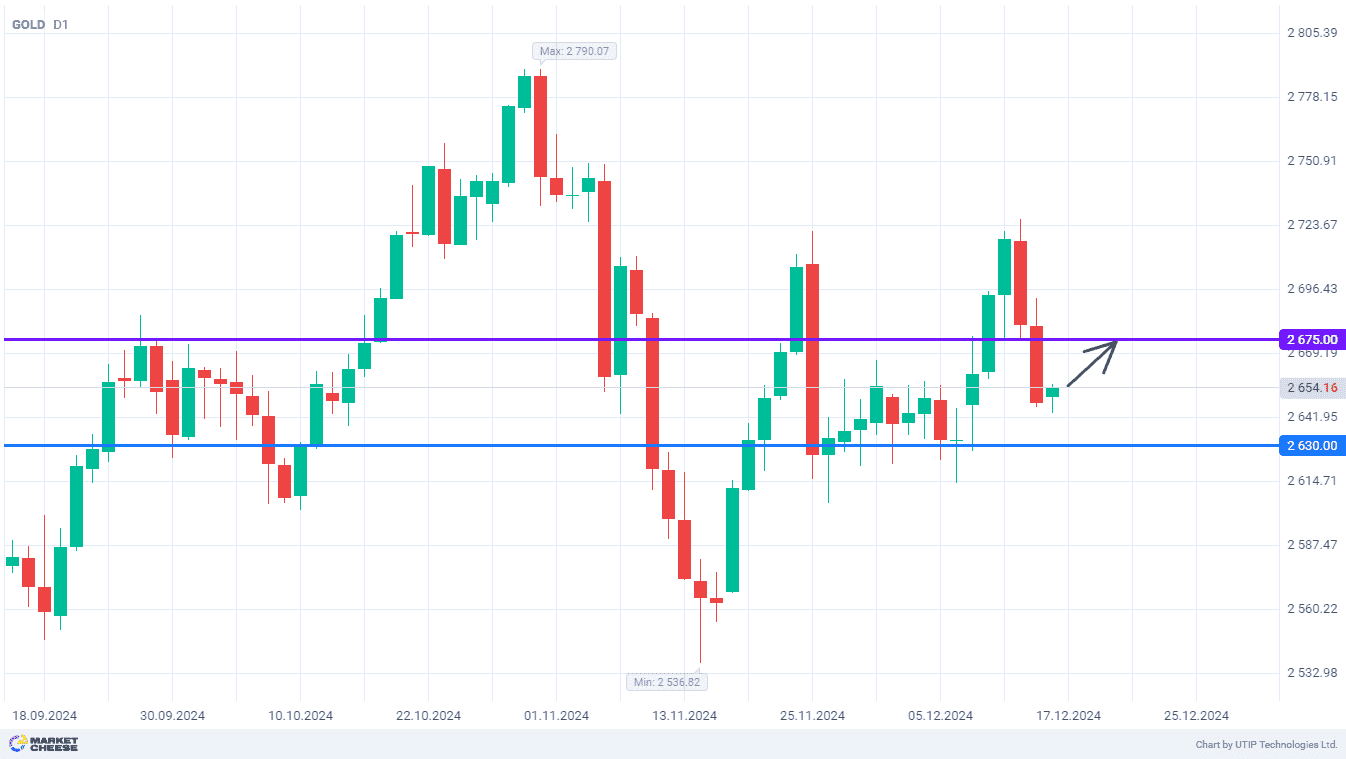

Gold prices started actively growing last week, but they failed to stay above $2,700 per ounce. The pullback on Thursday and Friday brought them back to lower levels, where the buying resumed today. Market participants are unlikely to be overly active before the main events of the next few days, but they will surely have enough strength to bring the yellow metal back to 2,675.

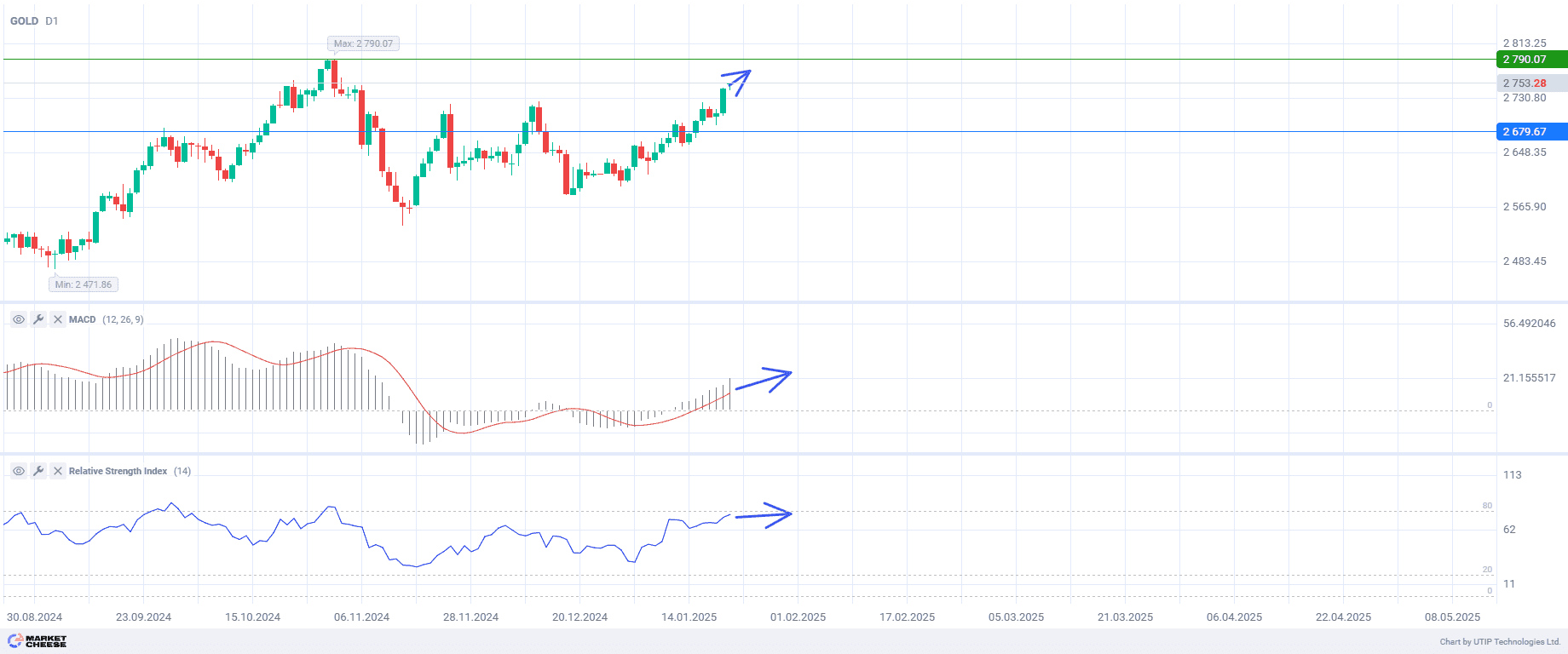

All of the attention is now focused on the Fed’s last meeting of the year, the results of which will be announced on Wednesday. Traders’ confidence in a 0.25% key rate cut exceeded 90%, and the main intrigue is traditionally centered around Jerome Powell’s upcoming speech. The head of the US regulator is expected to share his views on monetary policy in 2025, and these statements will have a great impact on gold and other financial assets.

Wells Fargo analysts believe that even the hawkish stance of Powell and his colleagues will not prevent the yellow metal from continuing to rise in price. According to the experts, the US central bank will reduce the borrowing costs only once next year, but gold will still be in high demand among investors. The world’s unstable geopolitical and economic situation affects traders’ sentiments. According to Wells Fargo, gold prices are expected to rise to the range of $2,800–2,900 per ounce.

Central banks continue to play an important role in supporting stable demand for the yellow metal. FXEmpire experts emphasize the People’s Bank of China’s (PBOC) renewed gold purchases in November after a six-month pause. As expected, China’s regulator just waited for more favorable prices and immediately took advantage of the pullback to replenish its reserves. As long as the PBOC and other central banks follow such tactics, any corrections in gold prices will be bought back over time.

The nearest target for the bulls in the gold market is to return to the level of 2,675. The further prospects can be considered only after the Fed’s meeting.

Consider the following trading strategy:

Buy gold at the current price. Take profit – 2,675. Stop loss – 2,630.