Yesterday’s data showed that the US labor market is cooling steadily amid rising job openings and low layoffs.

Job openings rose by 372,000 to 7.744 million in October, hiring fell by 269,000 to 5.313 million, and layoffs fell by 169,000, the most since April 2023.

US job openings rose sharply in October while layoffs fell by the most in a year and a half, suggesting the labor market continues to slow in an orderly fashion.

The Labor Department report also showed that employers are reluctant to hire more workers. Historically low layoffs strengthen the labor market and the economy as a whole through higher wages, which boost consumer spending.

The state of the labor market could help determine whether the Federal Reserve will cut interest rates for a third time this month amid a lack of progress in bringing inflation down to the US central bank’s 2% target.

A Reuters poll of economists showed payrolls rose by 200,000 last month after a gain of just 12,000 in October, the weakest since December 2020. The unemployment rate is forecast to rise to 4.2% from 4.1% in October.

The report points to continued resilience in the labor market and no major concerns about the economy, making it likely the Fed will be able to make another rate cut in December before pausing next year.

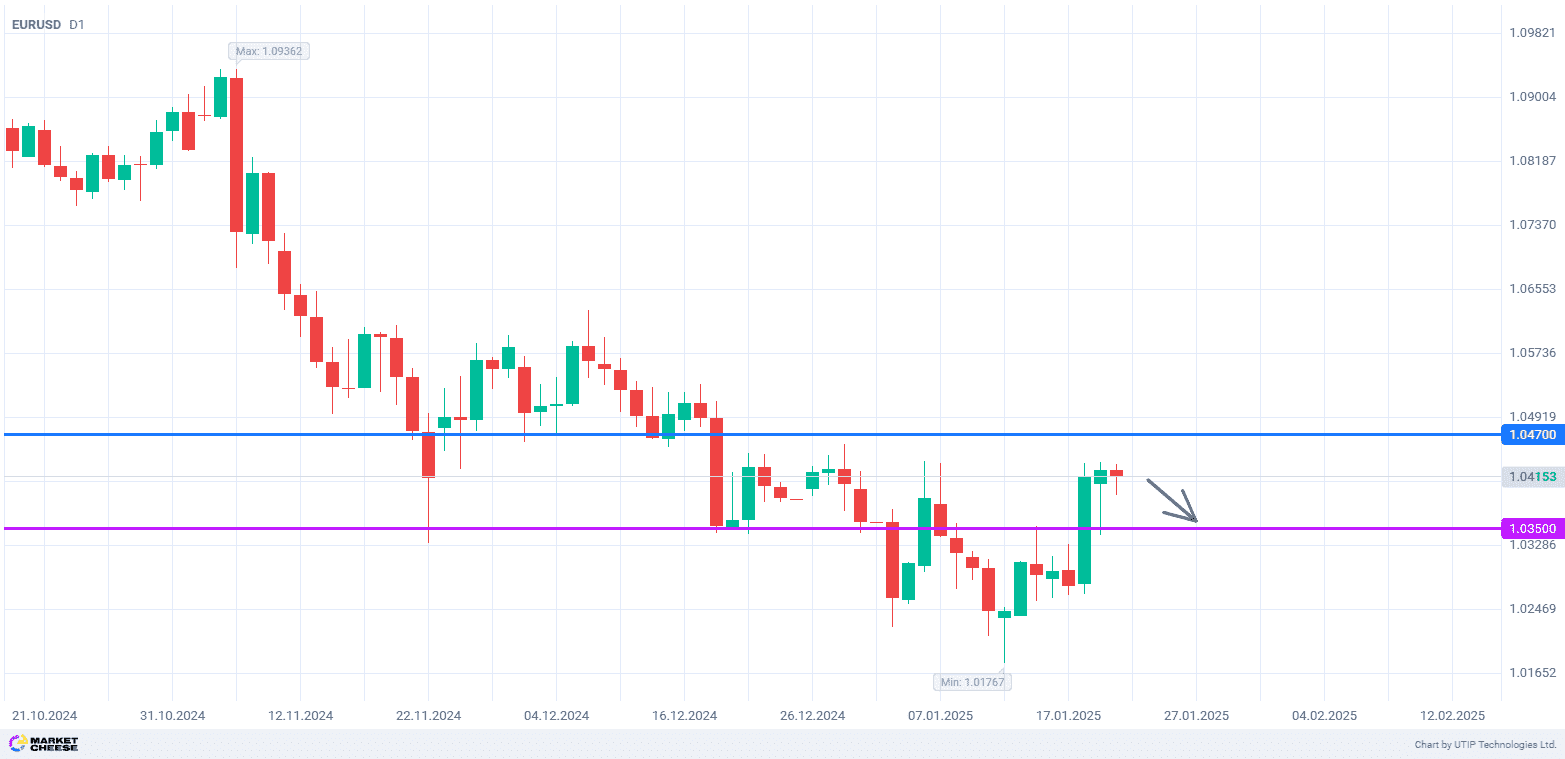

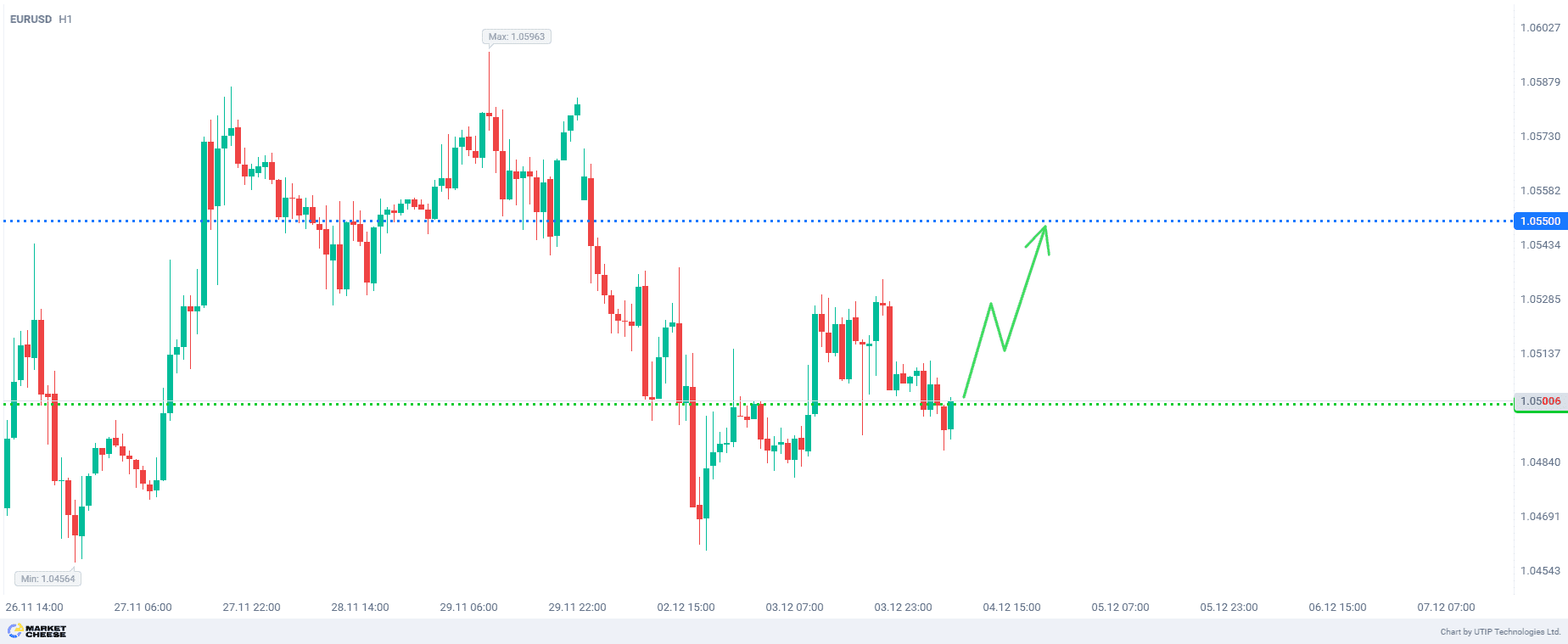

The latest data puts downward pressure on the US dollar and strengthens the EURUSD.

The overall recommendation is to buy EURUSD.

Profit could be taken at 1.0550. A stop loss could be set at 1.0450.

The volume of the opened position should be set so that the value of a possible loss, defined with a protective stop order, does not exceed 1% of your deposit.

Источник: