Natural gas prices are moderately rising this week due to the start of the heating season in the West. However, since the beginning of the month, the downward trend has persisted due to lower demand in Europe.

European Union (EU) countries continue to minimize the use of natural gas for power generation. According to Ember, electricity generation from gas-fired power plants fell by 14% in the first 9 months of this year.

In the period from January to September 2022, natural gas-fuelled electricity generation in the EU totalled 380.4 terawatt hours. For the first 9 months of this year, it reached only 325.8 terawatt hours. Thus, in absolute terms, natural gas-fired electricity generation decreased by 54.6 terawatt hours.

Overall, total electricity production in the EU in the first 9 months of 2023 decreased by 5%, also due to the slowdown in economic growth. Thus, the Manufacturing and Services PMI fell to 46.5 in October. This was the lowest value since November 2020.

As a result, weakening demand for natural gas has become normal in the EU. This has put downward pressure on fuel costs. In October, the average wholesale electricity price was 87.3 euros per megawatt hour. In October 2022, the figure was as high as €157.8 per megawatt hour.

Meanwhile, Europe is increasing the extraction of gas from reserves ahead of the upcoming cold snap. However, for the whole of this month, extraction remains at the lowest level ever recorded. It is important to note that the eurozone started the heating season with record gas reserves close to 100%.

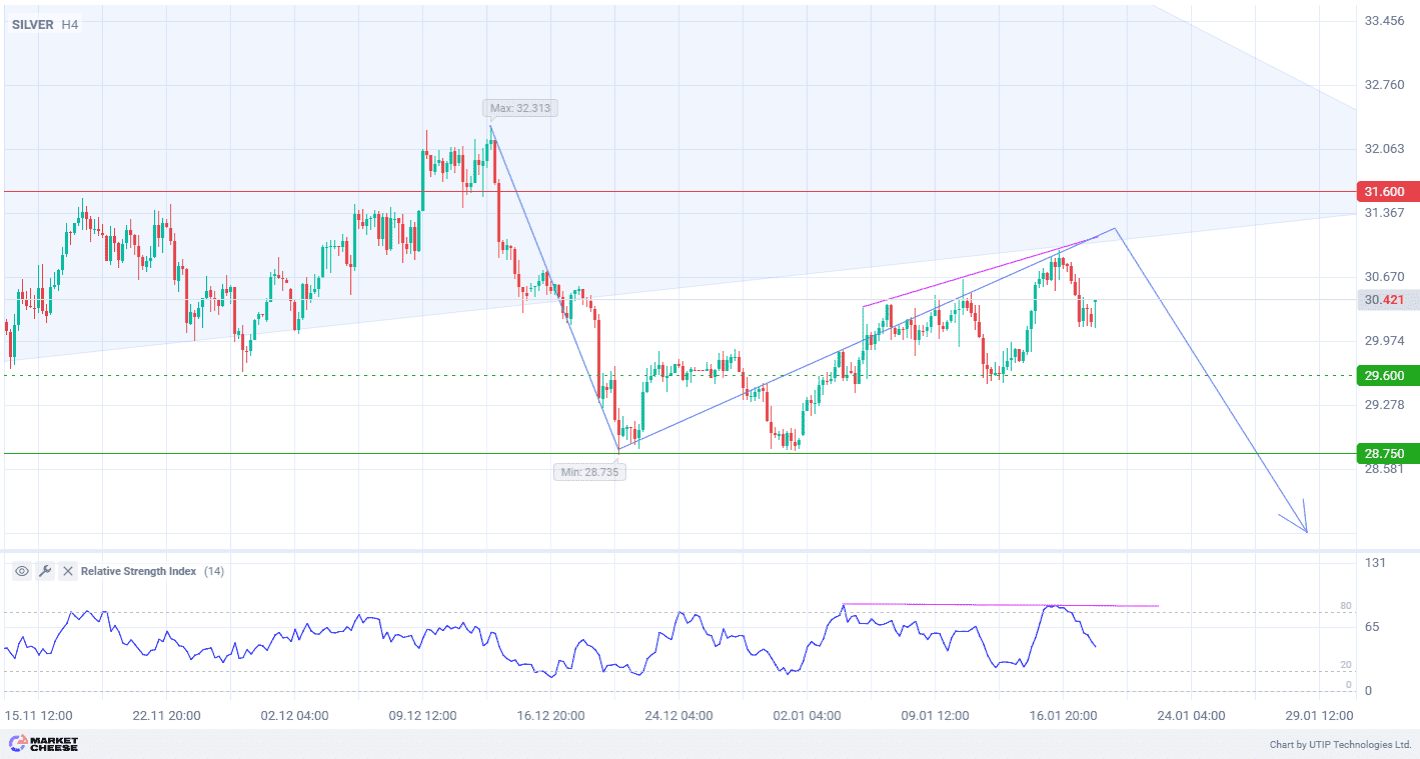

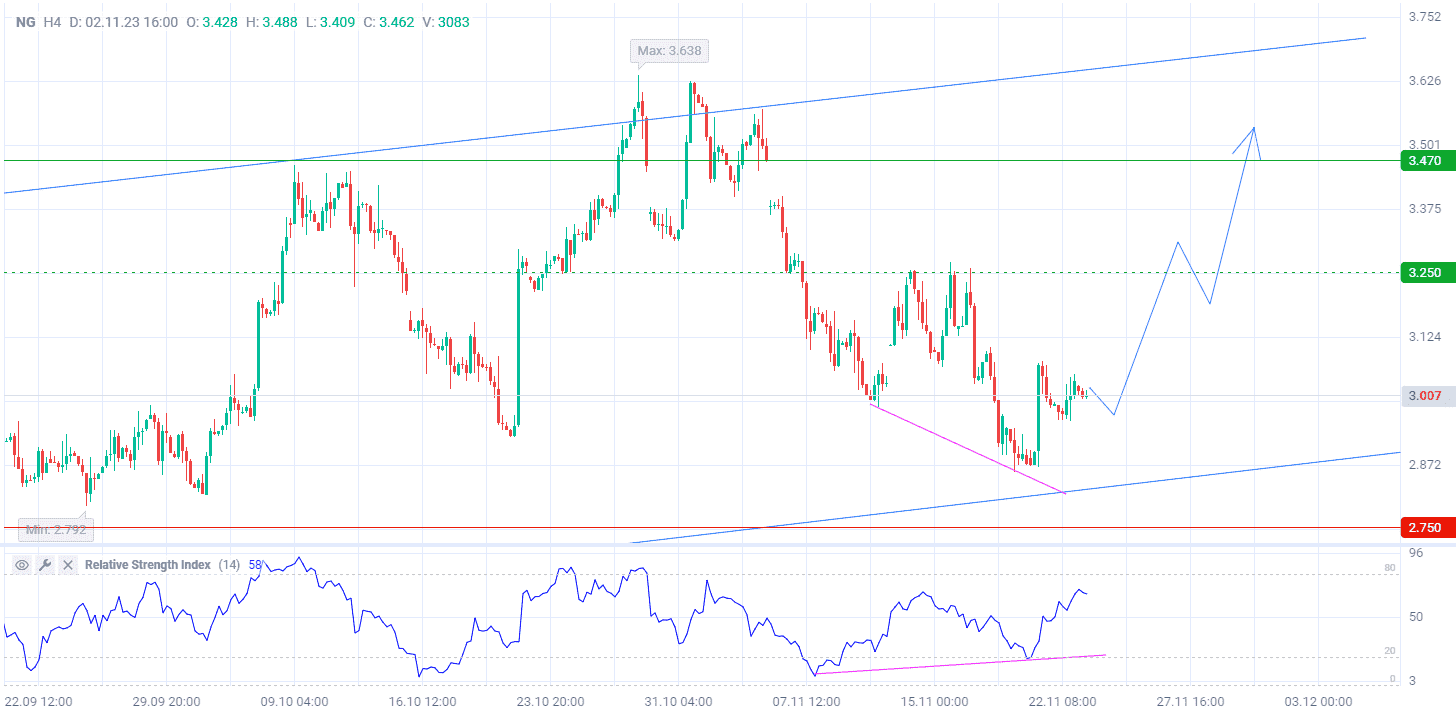

Natural gas prices are within a long-term upward corrective channel on the D1 timeframe. At the beginning of the week, the price showed a bullish sentiment as it approached the trend support. Divergence of the Relative Strength Index (RSI) (standard values) increases the probability of further price growth within the upward channel.

Signal:

Short-term prospects for natural gas suggest buying.

The target is at the level of 3.470.

Part of the profit should be taken near the level of 3.250.

A stop-loss could be placed at the level of 2.750.

The bullish trend is short-term, so trade volume should not exceed 2% of your balance.