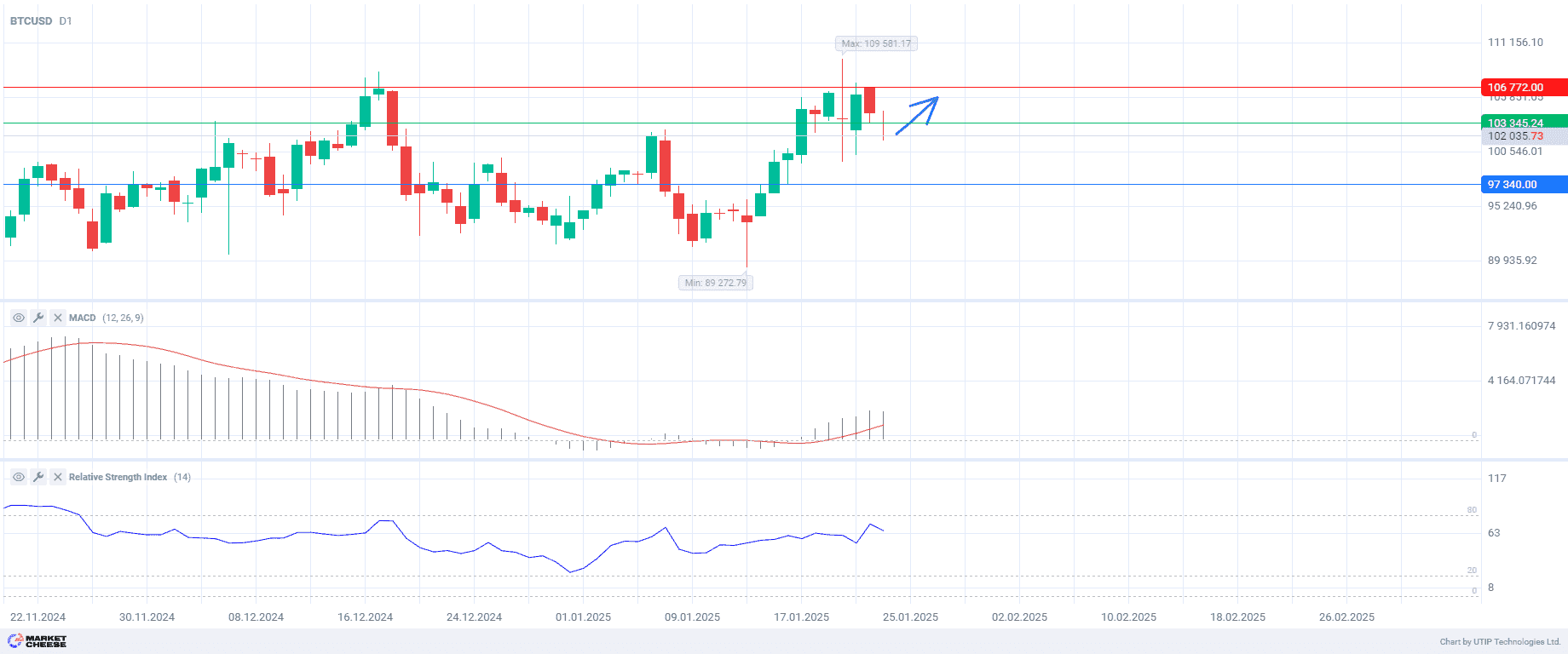

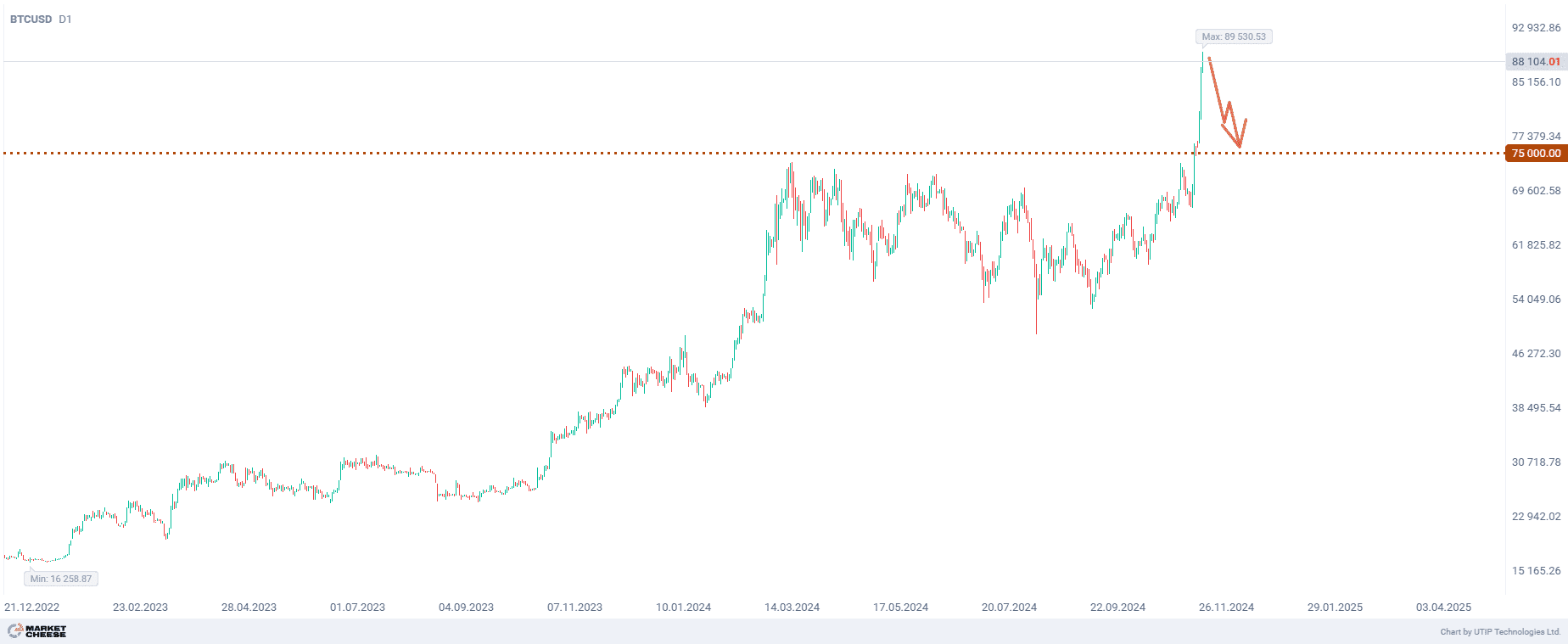

The excitement over Trump’s election to the next presidential term has caused a surge of many financial instruments, including Bitcoin. One technical feature of such a strong bear market for BTCUSD is that the growth momentum is sooner or later exhausted and the cryptocurrency makes a massive correction back down.

Looking at the historical data of BTCUSD on the daily timeframe, it may well be seen that such nearly vertical rises of the quotes then led to a correction by 70–90% of the initial uptrend.

The pair’s current strengthening will not be an exception. It raises two main questions: when will the correction start, and what level will be the target? To answer the first question, it is necessary to look again at Bitcoin’s historical chart. All previous corrective reversals started after forming specific reversal patterns like shelf or head and shoulders. As of today, there are no such figures yet, and they have not even started to form yet. It is necessary to monitor the instrument carefully in order not to miss the reversal. Wave analysis suggests that the first wave is still in progress, and it will be followed by two more waves of growth.

Under this scenario, Bitcoin could easily reach the price range of $90,000 to $100,000. Once the three ascending waves are seen on the chart and a reversal pattern is formed, selling can be entered.

It will be easier to determine the target. It is likely to be at the previous resistance level at $75,000.

The overall recommendation is to sell BTCUSD after a reversal pattern is formed. Profits should be taken at the level of 75,000. A Stop loss could be set at the level of 105,000.

The volume of the opened position should be set in such a way that the value of the possible loss, fixed with the help of a protective Stop loss order, is no more than 1% of your deposit funds.