The GBPUSD pair continued to rise on the morning of January 24th, and recovered after falling to its lowest level in more than a year on January 13th. The main factor behind this was the weakening of the dollar against the backdrop of Donald Trump’s aggressive policies, which allowed quotes to rise despite weak economic indicators from the UK. In particular, data on the country’s GDP growth of 0.1% against expectations of 0.2% reinforced concerns that the British economy is trapped in rising prices and stagnation, despite the recent slowdown in inflation.

At the Davos Forum on Thursday, Chancellor of the Exchequer Rachel Reeves outlined the government’s plans to invest in infrastructure and implement delayed projects such as airport expansion, which could have a positive impact on the pound. However, her new initiative to amend the Finance Bill failed to excite investors due to a lack of specific plans. Uncertainty in fiscal policy worsens the country’s competitiveness, forcing investors to look for more predictable markets.

As a result, the current situation creates difficulties for the GBP: the success of Reeves’ initiatives may strengthen the pound, but the lack of clear steps from the government may lead to its weakening.

Meanwhile, the dollar has stabilized in anticipation of the central bank’s verdict and Trump’s decision on tariffs. An upcoming Fed meeting next week may prove to be of little significance for the dollar as current interest rates are expected to remain unchanged.

The British manufacturing sentiment data will be released today. The current forecast is for a decrease of 0.1 to 46.9. If the actual data is better than forecast, we can expect the GBP to strengthen, otherwise GBPUSD will fall. Considering how wrong analysts have been in the past with the predicted data, it is better to expect a stronger fall in the country’s index, and therefore in the currency.

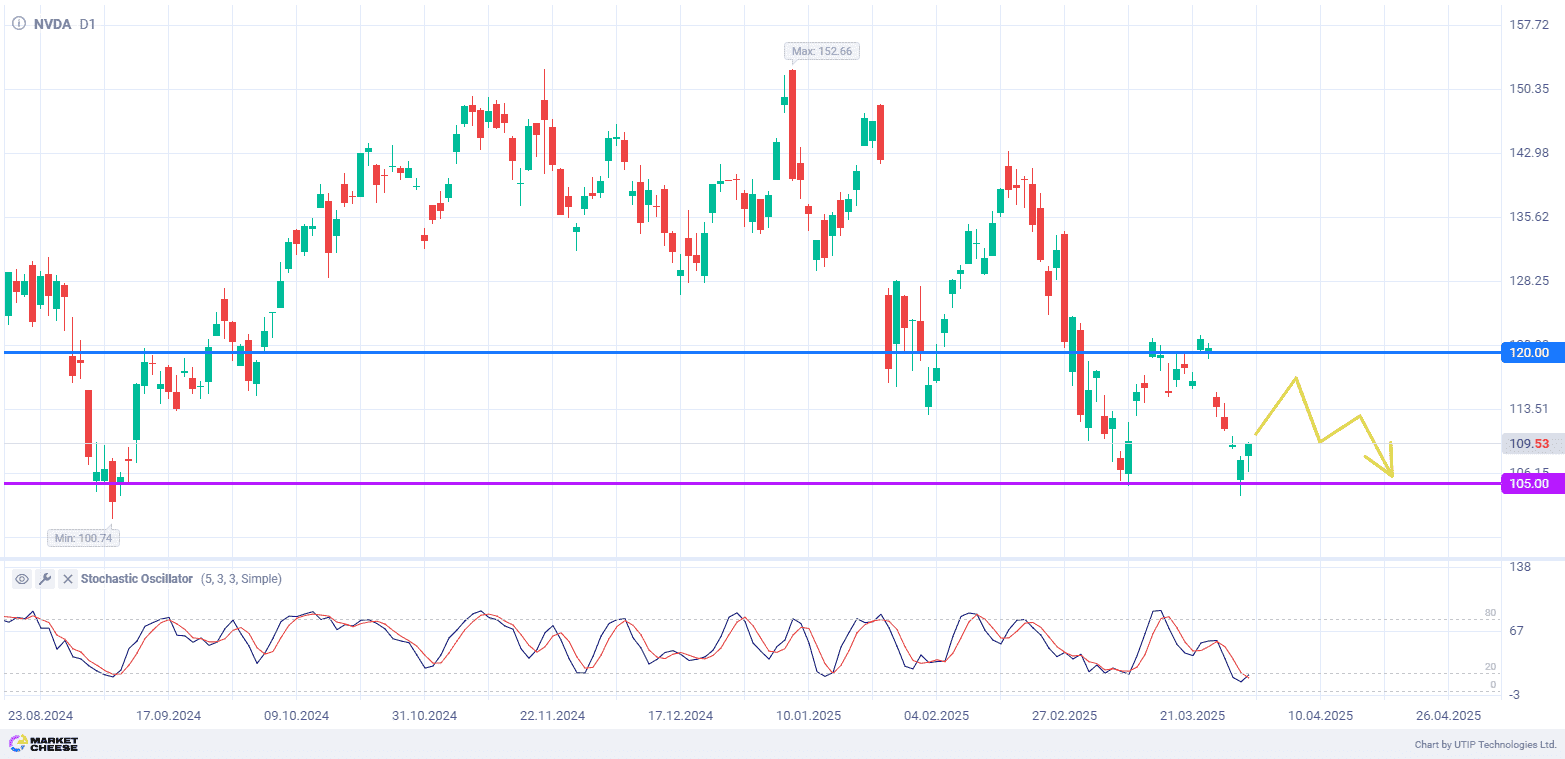

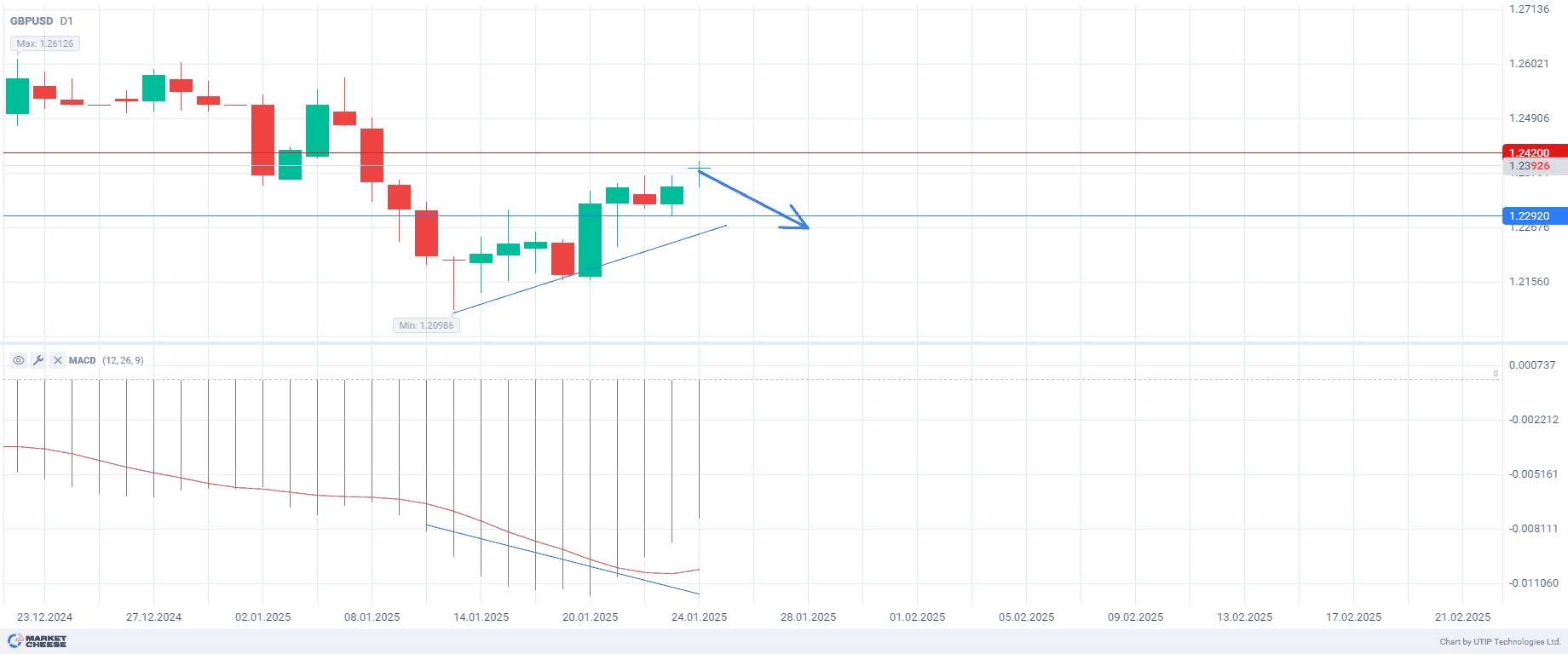

The technical analysis shows an imminent trend reversal. The MACD indicator shows a bearish divergence, which indicates a quick trend reversal and the beginning of the price decline. The macro indicator suggests a sell.

Current recommendation:

Sell at the current price. Take profit — 1.22920. Stop loss — 1.24200.

Источник: