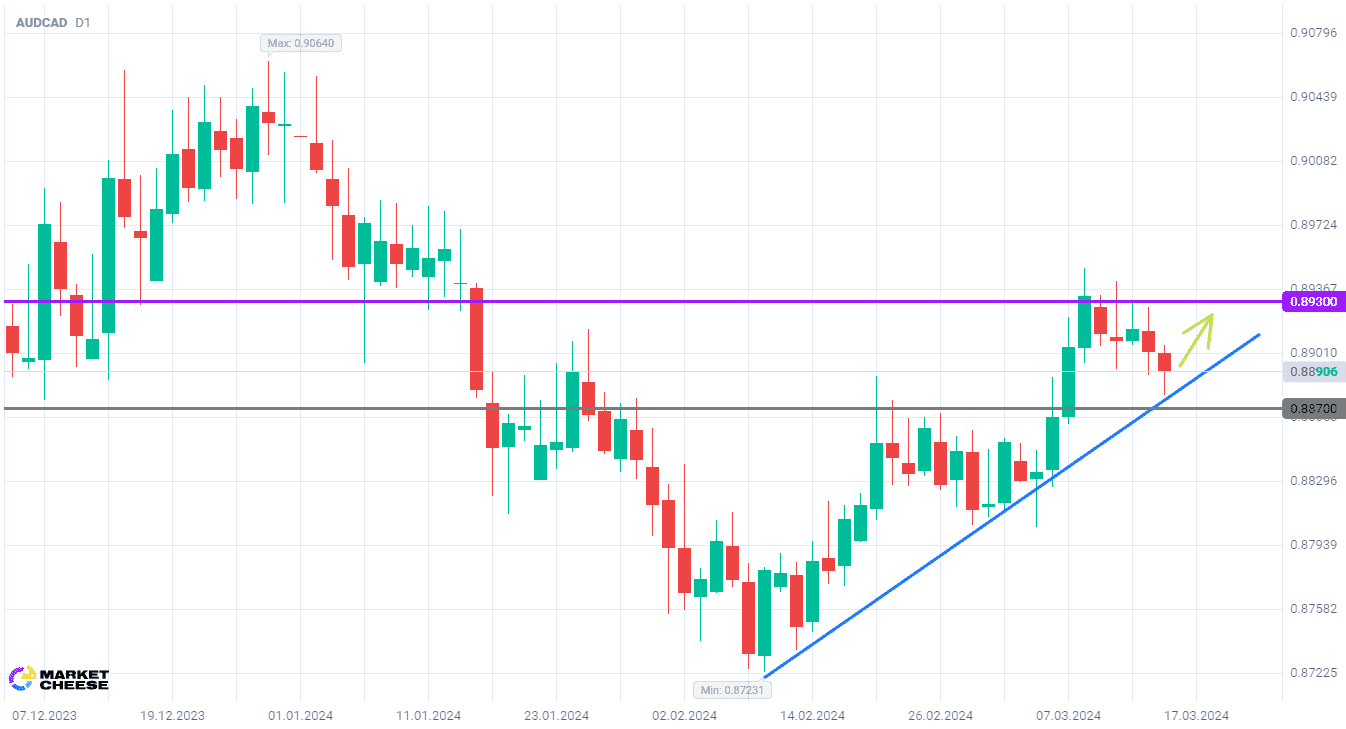

The AUDCAD currency pair is retreating from the local high set late last week just below the 0.895 level. The quotes have now reached the medium-term uptrend line which may stop the correction. The price looks more and more attractive for the buyers who are expecting a new growth wave of AUDCAD. Ahead of next week’s events, the bulls will surely consider increasing long positions.

On March 19, the Reserve Bank of Australia (RBA) will hold its second monetary policy meeting in 2024. Economists surveyed by Reuters expect the key rate to remain at 4.35% until September. The RBA is a rare exception among global regulators, with a projected date for the first monetary policy easing later than the summer. The country’s largest banks, such as ANZ and NAB, expect an even later rate cut. According to them, this step will take place as late as November.

Ben Picton, senior strategist at Rabobank, predicts only one cut in the RBA’s key rate this year. He outlines the continued growth of the national economy, even if at a slower pace compared to the 2021–2023 period. The labor market in Australia is still rather strong, which indicates that its monetary policy is only moderately tight. In such circumstances, the central bank’s officials should not cut rates too early.

Bloomberg analysts point to the difficulties of currency market participants who opened short positions on the Australian dollar. During the first week of March the number of these positions jumped by more than 16,000, the highest since 2006. However, the Australian currency continued to strengthen against traders’ expectations. Peter Dragicevich, strategist at Corpay Solutions, pays attention to the improvement in the economic outlook due to new stimulus from the government of China, Australia’s main trading partner.

The uptrend line from February lows will be a good support for AUDCAD. Having pushed away from it, the price can quickly return to the level of 0.893 and early March peaks.

Consider the following trading strategy:

Buy AUDCAD at the current price. Take profit – 0.893. Stop loss – 0.887.

Traders may also use a Trailing stop instead of a fixed Stop loss at their discretion