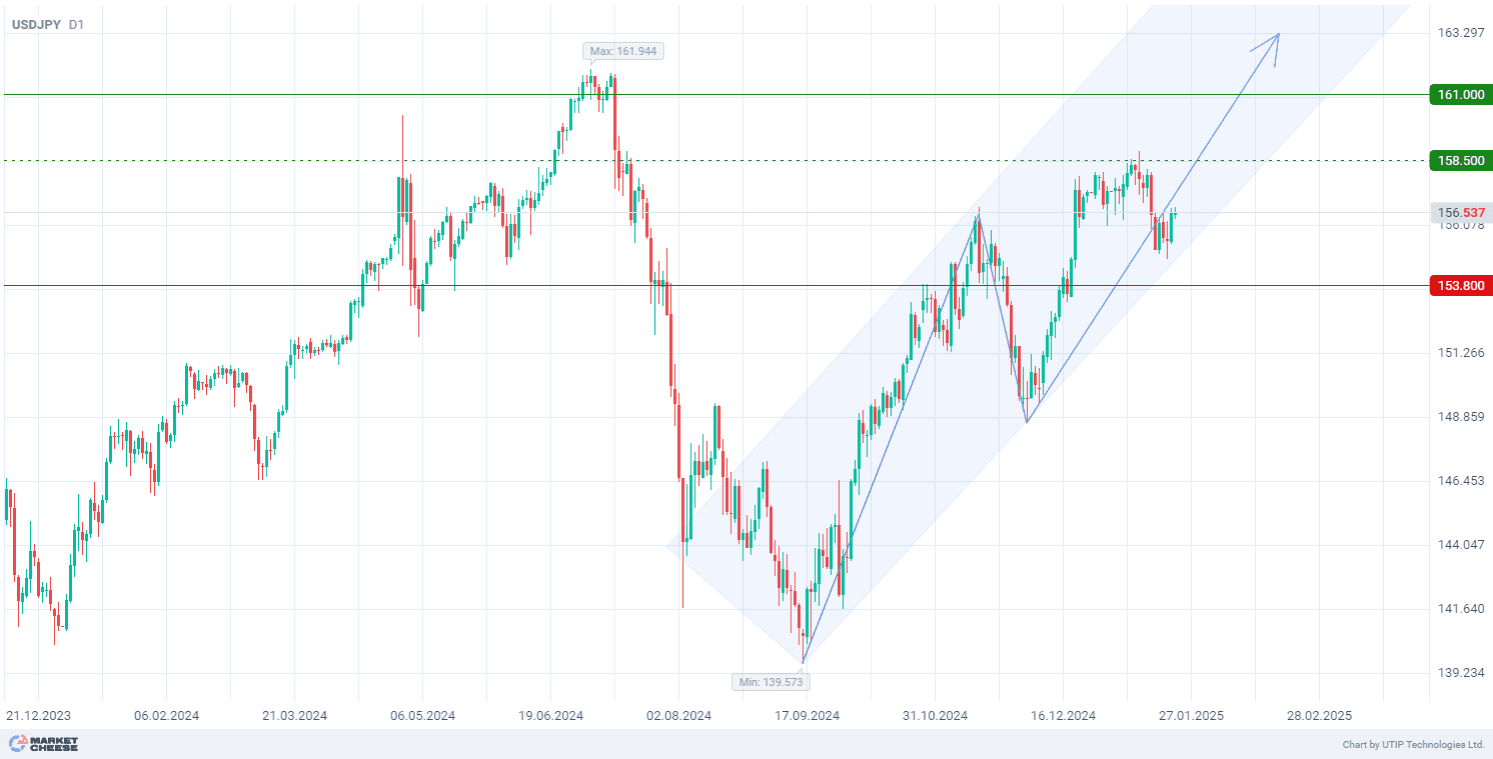

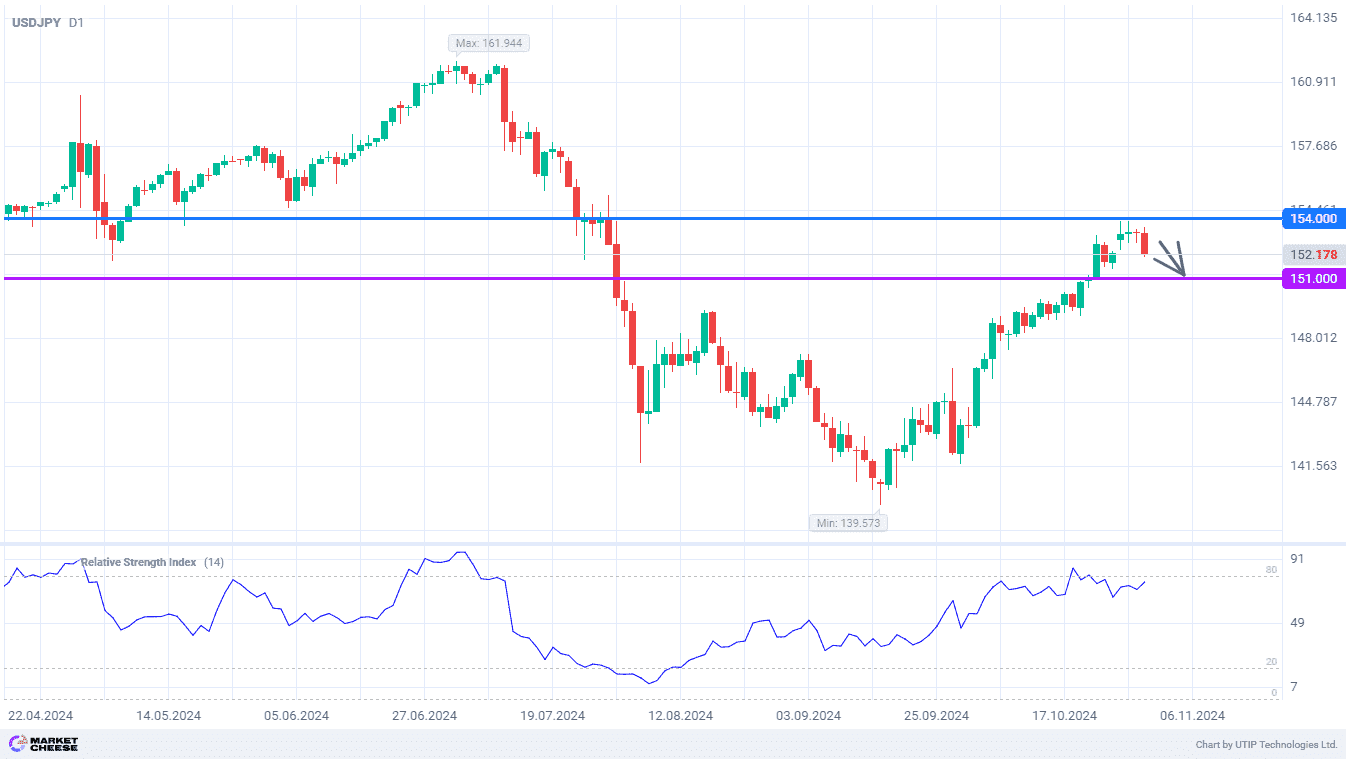

The USDJPY currency pair updated its 3-month high at the beginning of the current week, just a little bit short of the 154 level. Judging by the long upper shadows of the candlesticks on the daily chart, there are fewer and fewer people willing to continue buying the dollar against the yen at current prices. Quotes need a correction, the first signs of which appeared at today’s trading session. USDJPY may decline to 151, giving an opportunity for profitable opening of long positions without breaking the medium-term uptrend.

The yen was strengthened by the meeting of the Bank of Japan held on Thursday. The key rate remained at the same level of 0.25%, as market participants expected. Keiichi Iguchi, senior strategist at Resona Holdings, called the move reasonable amid political uncertainty in the country and the upcoming U.S. presidential election. Nevertheless, the Japanese regulator won’t keep a pause in the monetary tightening cycle for too long.

Taro Kimura from Bloomberg Economics considers December as a good time for a new increase in the cost of borrowing in Japan. He draws attention to the plans of the country’s companies to significantly increase wages and prices for their products next year. Because of this, inflation risks exceeding the central bank’s target level of 2%, and the national currency will be under strong pressure.

Bloomberg analysts expect the yen to rise against the dollar next week, when the U.S. Federal Reserve is expected to cut the key rate for the second time. According to their estimates, USDJPY quotes could decline to the level of 150. Even if tomorrow’s report on the U.S. labor market for October turns out to be strong, it won’t prevent the Fed from easing the monetary policy at the meeting on November 7. And in case Donald Trump wins the election and the dollar strengthens, the Ministry of Finance in Japan has already expressed its readiness to conduct currency interventions.

The RSI is close to the overbought zone, signaling the high chance of a further pullback in USDJPY quotes. The level of 151 could become the nearest correction target.

The following trading strategy can be suggested:

Sell USDJPY at the current price. Take profit — 151. Stop loss — 154.