The USDCAD currency pair is showing a moderate recovery after the previous day’s sharp decline. Investors are assessing the likelihood of US President Donald Trump’s announced plans to implement high tariffs on Canadian imports in February.

The US dollar is strengthening amid rising Treasury yields. However, expectations of two interest rate cuts by the Federal Reserve (Fed) in 2025 are limiting the US currency’s growth potential.

The Canadian dollar, on the other hand, is under pressure after Canadian inflation fell to 1.8% in December. This increases the likelihood of further interest rate cuts by the Bank of Canada. In addition, the position of this currency is negatively affected by the decline in oil prices, which play an important role in the country’s economy.

Political risks also play an essential role. Donald Trump threatened to impose 25% tariffs on imports from Canada and Mexico. However, the lack of specifics in his statements eased investors’ fears somewhat. This helped the Canadian currency avoid more significant losses.

The main attention of market participants is focused on the upcoming Fed meeting on January 28th and 29th. Investors are expecting the US central bank to keep its key interest rate in the range of 4.25–4.50%.

Uncertainty over the US tariff policy and the Fed’s future actions are keeping traders cautious.

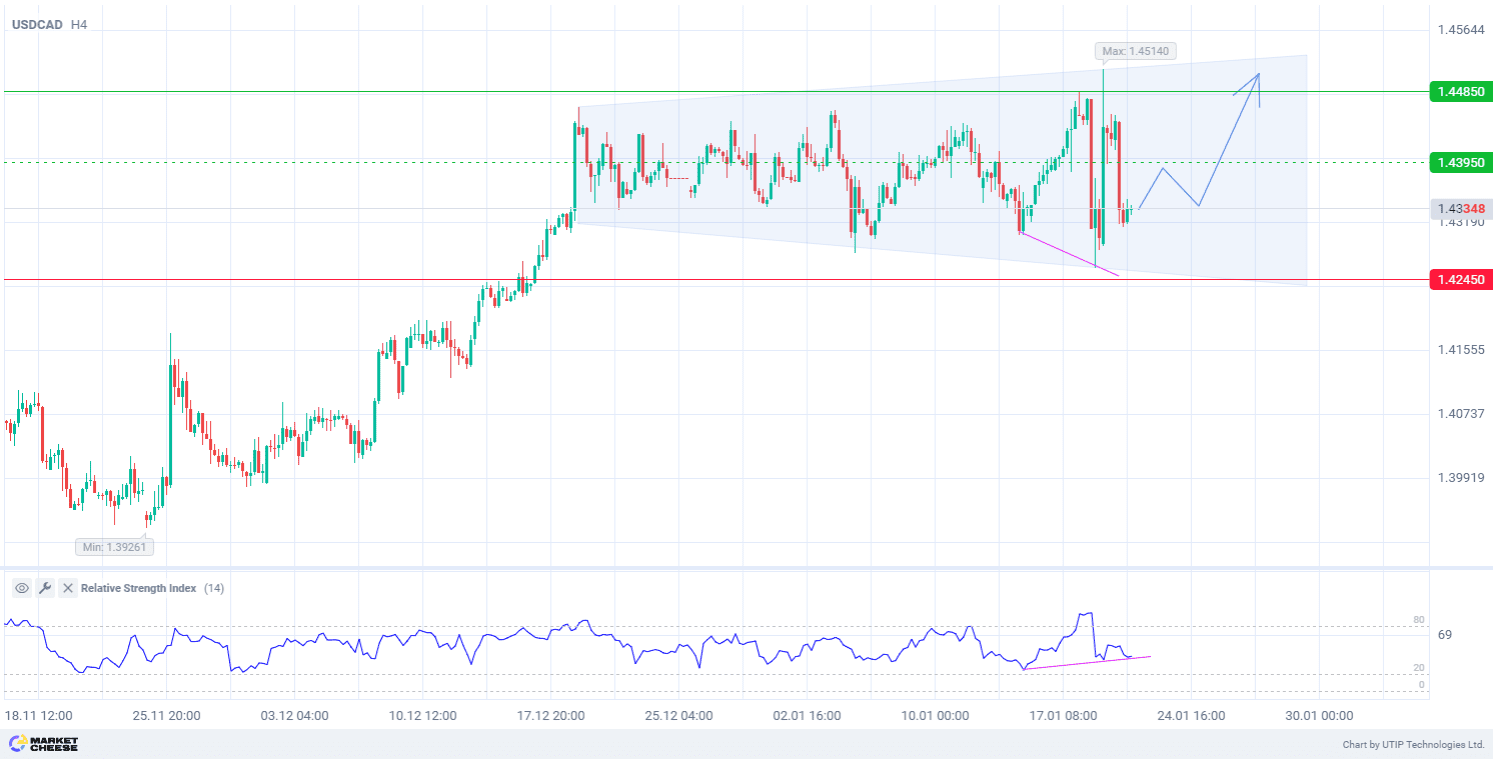

From a technical point of view, the USDCAD price is showing the formation of an expanding sideways range on the H4 timeframe. This movement confirms the uncertainty in the market. The divergence of the Relative Strength Index (RSI) indicates that the price may continue to fluctuate within this range, as the recent bounce from the support line has pushed the price towards the resistance.

Signal:

Short-term prospects for USDCAD suggest buying.

The target is at the level of 1.4485.

Part of the profit should be taken near the level of 1.4395.

A stop-loss could be placed at the level of 1.4245.

The bullish trend is short-term, so trade volume should not exceed 2% of your balance.

Источник: