USDJPY is rising for the second day in a row. The main reason for the pair’s strength is a moderate increase in the US dollar amid expectations of specific statements from President Donald Trump regarding trade tariffs.

However, the potential for a significant decline in the Japanese yen today remains limited. Markets are cautiously assessing the likelihood of the Bank of Japan raising interest rates after its two-day meeting on Friday. It is believed that the rate may be raised from 0.25% to 0.50% for the first time since the 2008 global financial crisis. Such a decision would be driven by the desire to achieve sustainable wage growth. This is a key condition for monetary tightening.

Against this backdrop, expectations for an easing of monetary policy by the Federal Reserve (Fed) provide an ambiguous backdrop for the USDJPY pair. The Fed meeting is scheduled for January 28th and 29th. Against the backdrop of slowing inflation and steady economic growth, the regulator may keep the federal funds rate in the range of 4.25-4.50%.

The US dollar may gain momentum from the release of key macroeconomic data, including jobless claims. There is also growing interest in President Trump’s statements. The implementation of the president’s trade initiatives could accelerate inflation, potentially forcing the Fed to slow the cycle of rate cuts or even return to rate hikes. This sets the stage for dollar growth.

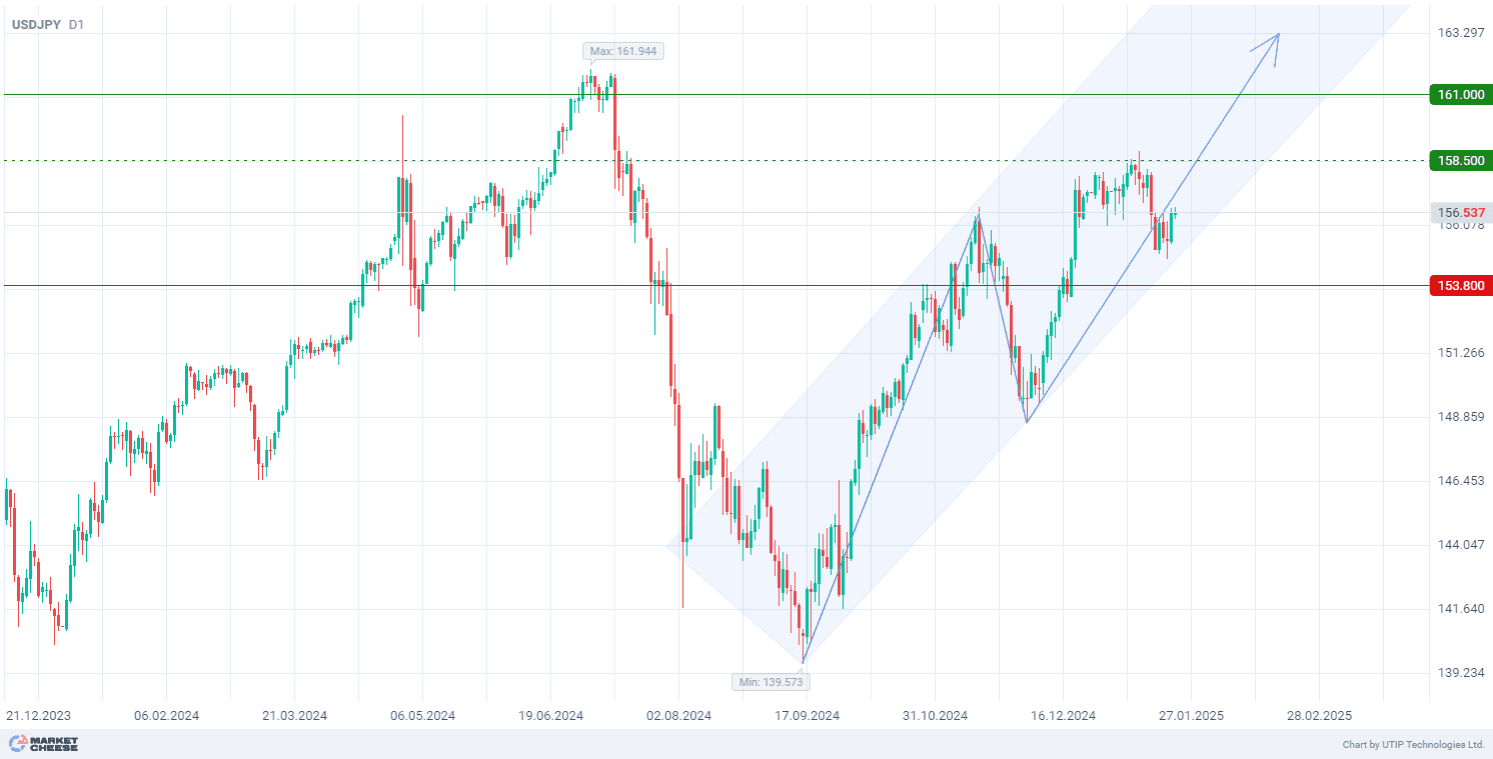

From a technical point of view, USDJPY continues to maintain an upward trend on the D1 timeframe. On the wave chart, the price is forming the third ascending wave, and the breakdown of the top of the first wave at 156.80 strengthens the signal for further growth. However, a possible interest rate hike by the Bank of Japan on Friday may trigger a short-term correction, providing opportunities for profitable buying at the channel support.

Signal:

Short-term prospects for USDJPY suggest buying.

The target is at the level of 161.00.

Part of the profit should be taken near the level of 158.50.

A stop-loss could be placed at the level of 153.80.

The bullish trend is short-term, so trade volume should not exceed 2% of your balance.