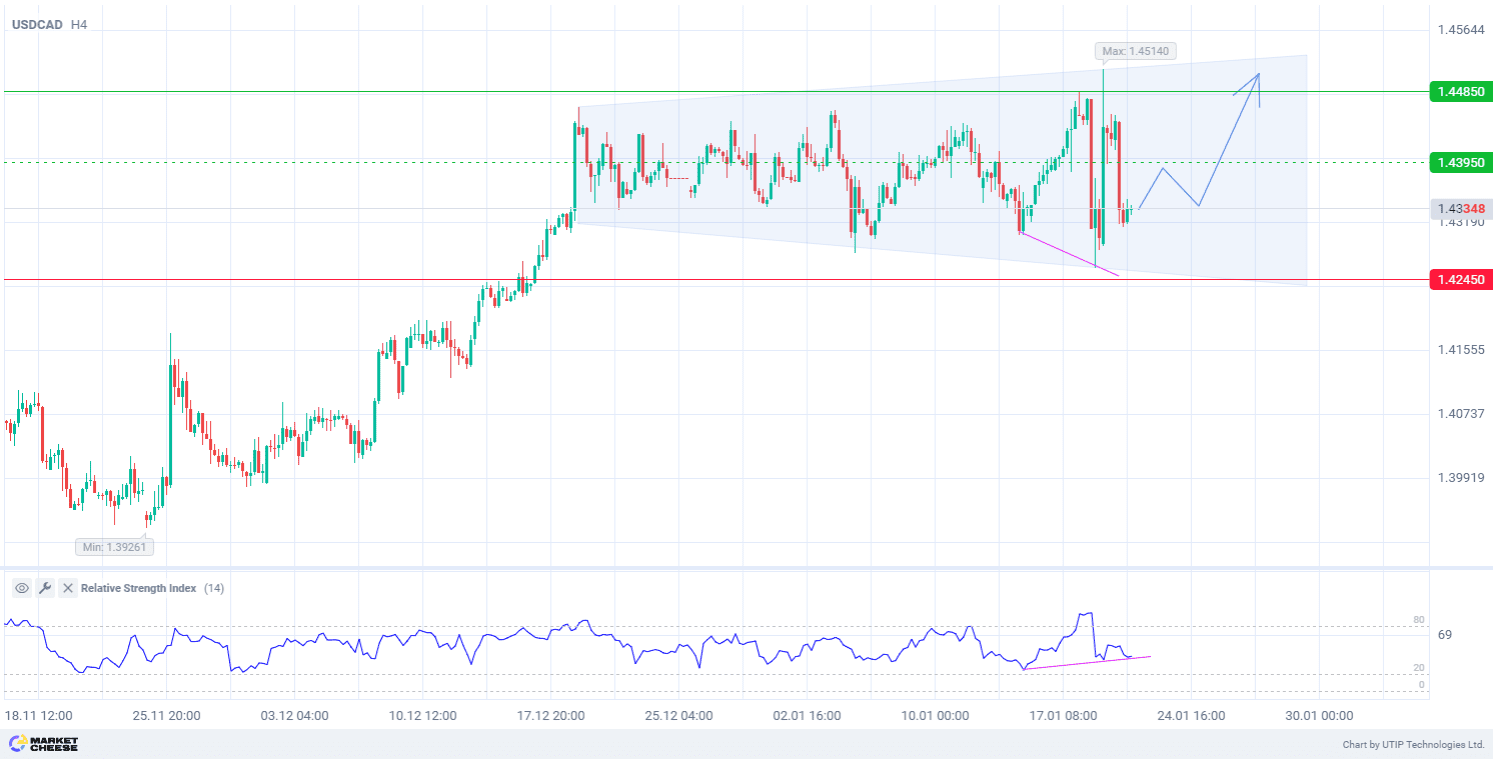

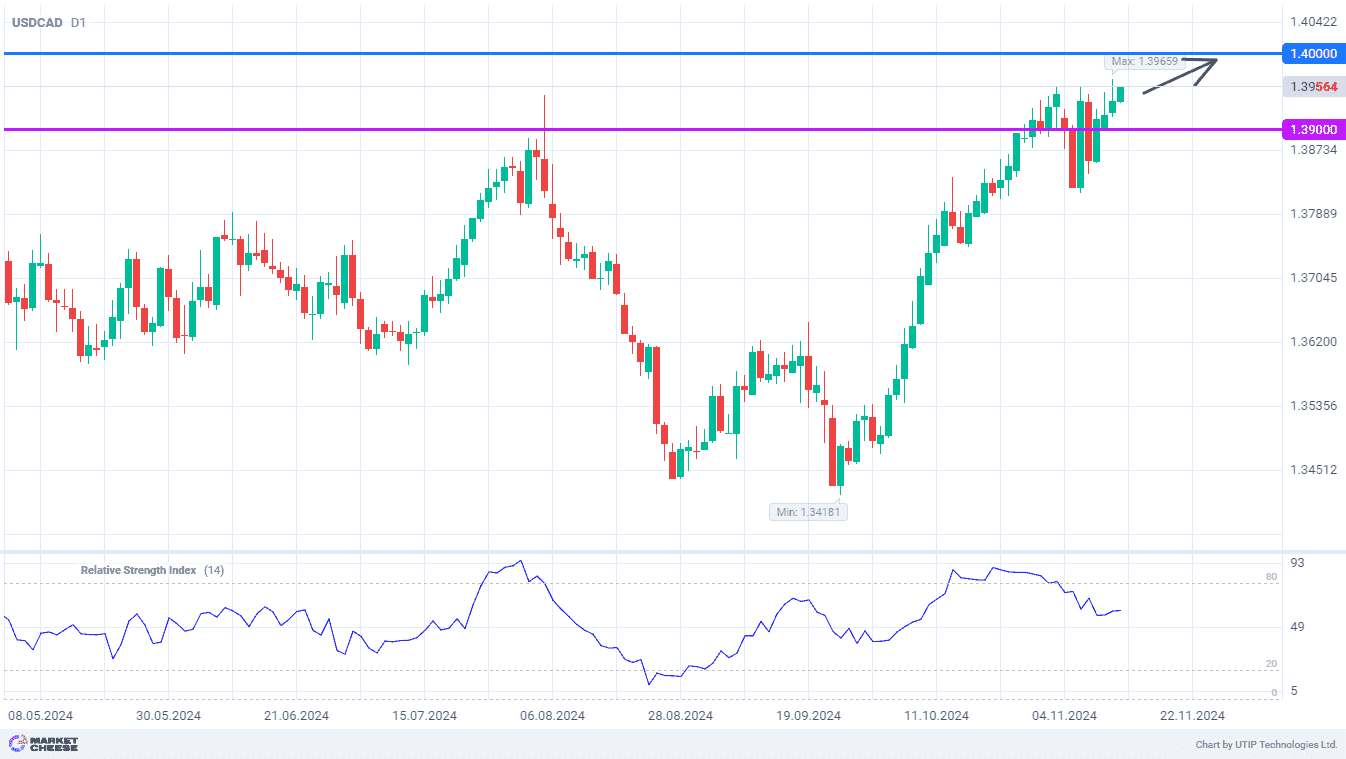

The USDCAD currency pair returned to moderate growth after a surge in volatility last week. Yesterday it hit a new high for 2024 and got close to the top of 2022 at 1.3977. But the buyers of the US dollar against its Canadian equivalent may not stop there, aiming to test the level of 1.4 for the first time since May 2020. Fundamentals are in favor of such a scenario.

Amo Sahota, director at Klarity FX, highlights a massive drop in G10 currencies against the US dollar. The Canadian dollar is not an exception, even though its losses are not as big as those of the euro and some other currencies. Sahota draws attention to a widening gap between US and Canadian bond yields. The spread between the 10-year debt securities of these countries reached 116 basis points yesterday, the highest level since 1995. This fact validates the USDCAD rally.

Financial market participants are confident in the strong US GDP growth rates due to Donald Trump’s return to the presidency. The Canadian economy, on the contrary, cannot share these optimistic predictions. Another confirmation of its weakness is the labor market report for October. Canadian companies created only 14,500 new jobs — much less than both analysts’ expectations of 27,900 and September’s 46,700.

The Canadian economy still has not received any tangible support, even though the Bank of Canada has taken 4 steps to lower interest rates. In such a situation, the BoC has no choice but to continue accelerated monetary policy easing. According to analysts’ estimates, the regulator with a 60% probability will cut the borrowing costs by 0.5% for the second time in a row at the meeting on December 11. The US Fed is expected to make a cut of only 0.25% in December, which will further widen the rate gap between US and Canada, putting upward pressure on USDCAD.

The RSI indicator last week removed the overbought condition and now does not prevent the USDCAD from further growth. The short-term target of the bulls is the level of 1.4.

Consider the following trading strategy:

Buying USDCAD at the current price. Take profit – 1.4. Stop loss – 1.39.

Источник: