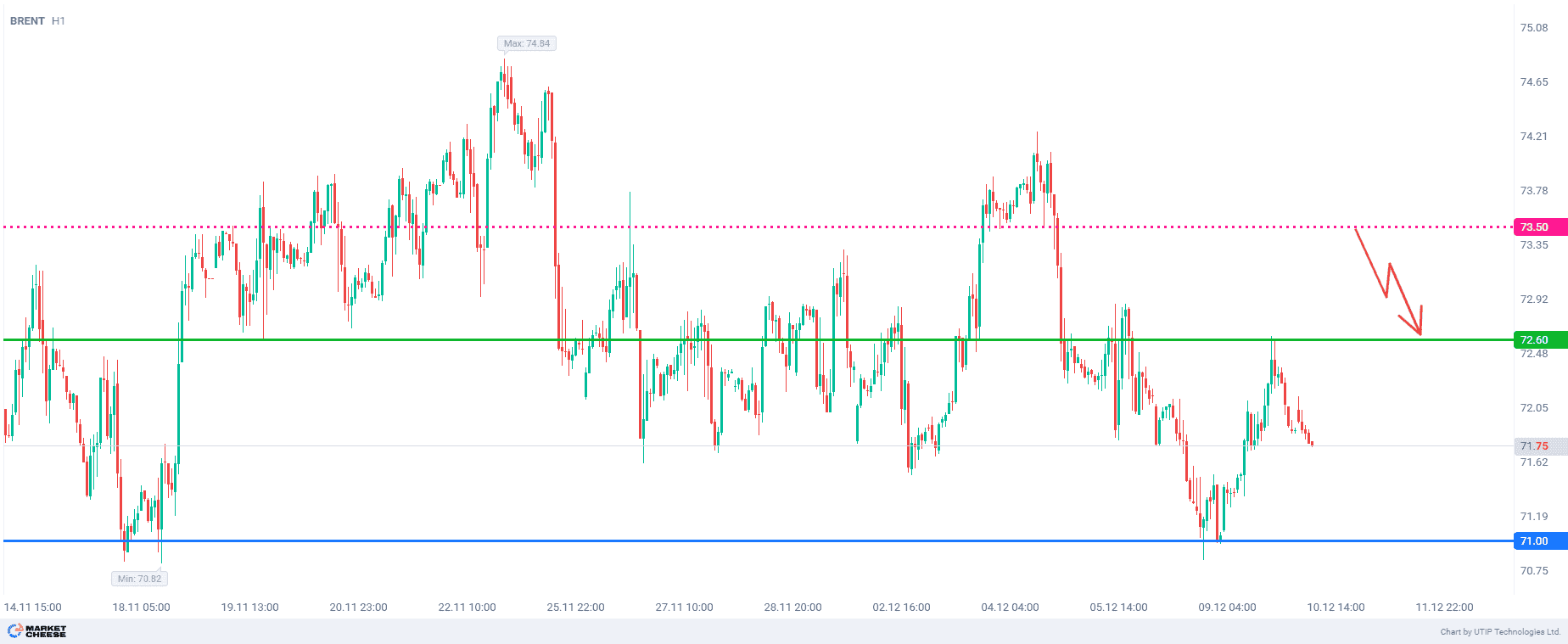

Last week Brent prices made another attempt to pierce the support zone of $70-71 per barrel, after which they rebounded. This zone, as it was mentioned in the previous reviews, will be broken sooner or later, but in the meantime the price will be preparing to make another run to this level. In order to gain strength, it needs to go up. The most likely scenario of downward movement is a potential breakdown from the resistance at 73.5. The target will be the level of 72.6.

From the macroeconomic point of view, oil prices are affected by the concerns about the impending supply glut. And this glut is overshadowing the prospects of new rounds of stimulus by China next year.

The market has high hopes for an aggressive stimulus policy in China, but for the moment oil price gains are limited until it becomes clearer what impact Beijing’s measures will have on the country’s crude demand outlook.

In a positive sign, China’s crude imports in November rose sharply from a year earlier, marking the first annual increase in seven months, data released on Tuesday showed. That’s because lower prices for supplies from the Middle East and demand for stockpiles boosted purchases.

Investors will be closely monitoring the annual Central Economic Work Conference in China, which is due to start on Wednesday.

There will also be plenty of oil market data and commentary this week, including reports from OPEC and the International Energy Agency.

The final recommendation is to sell Brent from the level of 73.5.

The profit could be fixed at the level of 72.60. The Stop loss could be placed at 74.50.

The volume of the opened position should be set so that the value of a possible loss, defined with a protective stop order, doesn’t exceed 1% of your deposit.