Gold is holding near its highest level since early November as investors see great risks and high costs in the functioning of the global economy following the election of Donald Trump. As has been noted many times before, many of the newly elected president’s initiatives are pro-inflationary in outlook.

Trump’s statements about imposing high tariffs on international trade are boosting demand for safe-haven assets. In particular, he has talked about the possibility of imposing a 10% tariff on Chinese goods and a 25% tariff on imports from Canada and Mexico.

Investors are now focused on the impact of the Trump administration’s tariff and tax cut policies, which are likely to undermine the nation’s finances and reignite inflation. This could limit the Federal Reserve’s ability to continue easing monetary policy. Higher borrowing costs are typically a headwind for gold because it does not generate interest income.

In addition, the precious metal could get a boost from safe-haven demand amid concerns about the new president’s immigration policies, as a contracting labor market will lead to higher wages and faster inflation rates, leading to another round of Fed policy tightening.

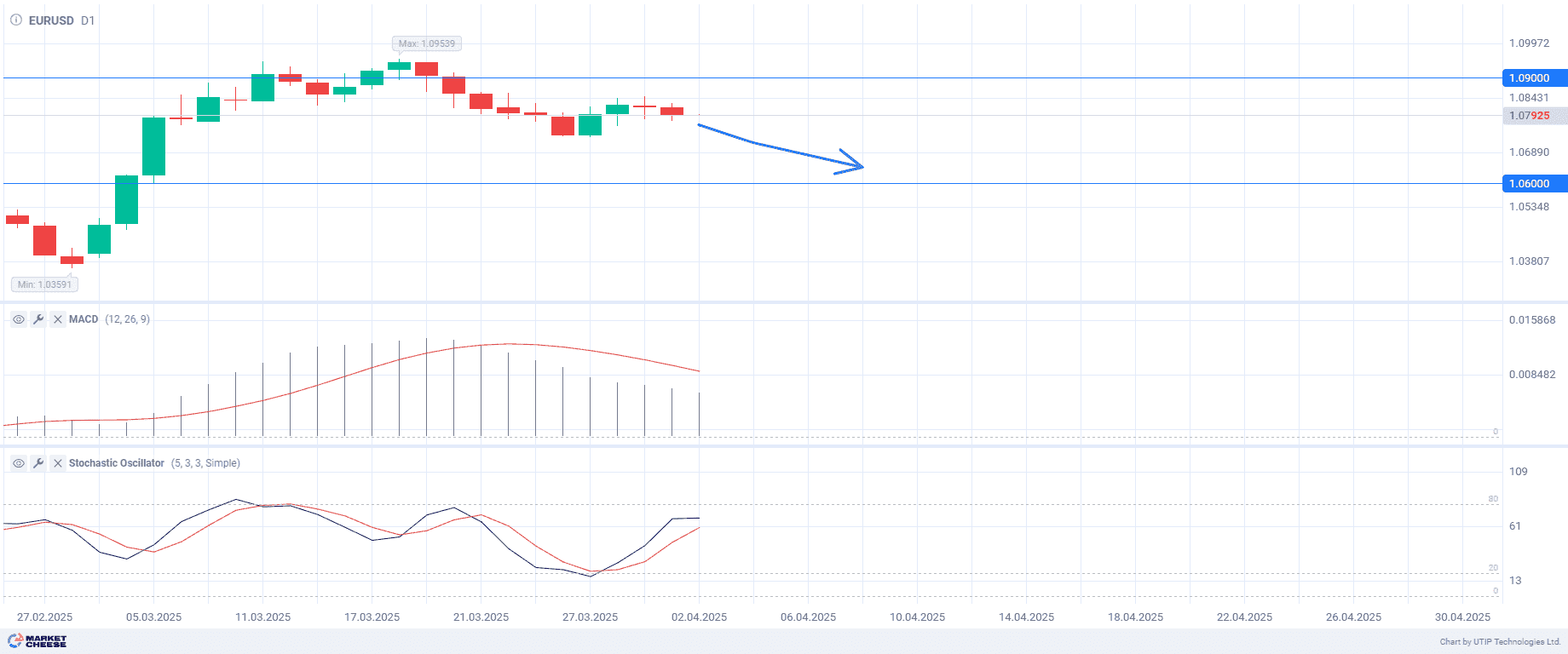

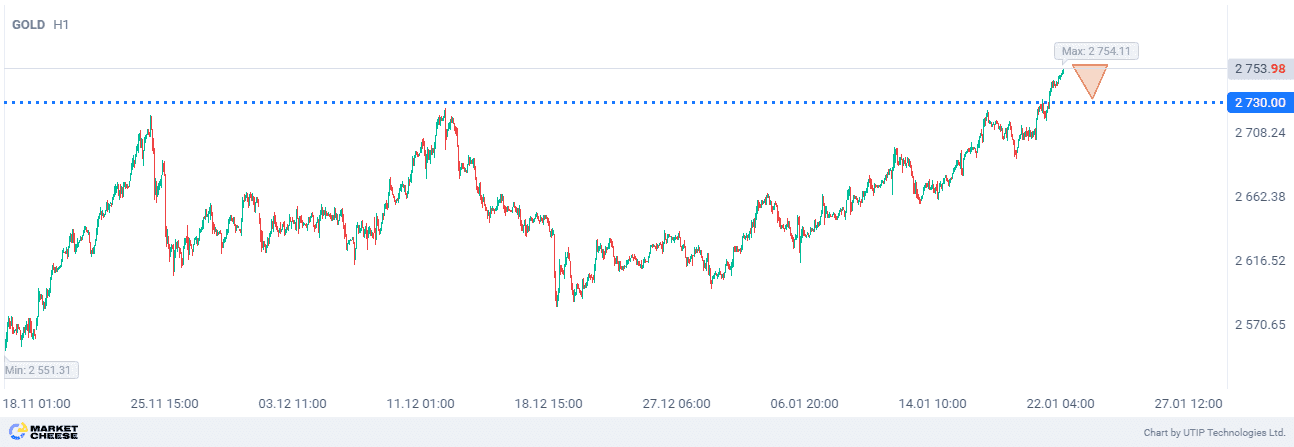

From a technical point of view, gold is likely to correct down to the previously breached 2730 level.

The overall recommendation is to sell gold.

Profit could be taken at 2730. A stop loss could be set at 2780.

The volume of the opened position should be set so that the value of a possible loss, defined with a protective stop order, does not exceed 1% of your deposit.