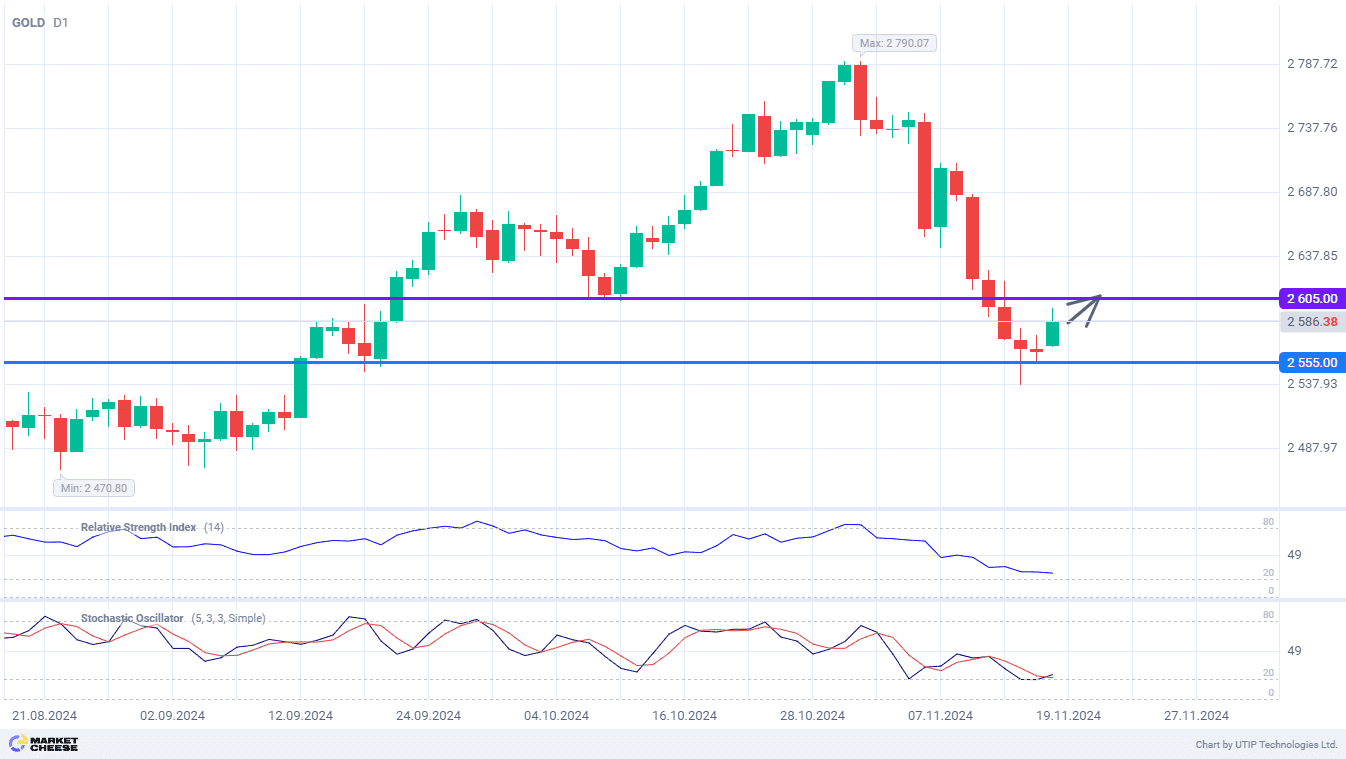

For gold prices, the past week was the worst in the last 3 years. The price of the yellow metal declined by about 5%, and the extent of the correction exceeded 8% since the all-time high reached on October 31. More and more market participants start to expect an upward price rebound, and the first indications of one have already been received. On Friday, gold price stabilized just above the level of 2550, and today’s trading session shows an increase in buyers’ activity. They will first target the October low and the level of 2605.

IG analysts led by Axel Rudolph consider the drawdown in gold prices below the level of 2600 clearly excessive. In their opinion, this decline is a good opportunity to buy the yellow metal at favorable prices. The rebound in gold prices is supported by central bank purchases, ongoing geopolitical tensions and pro-inflation risks following Donald Trump’s victory in the US presidential election.

Goldman Sachs experts point to a similar set of factors as drivers of a new upward trend in gold prices. The escalation of trade tensions and rising concerns over the US fiscal instability may also contribute to the rise in gold prices. According to the estimates of Goldman Sachs representatives, the price of the yellow metal may reach $3,000 an ounce by December 2025. The increasing physical market demand will also be a significant factor contributing to a rise in gold prices.

The correction in gold prices, which took place in November, has already led to a significant increase in consumption of the metal in India. In the country’s domestic market, 10 grams of gold now cost less than $870, although 2 weeks ago the figure almost reached $950. A surge in demand allowed Indian dealers to increase the premium to world gold prices from $3 to $16 an ounce. Meanwhile, there has been no such reaction from the Chinese population so far. If China also resumes mass purchases, gold will quickly recover losses.

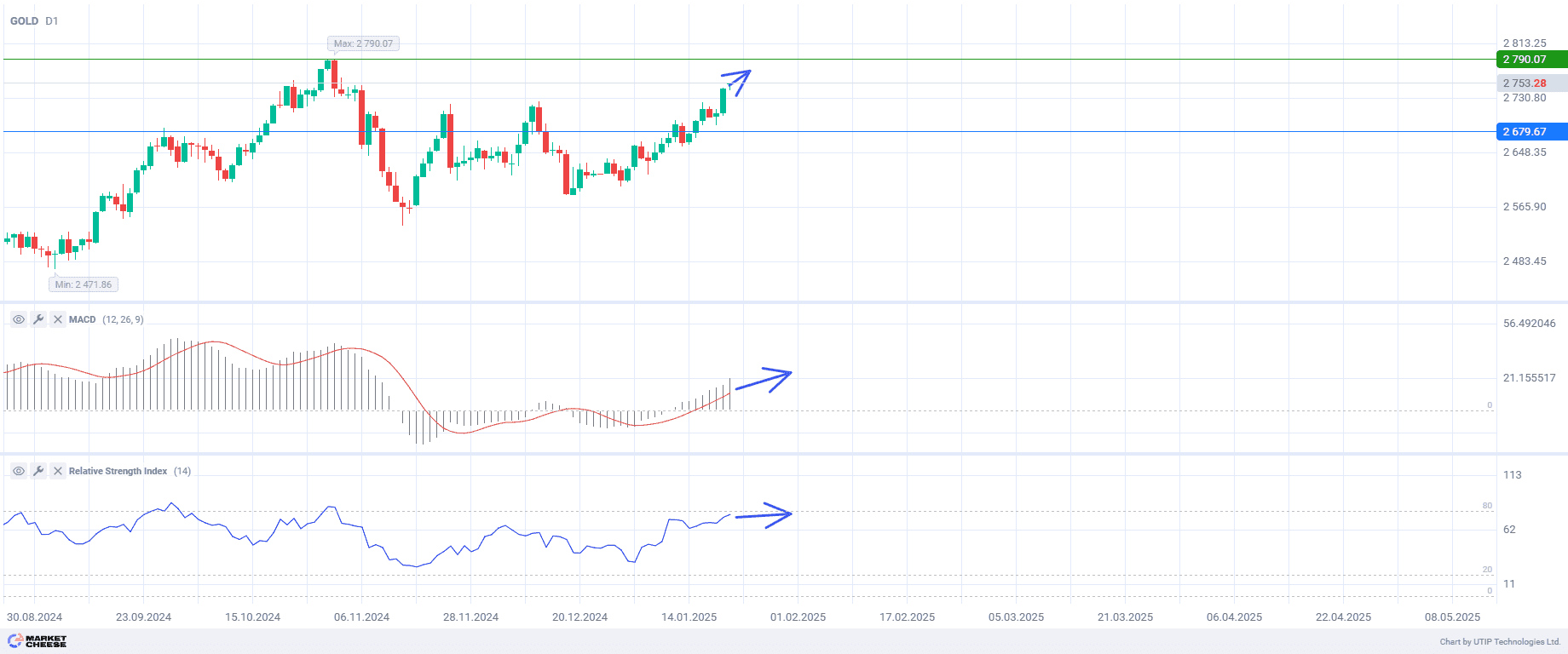

The Stochastic indicator is already signaling an upward reversal in gold prices, while the RSI is moving pretty close to it. The nearest bullish target is the level of 2605.

Consider the following trading strategy:

Buy gold in the range of 2570–2580. Take profit – 2605. Stop loss – 2555.