On Friday, February 21, the S&P 500 index showed a significant decline, canceling out all its gains over the past two weeks and reaching a daily volatility of 2%. On Monday, February 24, the opening price was 6039.0.

The drop that had begun last week on Thursday and persisted on Friday was due to increased inflation expectations in the US, which reached a 30-year high. This followed unfavorable economic reports and Donald Trump’s new tariff threats and concerns about weakening consumer demand.

According to the latest February data from the University of Michigan, consumers expect prices to rise 3.5% per year over the next 5–10 years. More than half of consumers polled expect the unemployment rate to increase next year, which is the highest figure since 2020.

These factors put significant pressure on the index, especially on companies in sectors vulnerable to changes in consumer demand and inflation.

The sectors that declined the most on Friday were Consumer Discretionary (-2.77%), Information Technology (-2.45%) and Industrials (-2.23%). The only sector that was unaffected and showed positive dynamics was the Consumer Staples (+1.00%). This can be explained by the fact that it is less vulnerable to changes in consumer demand and inflation.

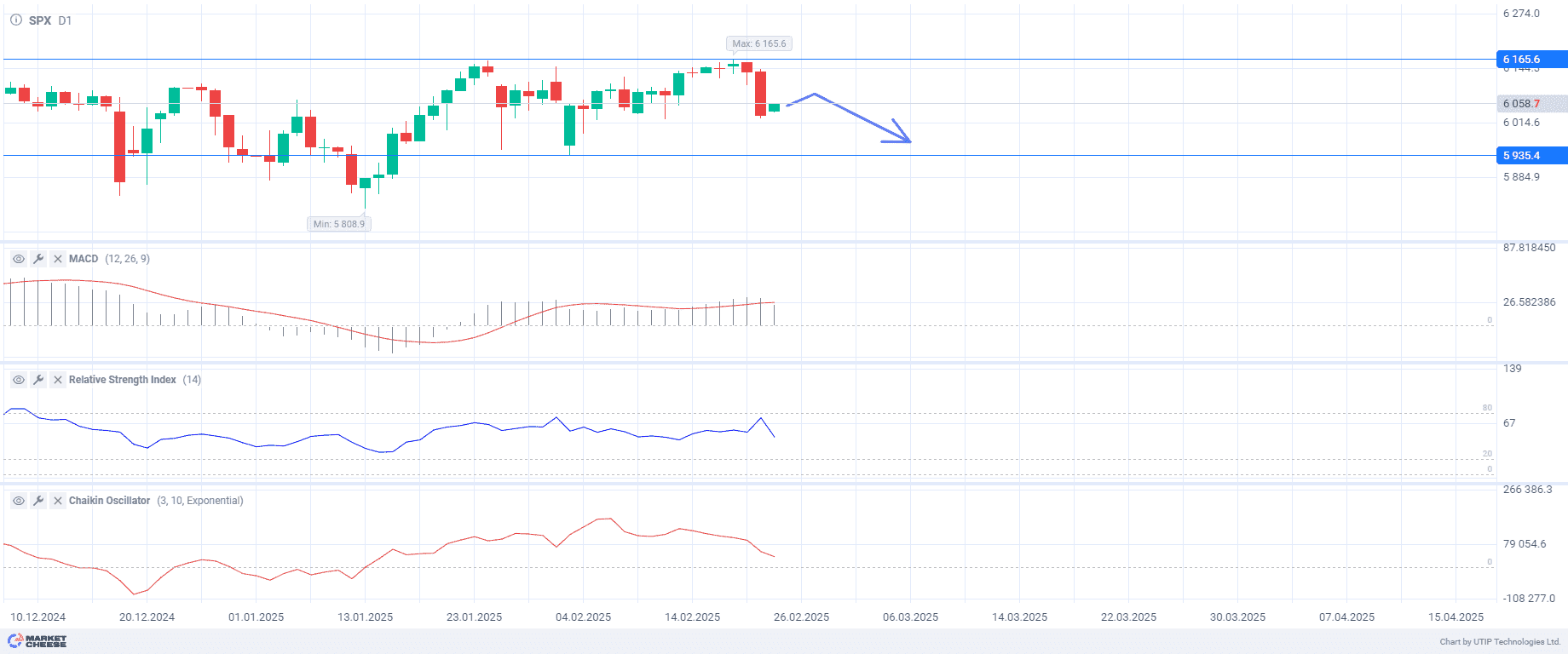

Technical analysis suggests that the market is demonstrating signs of correction after growth. The S&P 500 index shows a decline after reaching a local high at 6165.6. The current price is at 6056.6, indicating a correction after growth. The MACD lines remain above the zero mark, suggesting a persistent uptrend. However, the MACD histogram points to a decline, signaling that the upward momentum is slowing down. The RSI value is around 52, pointing to a neutral market condition (without being overbought or oversold). The recent decline in RSI confirms the weakening of the bullish sentiment. The Chaikin oscillator shows a decline, which indicates a decrease in the volume of purchases and a possible increase in selling pressure.

Until March 3, 2025, sideways or downward movement is likely to be maintained, unless new growth drivers emerge. If the price continues to drop, the nearest support level could be around 5935.4 (previous period’s low). If this level is broken through, the price may go even lower.

Current recommendation:

Sell at the current price. Take profit — 5935.4. Stop loss — 6165.6.

Source: