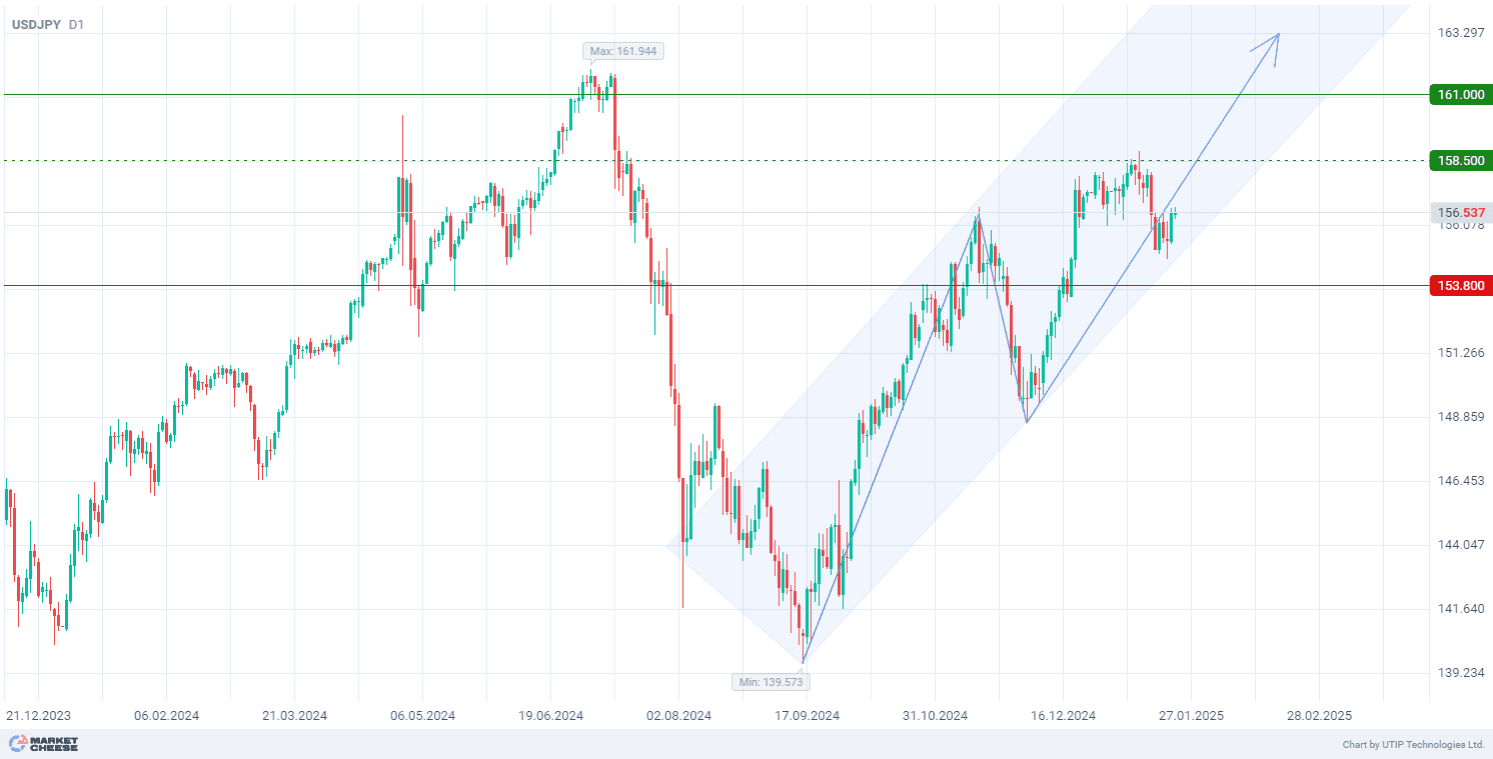

The USDJPY currency pair is still rising on Thursday amid weakness in the Japanese yen and investor uncertainty over the future course of Japan’s monetary policy. One of the key pressure factors for the yen is the uncertainty regarding interest rate hikes by the country’s central bank. Economic data, such as a decline in real wages and a decrease in household spending, raise doubts about the sustainability of Japan’s economic recovery.

Against this background, the US dollar is strengthening, reaching an eight-week high on expectations of a smaller interest rate cut by the Federal Reserve. Now it’s supposed to be delivered by 25 basis points in November, instead of the previously expected 50 points. This is also supported by more hawkish views presented in the FOMC meeting minutes. Policymakers discussed the need for a cautious approach to further rate cuts due to persistent inflation risks.

As San Francisco Fed President Mary Daly said on Wednesday, there could be one or two more rate cuts this year if the economy keeps growing as projected. Risks of higher inflation remain and the economic outlook is still uncertain, the official said.

Rising US Treasury bond yields are also supporting the dollar’s strength. The expected inflation data scheduled to be released on Thursday and Friday may change the volatility in the market. However, the sentiment on the USDJPY pair remains bullish.

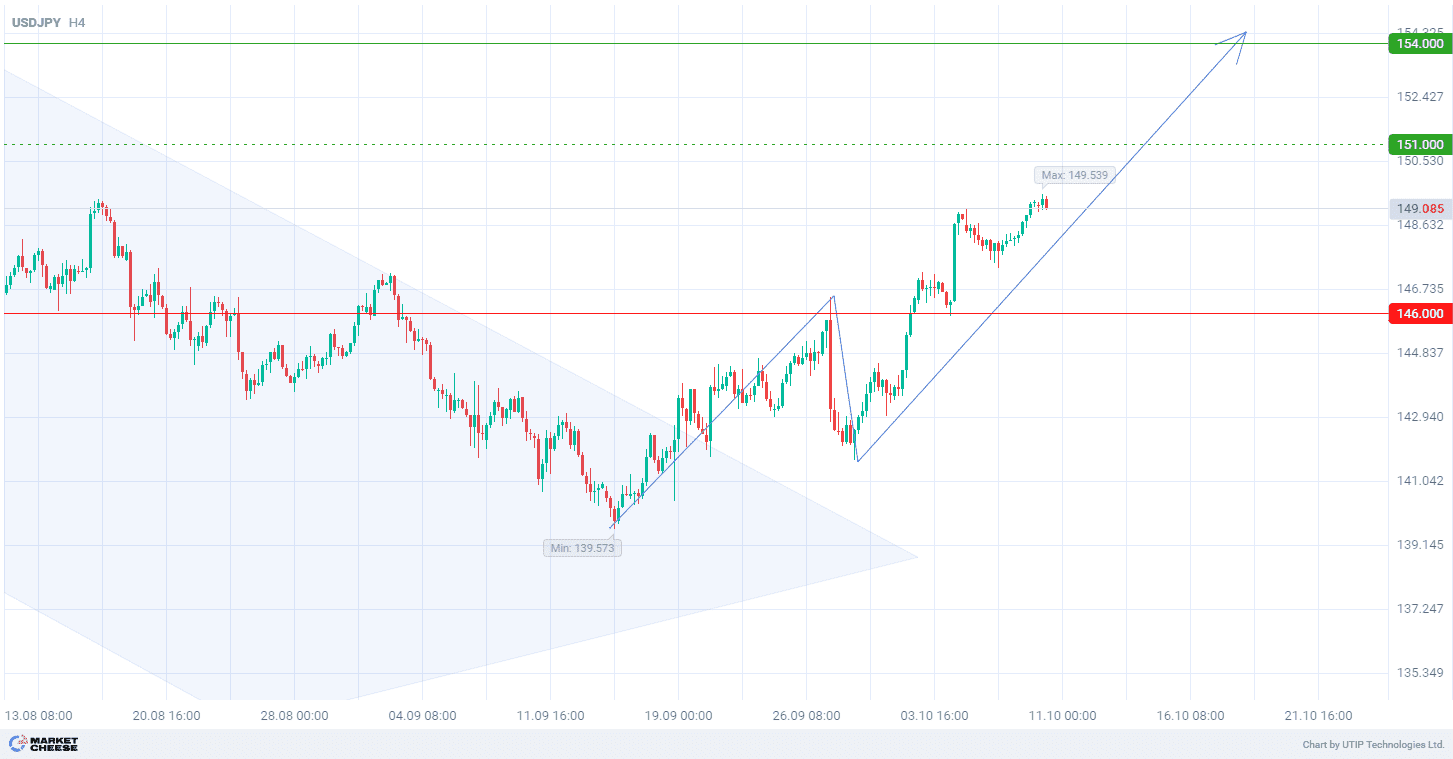

From a technical point of view, the USDJPY quotes are forming an uptrend on the H4 timeframe. The wave analysis shows that the price is in the process of forming the third ascending wave. Breaking through the top of the first wave at 146.50 indicates a possible strengthening of the upward momentum.

Signal:

Short-term prospects for the USDJPY currency pair suggest buying.

The target is at the level of 154.00.

Part of the profit should be fixed near the level of 151.00.

A stop loss is at the level of 146.00.

The bullish trend is of a short-term nature, so it is recommended to choose a trading volume of no more than 2% of your balance.

Источник: