Over the past July and August, global financial markets were intrigued about the size of the already predetermined key rate cut by the Federal Reserve. Market volatility was mainly driven by the prevailing view at the moment — whether it would be cut by 0.25% or by 0.5% at once. By the present moment, this mystery has worn off, and a new one is required. Now the main outlines of a new dilemma have been generally defined: will there be one, two, or three cuts by the end of the year? And what will be the size of each step?

The next Fed meeting is scheduled for November 7. Right now, financial markets are pricing in a 52% chance of a 0.25% rate cut, and a corresponding 48% chance of a 0.5% cut. That is almost evenly matched, and so it creates a lot of nervousness. The scales can fluctuate from even minor news and changes in the economic data. Nine Fed officials are scheduled to deliver speeches this week, and each of them can have great impact on the market.

Among the upcoming important events, it’s worth mentioning the expected release of the US GDP for Q2 on Thursday and the publication of the core Personal Consumption Expenditures Price Index on Friday. If both indicators actually show a value above the forecasted expectations, i.e., GDP above 3.0%, and the PCE index (year-on-year) above 2.6%, it will indicate the persistence of inflationary pressure in the economy. In this case, the scales would tip toward a higher probability of a quarter-point rate. And this will probably cause a short-term decline in the EURUSD quotes.

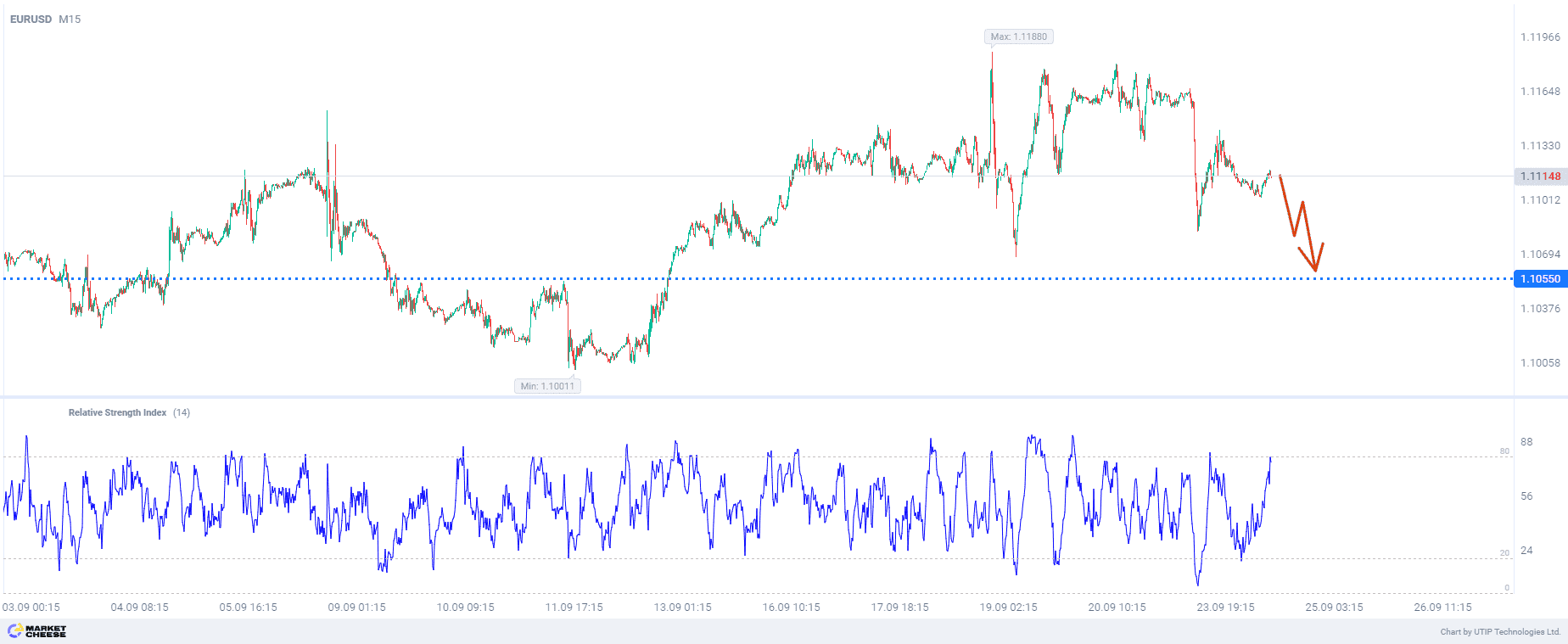

Now the EURUSD pair is at the border of the technical overbought zone, which may increase the chances for the downward movement.

The final recommendation is to sell EURUSD in case the actual figures of the US GDP and the core PCE price index come out above the forecasted expectations. Otherwise, it is better not to enter the EURUSD trade.

The profit is taken at the level of 1.0550. The loss is fixed at the level of 1.1170.

The volume of the opened position should be defined in such a way that the value of the possible loss, fixed with the help of a protective stop order, amounts to no more than 2% of the size of your deposit funds.