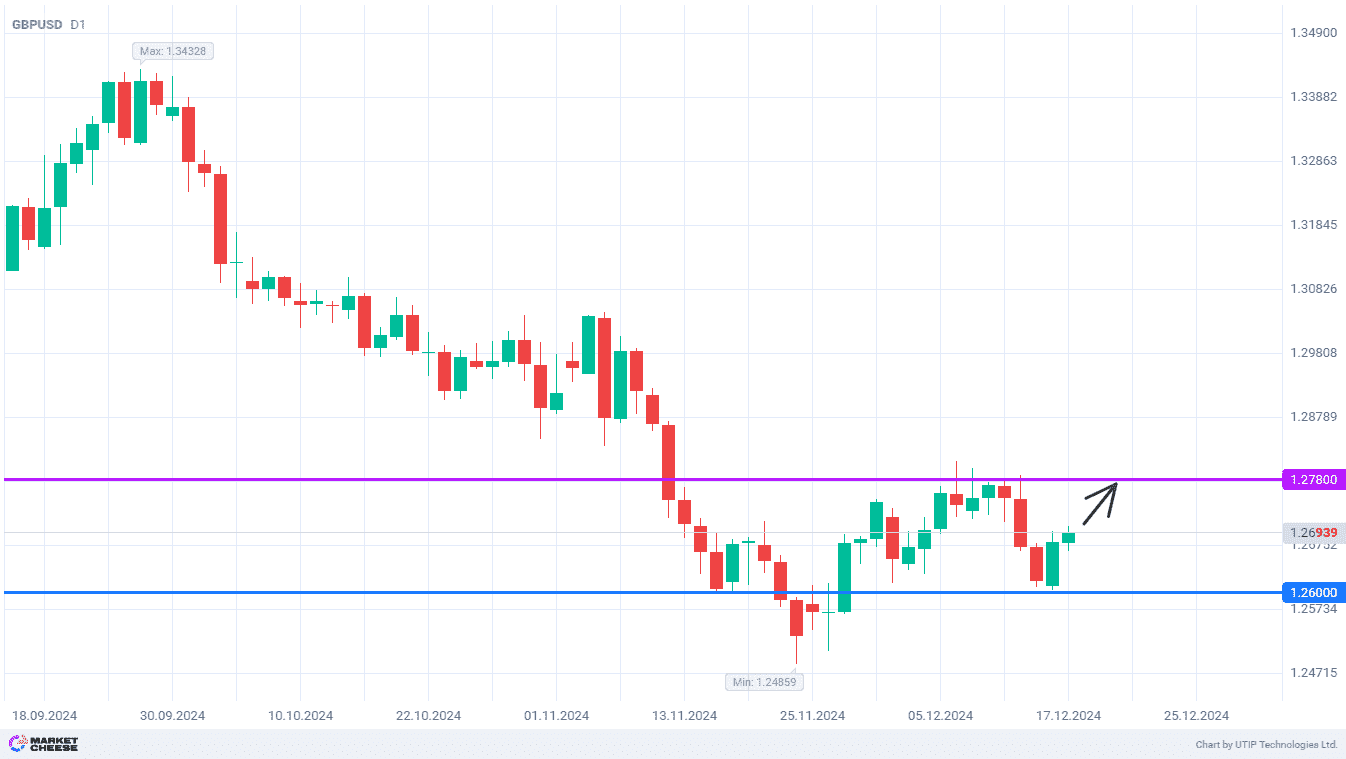

The GBPUSD currency pair began this week at the December low, from which the bulls triggered a rebound of quotes. Today the price growth has slowed down, but without signs of large-scale sell-offs. The buyers of the pound against the dollar are able to hold the initiative up to the level of 1.278, which recently acted as a strong resistance. The UK’s latest economic statistics may at least partially ease the pessimism about the national currency’s prospects.

Reports on Purchasing Managers’ Indices presented on Monday showed that the situation has stabilized. The manufacturing PMI worsened, while the index of the service sector was better than expected. At the same time, companies’ assessment of future inflation increased for all major cost components, with wage expenditures growing most rapidly in 9 months.

Today’s data from the UK Office for National Statistics confirmed increased pressures on prices from rising wages. Pay growth accelerated from 4.4% to 5.2% against analysts’ expectations of 4.6%. The new national government has already announced bonuses for civil servants, which may become another pro-inflationary factor. Under these circumstances, the Bank of England (BoE) will probably have to be strict.

According to analysts polled both by Reuters and Bloomberg, the UK central bank will keep the key rate unchanged at 4.75% after its meeting on December 19. Next year, monetary policy in the UK is expected to be eased no more than 3 times. Christ Williamson, chief economist at S&P Global Market Intelligence, awaits a moderately hawkish rhetoric from the BoE, especially if their colleagues at the US Fed will also show restraint on Wednesday.

The short-term growth potential of GBPUSD extends to 1.278, where the sellers are expected to become more active. This scenario should be taken into account if the quotes are above 1.26.

Consider the following trading strategy:

Buy GBPUSD at the current price. Take profit – 1.278. Stop loss – 1.26.

Source: