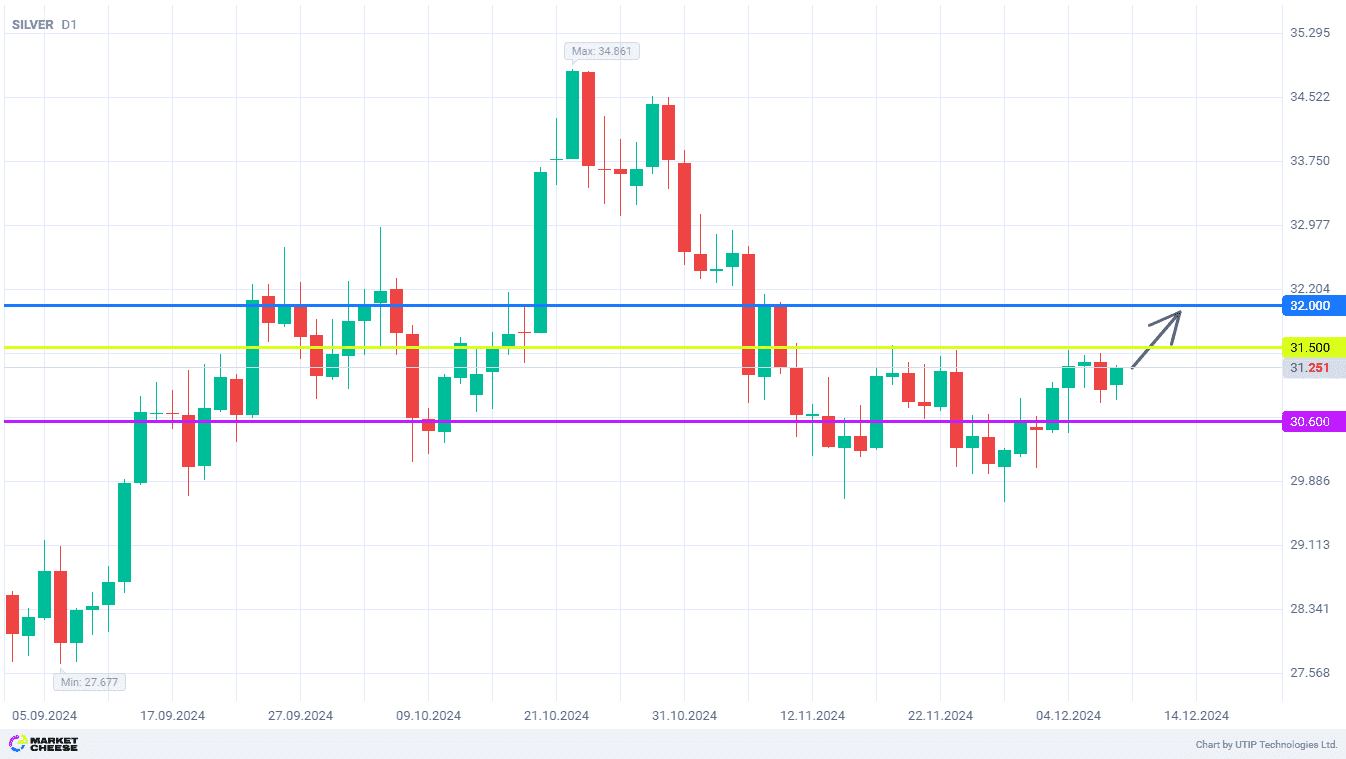

Silver prices after falling to lows of mid-September quickly returned to the level of 31.5. On Friday, the white metal’s buyers once again failed to conquer this milestone, but the scale of the pullback was quite moderate. At today’s trading session, there is an attempt to buy back the local drawdown before it turns into a full-fledged correction. If the bulls are successful, there will be another test of 31.5 level, and then a rise to the level of 32 is possible.

In the opinion of Michael DiRienzo, the head of the Silver Institute, the negative impact of import tariffs of the elected U.S. President Donald Trump on the market is overestimated. The main casualty at the moment is the investment demand sector for the white metal with losses of 15%. However, the industrial sector, especially in China, is becoming an increasingly important silver consumer and could support prices. DiRienzo estimates that this year alone, the electrical and electronics industry in China has accounted for about 6.6 thousand tons of silver demand.

Commerzbank precious metals analyst Carsten Fritsch also pays attention to the industry of China in the context of silver consumption growth. For instance, the demand for this metal in the solar energy sector has doubled over the last 3 years and will increase further due to technological progress. In addition to solar panels, silver is increasingly being used in electrical and electronics manufacturing.

The cycle of monetary policy easing by the leading central banks also has a positive impact on the attractiveness of precious metals. This week, the ECB is expected to lower interest rates, and on December 18, the U.S. Fed is going to do the same. Taking into account the pullback of quotations by 10% from the October maximum, silver prices have a significant potential for recovery. Commerzbank forecasts that the white metal will reach $32 per troy ounce by the beginning of 2025 and $33 by the end of the year.

A breakdown of the 31.5 level from below upwards could be a signal for a December rally in the silver market. The next target within the upward movement will be the level of 32.

The following trading strategy can be suggested:

Buy silver at the current price. Take profit 1 — 31.5. Take profit 2 — 32. Stop loss — 30.6.