The USDCAD currency pair is under pressure as the dollar is weakening. According to data released on Tuesday, US consumer confidence in September fell to its lowest level in three years, increasing concerns about the labor market. This reinforced expectations of more aggressive monetary policy easing by the U.S. Federal Reserve at its November meeting. This prospect has sent the dollar down by 0.2%.

According to the CME FedWatch tool, traders now estimate the likelihood of a 50 basis point rate cut in November to be more than 75%.

Moreover, on Tuesday, Fed spokeswoman Michelle Bowman stated that inflation remains at levels high above the U.S. central bank’s 2% target. In her opinion, this suggests caution is warranted as the Fed continues cutting interest rates.

Looking ahead, investors are awaiting the release of additional U.S. economic data, including the Personal Consumption Expenditure Price Index and jobless claims. These data, set to be released later this week, will provide a clearer indication of the Fed’s further steps.

Meanwhile, Bank of Canada Governor Tiff Macklem stated that the timing and pace of rate cuts will depend on incoming economic data. The next meeting of the Canadian regulator concerning the interest rate is scheduled for October 23.

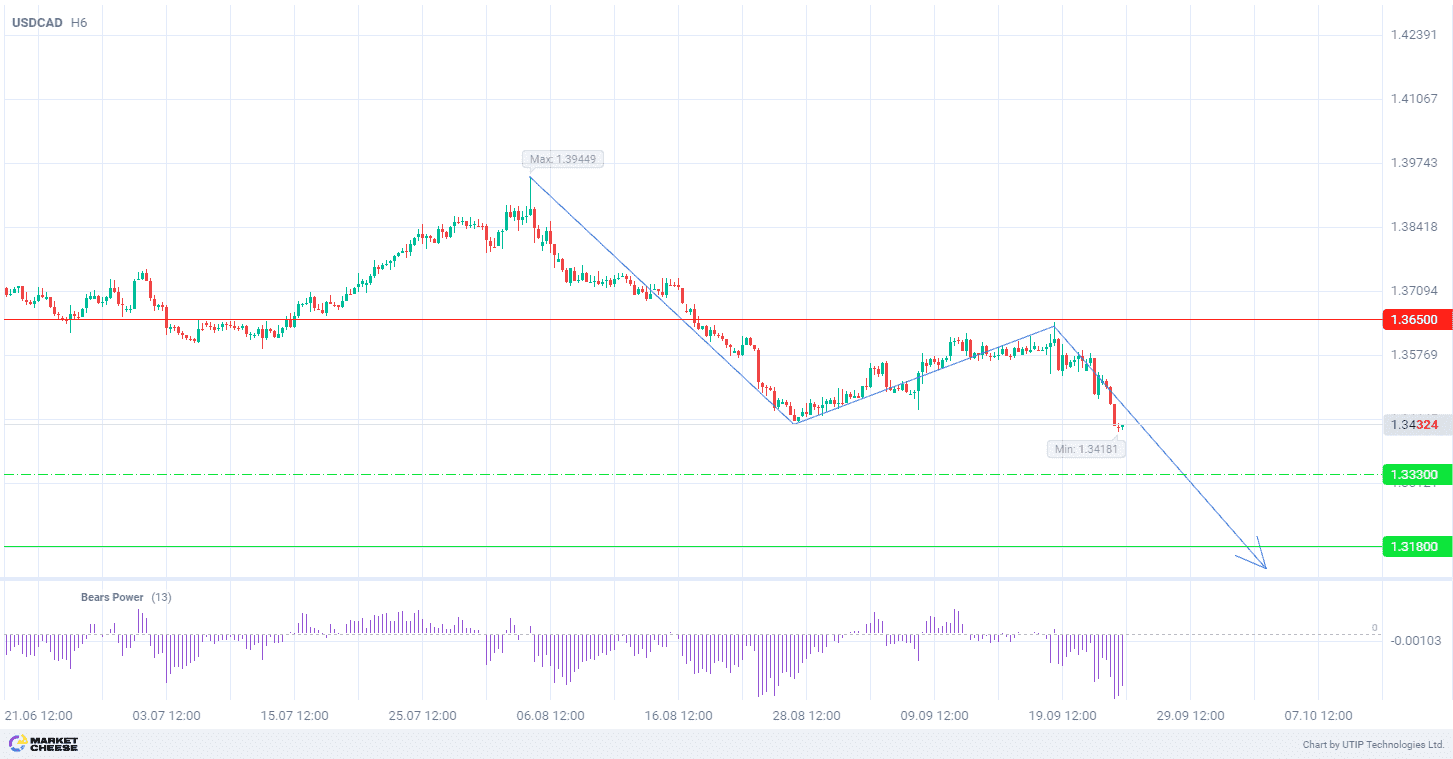

From a technical point of view, the USDCAD currency pair quotes are forming a downtrend on the H6 timeframe. In terms of wave analysis, the price is in the process of forming the third downward wave. The breakthrough of the top of the first wave at 1.3435 has already taken place. The volumes of the Bears Power indicator remain in the negative zone, reinforcing the signal for the pair’s decline and possible strengthening of the third wave impulse.

Signal: Short-term outlook for the USDCAD pair is to sell.

The target is near the level of 1.3180.

Part of the profit should be fixed near the level of 1.3330.

The Stop-loss is placed near the level of 1.3650.

The bearish trend has a short-term nature, so it is worth keeping the volume of trade to no more than 2% of your balance.