Natural gas prices have been growing in recent days despite seasonal trends. The price rose from Monday’s level of 3.599 to 4.271 on Wednesday. Trading opened at 4.247 on Thursday.

The weather in Europe and the US remains the main driver of natural gas price increases. The cold weather is forecast to continue until at least early March, leading to growing demand for heating. Low temperatures are also noted to affect production capacity, since freeze-offs limit the gas supply on the market.

The situation on the European market provides additional support to gas prices. Despite the record supply of Russian gas via TurkStream, which is currently the only active shipping route, concerns about Europe’s energy security remain. Besides, the gas storage filling target is being discussed to be reduced from 90% to 80%, which indicates the uncertainty of future supplies, creating additional support to prices.

According to UBS, gas stock in Europe’s storages was 47% (49 billion cubic meters) as of February 11. This is 5% below the five-year average and 20% less than a year ago. Gas withdrawal amounted to 4.5 billion cubic meters, which is significantly higher than last year’s rate. By the end of winter, stocks may drop to 30%, down from 58% in 2024. As a result, Europe will have to increase LNG imports to replenish reserves.

Thursday’s data on natural gas reserves in the US can affect the prices. The release may be the key driver of short-term volatility. If the stocks are below expectations, the current bullish trend will strengthen, considering high demand due to the cold weather. Higher than expected reserves may be a correction factor for the overbought market.

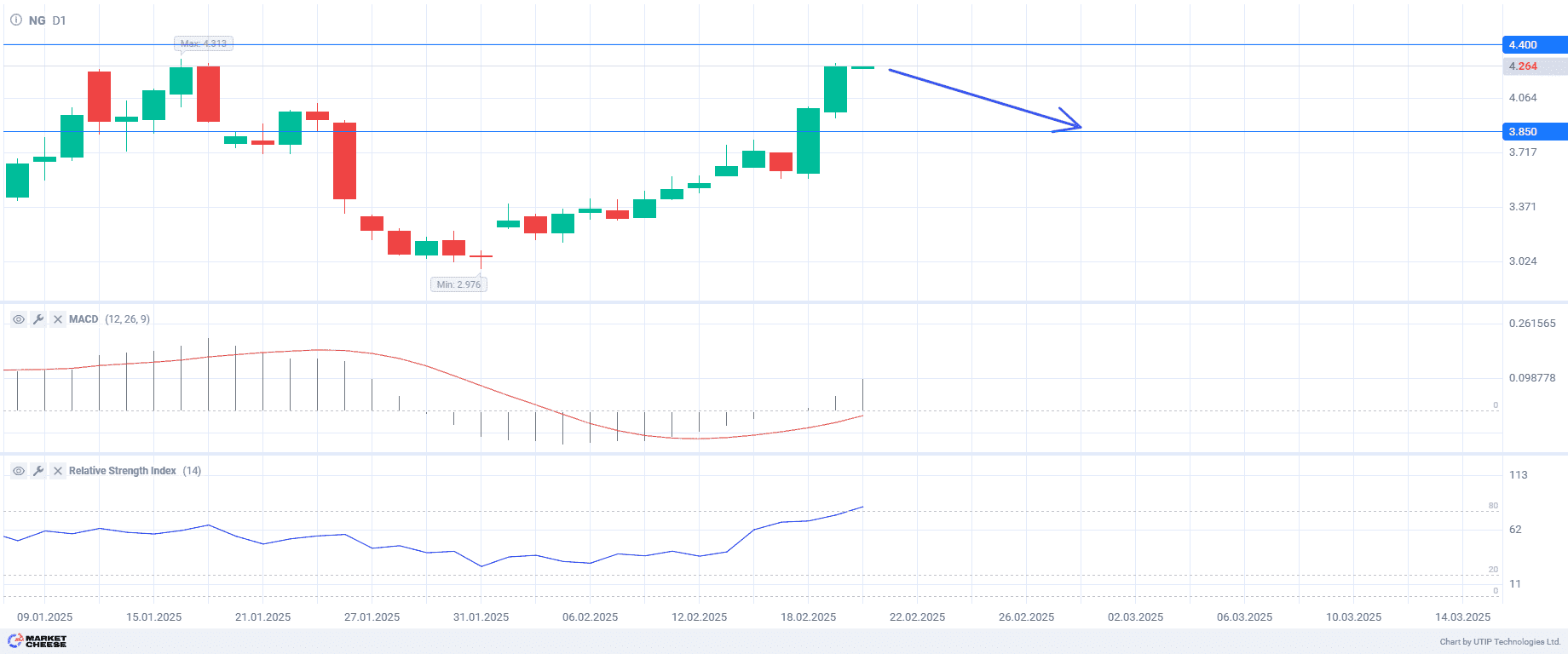

The technical analysis signals a possible price correction. The RSI shows that the market has reached an overbought level, which might lead to a rebound and lower natural gas prices. Meanwhile, the MACD indicator confirms the bullish trend. However, with the RSI in the overbought area, an upcoming price correction is highly possible, even despite the upward dynamics of MACD. The correction is expected in late February or early March.

Current recommendation:

Sell at the current price. Take profit – 3.850. Stop loss – 4.400.